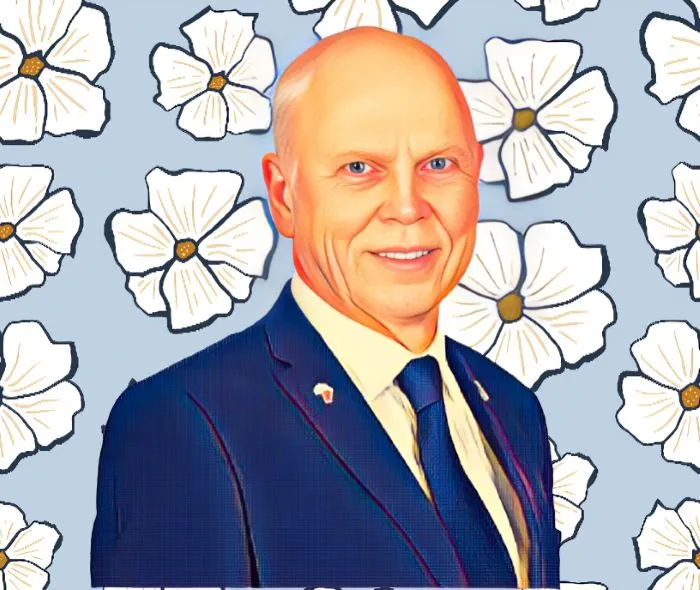

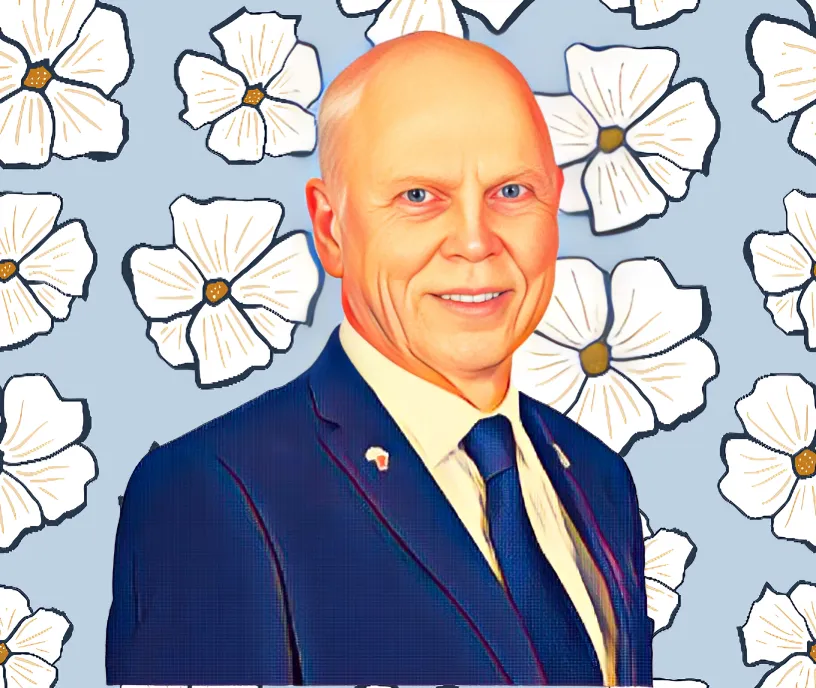

Sibanye suffers $311 million loss under Neal Froneman

Sibanye-Stillwater narrows 2024 loss to $311 million under Neal Froneman, showing signs of recovery amid weak metal markets and operational restructuring.

Skip to content

Skip to content

Sibanye-Stillwater narrows 2024 loss to $311 million under Neal Froneman, showing signs of recovery amid weak metal markets and operational restructuring.

This follows a strong recovery in Aspen's share price on the Johannesburg Stock Exchange (JSE).

In the past two weeks, Adrian Gore's stake has dropped by R753.34 million ($39.83 million) as Discovery's shares slide on the JSE.

The company paid out R11.5 billion ($593 million) in benefits, with wellness incentives and living benefits surpassing traditional death claims for the first time.

South African businessman Barry Swartzberg’s stake in JSE-listed Discovery has dropped by $40.1 million, falling from R5.5 billion ($283.8 million) to R4.72 billion ($243.7 million).

Despite the decline, Ravazzotti remains a key player in South Africa’s retail and manufacturing sector.

Attridge, co-founder and group chief advisor of Aspen Pharmacare, holds a 4.3-percent stake in the company.

His career—spanning executive leadership, major acquisitions, and boardroom influence—reflects a deep understanding of South Africa’s shifting economic landscape.

The investment aims to improve agricultural efficiency and expand market access in one of Africa’s most crucial sectors.

The surge cements Swartzberg’s position as one of South Africa’s richest investors and a key player on the JSE.

This adds to an earlier loss of $46.83 million between Jan. 1 and 13, when his stake in Italtile dropped from $551.82 million to $504.99 million.

PIC's decision reflects a strategic adjustment in response to rising costs and a slow economy, affecting South African businesses like Transaction Capital.

This corresponds to a 5.24 percent drop in Aspen’s stock price on the Johannesburg Stock Exchange (JSE) in 9 days.

Des de Beer increased his Lighthouse Properties stake by 1.61 percent, acquiring $13.7 million in shares throughout 2024.

Anton Pillay leads Coronation Fund Managers, overseeing $38.7 billion in AUM, driving sustainable growth and ethical investment practices.

Total revenue climbed 7 percent to R2.19 billion ($124.2 million) from R2.04 billion ($115.7 million) a year earlier.