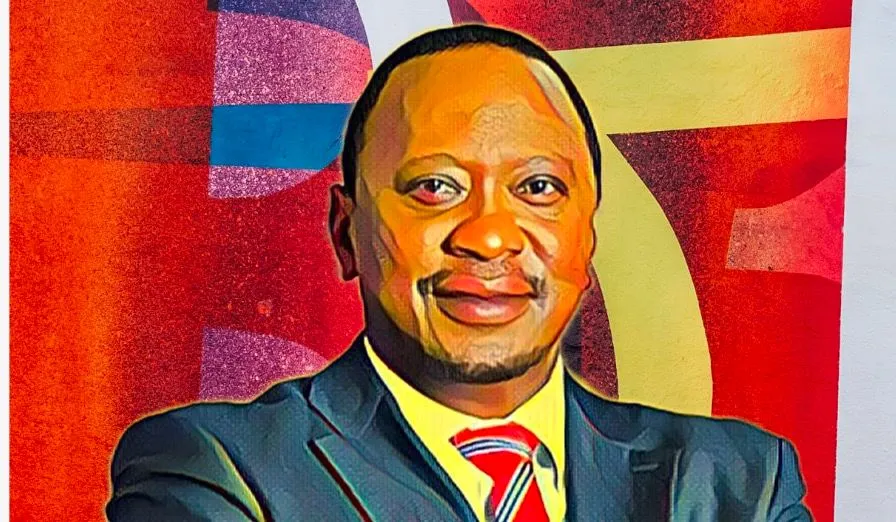

10 assets owned by Kenya’s largest landholders, Kenyatta family

Driven by the vision for Kenya’s development, the Kenyattas have strategically invested in sectors crucial to the nation’s growth, from infrastructure to agriculture.

Skip to content

Skip to content

Driven by the vision for Kenya’s development, the Kenyattas have strategically invested in sectors crucial to the nation’s growth, from infrastructure to agriculture.

NCBA’s new Kerugoya branch brings tailored banking services to Kirinyaga County, supporting local businesses and economic growth.

NCBA Bank opens a new branch in Kitui, boosting financial access and empowering local businesses to drive economic growth in the region.

NCBA Bank Kenya launches a “No Monthly Fees” initiative for business accounts, easing financial pressure on SMEs as loan rates rise.

NCBA Bank unveils a new branch to deepen local engagement and enhance financial inclusion in Kwale County of Kenya.

NCBA Bank invests Ksh644 million ($5 million) in cybersecurity, enhancing firewalls amid rising cyber threats in Kenya.

NCBA Bank Kenya justified the increase, citing the need to align with prevailing market conditions.

The $50-million loan from Proparco represents a significant milestone for NCBA Group as it continues to drive sustainable economic growth and support SMEs in Kenya.

Through their late patriarch’s estate, the Kenyatta family maintains a significant 13.2-percent stake in NCBA Group, equivalent to 217,497,023 ordinary shares.

The Kenyatta family owns a 13.2-percent stake in NCBA Group through the estate of their late father, Jomo Kenyatta.

NCBA Group is partially owned by some of Kenya’s wealthiest families, including the Kenyatta, Merali, and Ndegwa families.

The Kenyatta family’s equity holdings in NCBA Group see a $11.26-million decline as stock market volatility persists.

NCBA Group is partially owned by some of Kenya’s richest families.

Kenya’s wealth gap is staggering.

The Kenyatta family owns a 13.2-percent stake in NCBA Group.

NCBA’s loan to Grit now represents more than 2.27 percent of the real estate company’s overall debt.