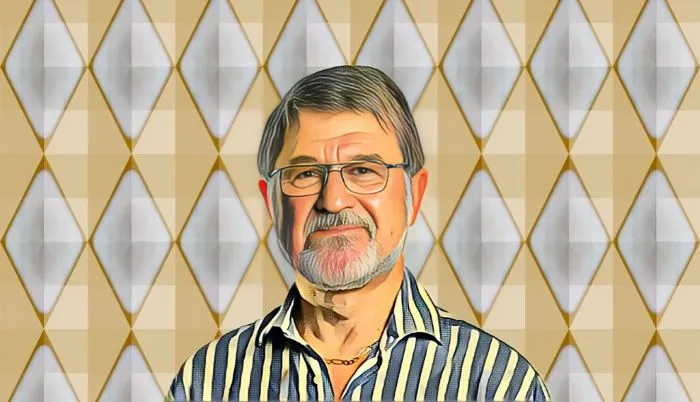

Johann Rupert’s Richemont supports YNAP with $114 million loan

Richemont backs YNAP with a $114 million credit line to bolster digital luxury expansion, following EU approval of Mytheresa’s acquisition of YNAP.

Skip to content

Skip to content

Richemont backs YNAP with a $114 million credit line to bolster digital luxury expansion, following EU approval of Mytheresa’s acquisition of YNAP.

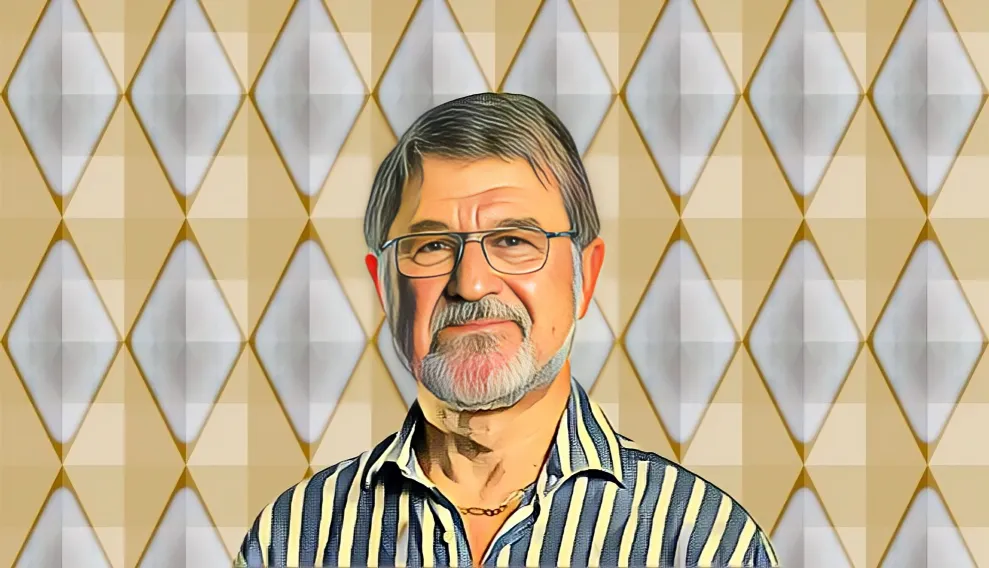

This follows a recent rally in the share price of the retail banking giant on the Johannesburg Stock Exchange (JSE).

PSG's net profit rose 23.47 percent to R1.38 billion ($73.21 million), up from R1.12 billion ($59.29 million) in the previous year.

His stake in Richemont benefited from a 5% surge in shares following President Trump’s announcement of a three-month tariff pause, excluding China.

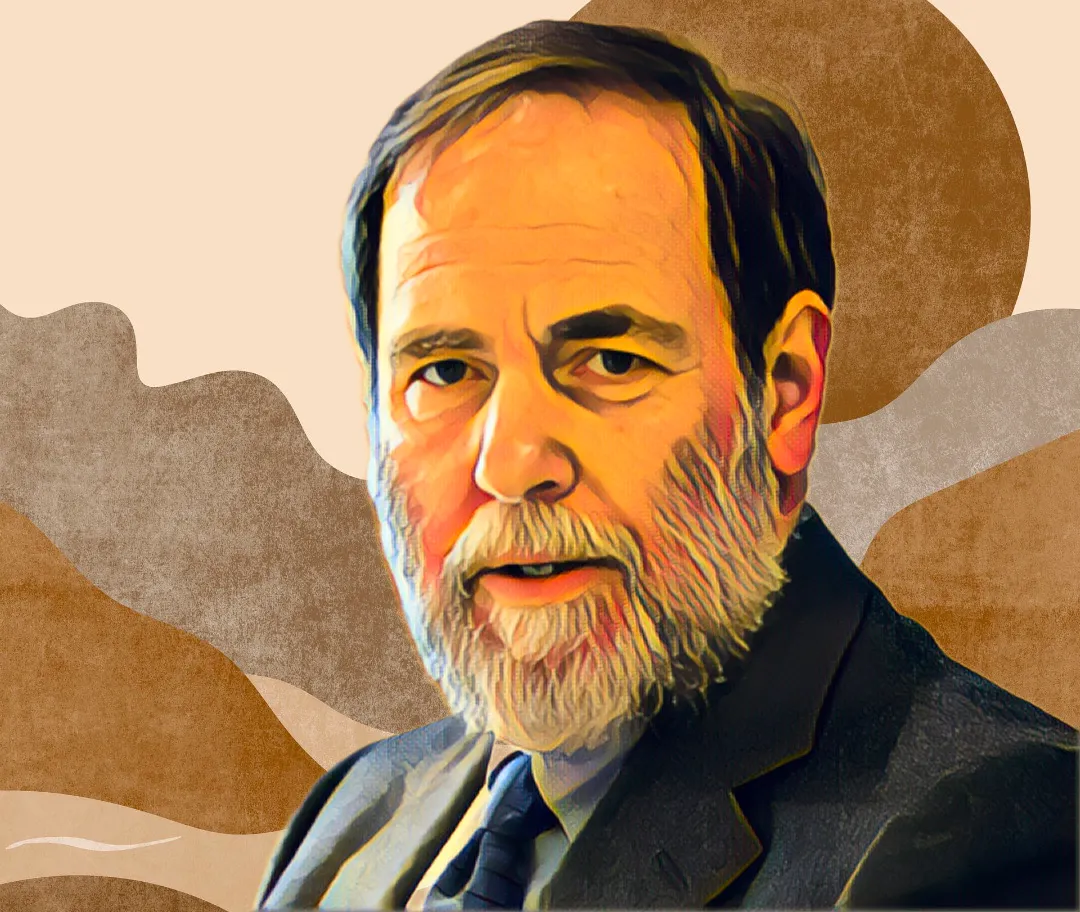

Ivan Glasenberg increases stake in Glencore after decade-long gap. His stake is worth around $3.7 billion, making him Glencore’s largest individual shareholder.

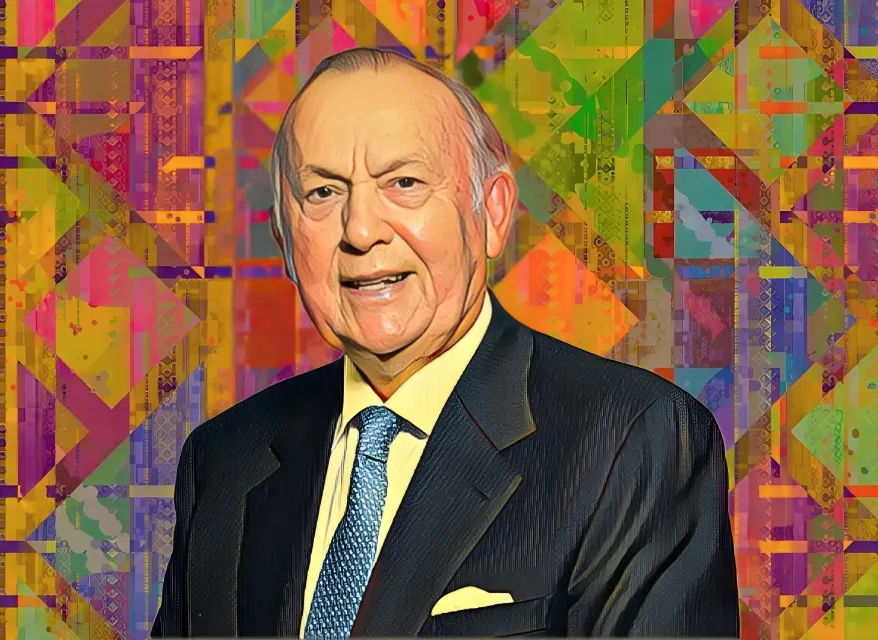

South Africa's richest man, Johann Rupert, saw his net worth fall from $17 billion on March 4 to $13.8 billion at the time of this report.

The entrepreneur aims to launch a platform like ‘The Daily Wire’ for South Africa, expanding his influence in media and politics.

The recent dip means Oppenheimer has lost $250 million year-to-date, reversing the $550 million gain recorded just 38 days ago.

The deal will add 462 stores across South Africa, Botswana, Lesotho, Namibia, and Eswatini to Pepkor’s expanding retail network, strengthening its position in the adultwear market.

The boost in Mouton’s wealth is largely attributed to Capitec Bank, where he holds a 5.1 percent stake through the J.F. Mouton Familietrust.

This latest increase builds on an earlier gain of $185 million between Jan. 28 and Feb. 10, when his stake climbed from $2.08 billion to $2.27 billion.

This decline follows a steeper loss earlier this year, when his stake dropped by $817.53 million between Jan. 24 and Feb. 23.

The move is aimed at consolidating control, unlocking shareholder value, and streamlining operations.

This follows a strong start to the year, when his net worth surged by $3.32 billion, rising from $13.7 billion to $17 billion by early March.

His leadership has reshaped CAF’s financial outlook, attracting record sponsorship deals and boosting revenue streams.

Motsepe’s net worth surged to $3 billion for the first time since August 2024, marking a significant recovery.