Lamia Tazi gains $14 million from Sothema stake in 18 days

This upswing has further cemented her position among Morocco’s wealthiest individuals.

Skip to content

Skip to content

This upswing has further cemented her position among Morocco’s wealthiest individuals.

While he hasn’t ruled out an interest in owning a football club in the future, he made it clear that no talks or plans have been initiated regarding Sheffield Wednesday.

Egypt’s richest man Nassef Sawiris left the UK for Italy, blaming “years of incompetence” by the Conservative government on tax policy.

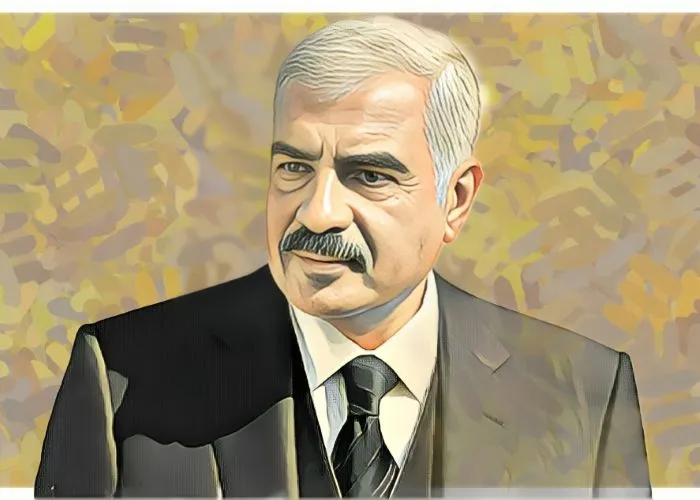

Mohamed El-Kettani has transformed Attijariwafa Bank into Morocco’s top private lender and a $15-billion African banking powerhouse spanning 27 countries.

If the deal goes through, Sefrioui would join Nassef Sawiris as one of few African billionaires with stakes in English football.

Revenue for the period grew from $80.64 million in 2023 to $111.9 million in 2024, a 39 percent increase.

This acquisition is a strategic move that strengthens DPI's presence across the African continent.

Hend El-Sherbini is one of Egypt’s leading executives and a key figure in the MENA region’s healthcare sector.

According to data tracked by Billionaires.Africa, the family’s stake has declined by EGP873.06 million ($17.09 million) since Feb. 4.

The dip highlights the challenges investors face amid global economic uncertainty and market conditions.

The Cairo-based developer said it has repurchased 42.7 million shares, about 2 percent of its total share capital, through open-market transactions.

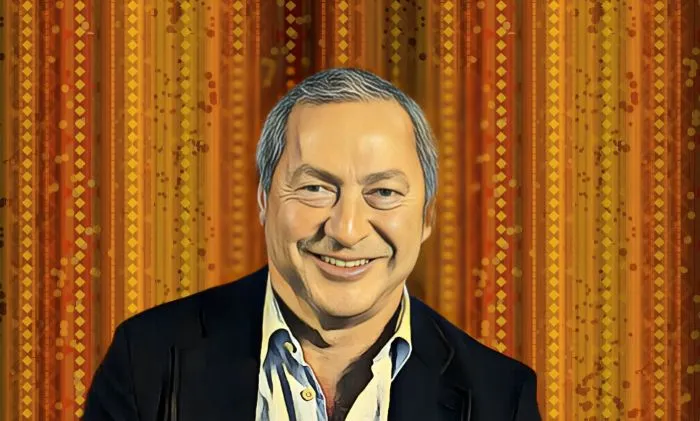

Egyptian billionaire Samih Sawiris will perform at the Cairo Opera House on May 7, 2025, to raise funds for Gaza’s displaced refugees.

The capital boost highlights increasing investor confidence, positioning the company for continued expansion.

Mansour Group to invest $150 million in two Egypt factories to boost local auto production and expand the country’s industrial footprint.

The setback comes on the heels of a more positive period earlier this year, when his stake grew by $54.87 million.

Moroccan real estate tycoon Alami Lazraq has seen the market value of his stake drop by MAD1.02 billion ($123.26 million) over the past month.