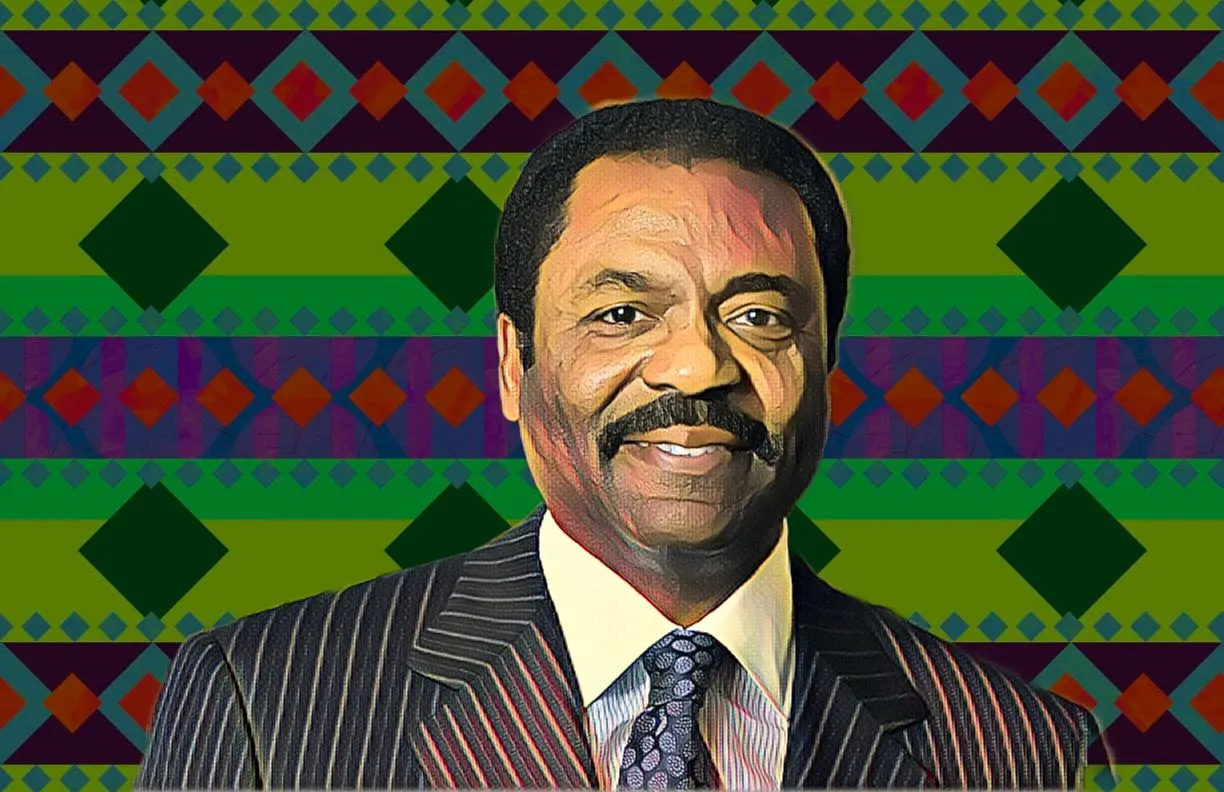

Vista, led by Black billionaire Robert F. Smith, explores $4 billion Granicus sale

While discussions are still in the early stages, Vista Equity Partners and Harvest Partners are aiming for a valuation of more than 20 times Granicus’ $175 million in EBITDA.