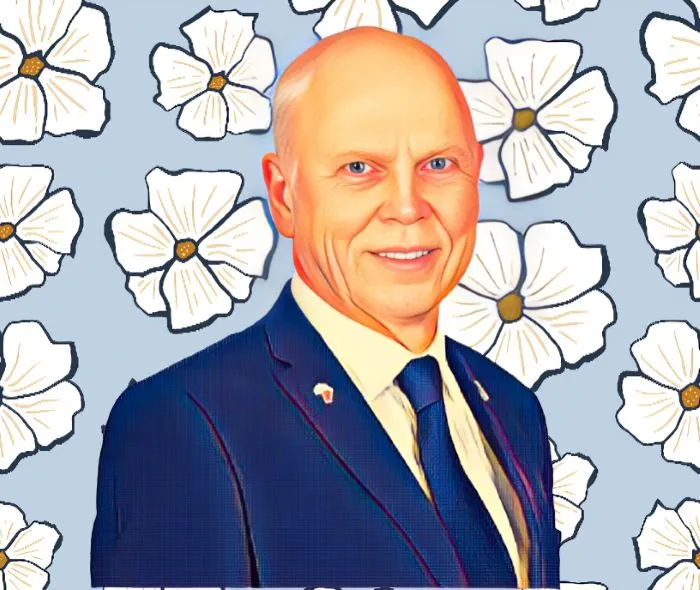

Sibanye suffers $311 million loss under Neal Froneman

Sibanye-Stillwater narrows 2024 loss to $311 million under Neal Froneman, showing signs of recovery amid weak metal markets and operational restructuring.

Skip to content

Skip to content

Sibanye-Stillwater narrows 2024 loss to $311 million under Neal Froneman, showing signs of recovery amid weak metal markets and operational restructuring.

Aspen shares dive 30% amid $148.7 million mRNA tech dispute, stoking investor fears over financial stability.

Capitec to pay $47.6 million to three South African shareholders

This reflects his role in steering the bank through a period of significant growth, strengthening its position as a leader in the country’s financial sector.

The PIC has pledged its support by agreeing to accept a standby offer for 41.6 million Barloworld shares, which translates to 21.93 percent of the company’s total issued shares.

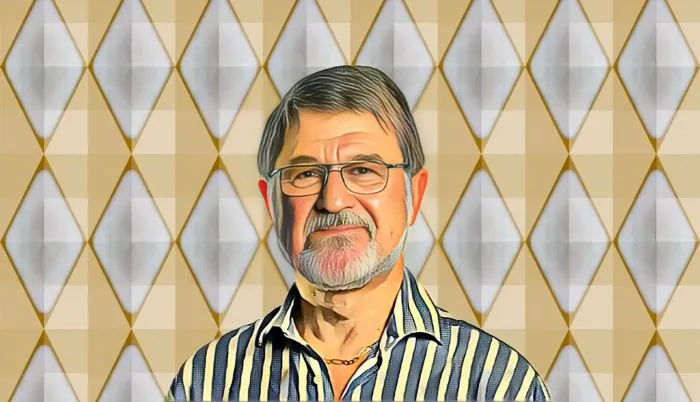

The rise in Jannie Mouton’s stake in Capitec Bank strengthens his position among South Africa’s billionaires.

Calisto’s 64.81% stake in Karooooo—about 20 million shares—has gained $71.5 million in market value over the past two weeks.

The decline has sparked debate, with Remgro recently valuing Maziv at $2.8 billion, outpacing even larger rivals like Telkom.

The performance underlines the leading retail bank’s ability to deliver in a challenging global economic environment.

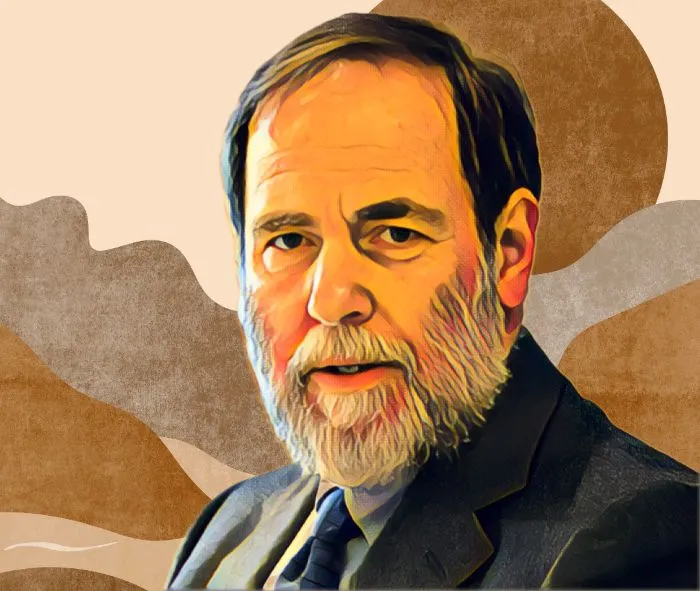

Hilton Schlosberg transformed Monster Beverage from a struggling juice company into a $57 billion giant.

This follows a strong recovery in Aspen's share price on the Johannesburg Stock Exchange (JSE).

In 2024, ArcelorMittal SA paid Eskom $171 million for electricity as rising costs, weak demand, and imports pressured the steelmaker.

The recent upswing is largely credited to the revaluation of his wide-ranging private investments.

Richemont backs YNAP with a $114 million credit line to bolster digital luxury expansion, following EU approval of Mytheresa’s acquisition of YNAP.

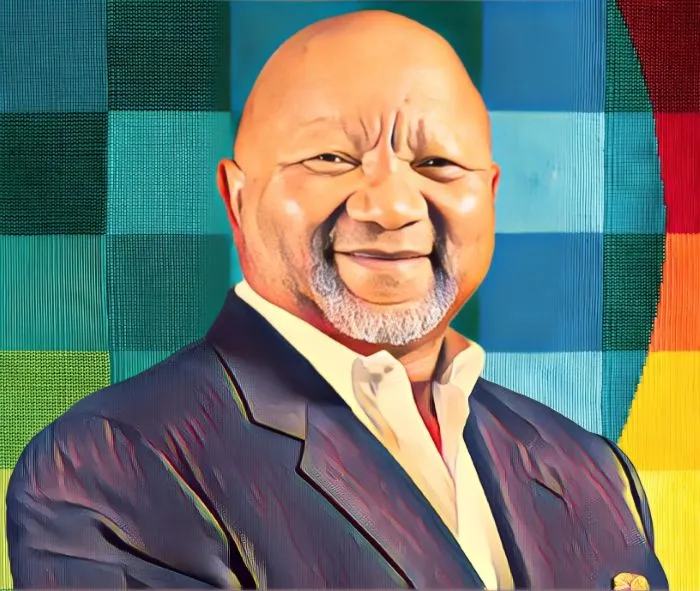

South African entrepreneur Mzi Khumalo built Capital Alliance into an $8 billion asset manager, blending sharp business acumen with social impact.

The Johannesburg-listed telecom giant raised medium-term guidance, signaling a potential turnaround driven by gains in Egypt and fintech.