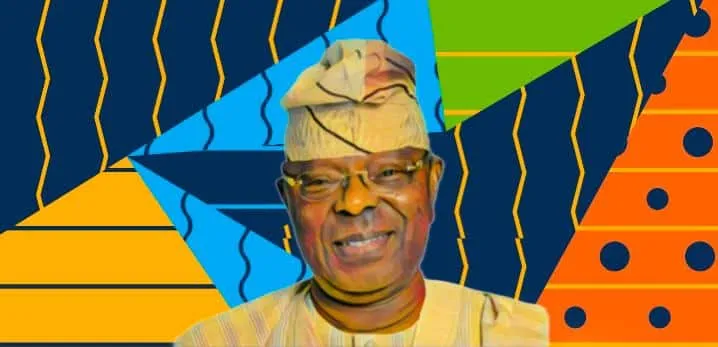

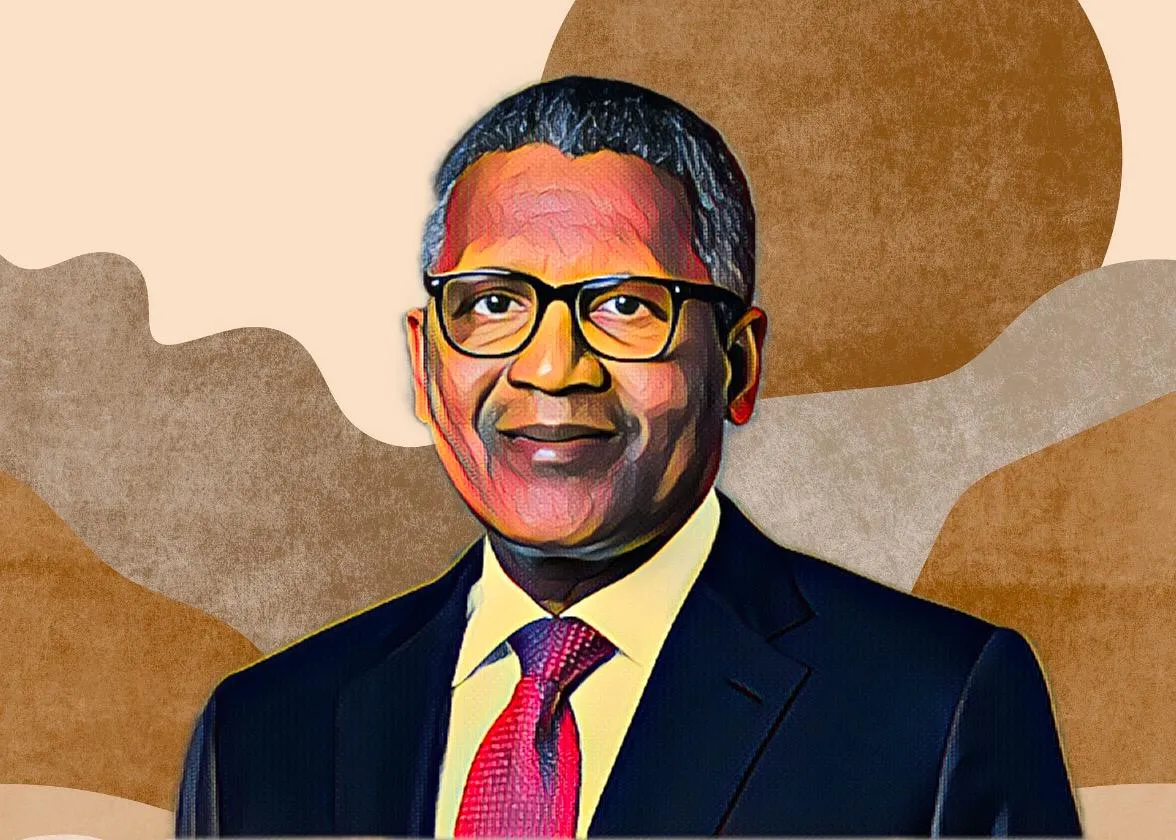

Nigerian businessman Oba Otudeko summoned to court over $24 million fraud

The case adds to his growing legal troubles, marking another chapter in the challenges facing the former FBN Holdings chairman and founder of Honeywell Group.

Skip to content

Skip to content

The case adds to his growing legal troubles, marking another chapter in the challenges facing the former FBN Holdings chairman and founder of Honeywell Group.

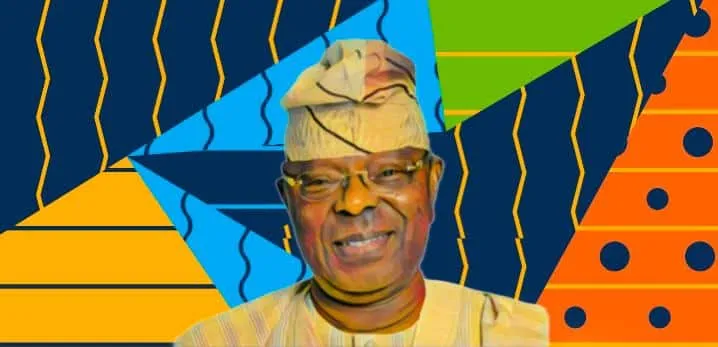

His investments have positioned him as a quiet force in Nigeria’s corporate world, with ownership in some of the country’s most essential industries.

The cement manufacturer recorded a 6.4 percent rise in profit despite surging finance costs and operational expenses.

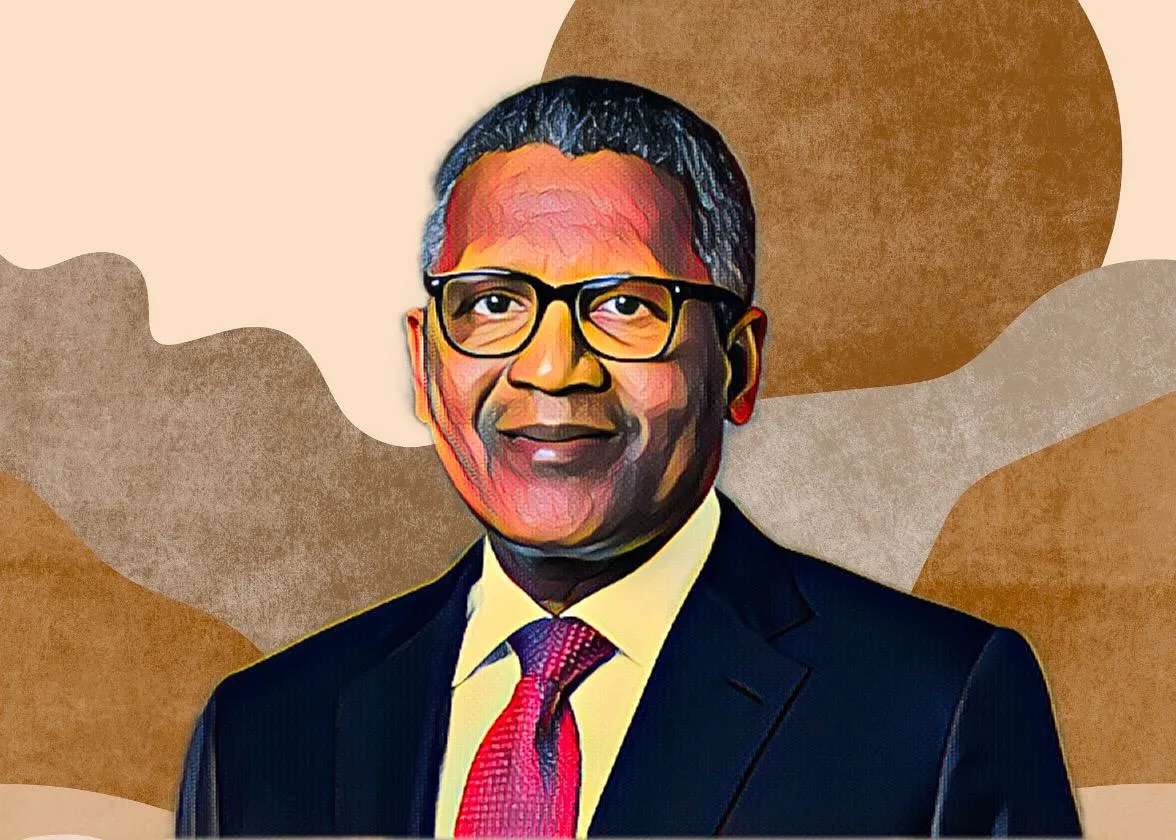

This increase highlights the strong performance of the Lagos-based lender and the confidence investors have in its prospects.

This milestone solidifies Zenith’s position as one of Nigeria’s top-capitalized financial institutions.

This highlights Oando's dominance in the energy landscape as the company continues to expand its footprint both locally and globally.

The issuance is part of the company’s N250-billion ($160.56 million) commercial paper program.

Access Bank's decision to establish a presence in Malta signals its broader push into key global markets, following the recent opening of its Hong Kong branch.

Funke Opeke steps down after 14 years as MainOne's CEO following a milestone $320 million acquisition by Equinix.

The refinery specified that any referenced payments were processed through the Nigerian National Petroleum Company (NNPC) Limited, not directly to them.

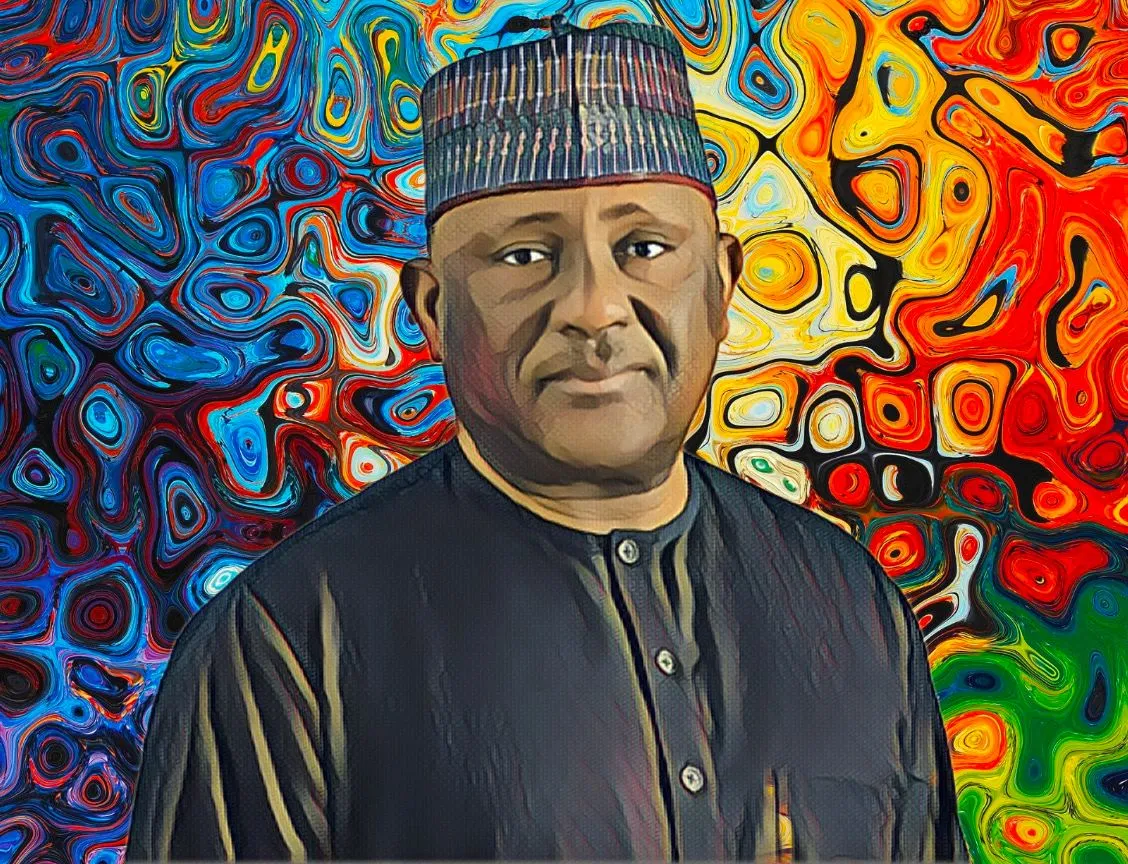

His leadership has helped push the group’s total assets past $16 billion, a milestone for the Lagos-based financial services provider.

The boreholes, part of IHS Nigeria’s ongoing collaboration with UNICEF, are designed to help prevent waterborne diseases and mitigate health risks for flood-affected residents.

Despite revenue gains, net profit fell 18.64% to N8.96 billion ($5.45 million) due to rising costs.

This is part of a broader strategy to combat the ongoing energy shortages that have long plagued the nation.

This move is designed to enhance Access Bank's footprint in Kenya’s burgeoning financial market, reflecting the institution's commitment to expanding its presence in East Africa.

This funding will elevate the company’s digital payment and banking capabilities, reinforcing its commitment to revolutionizing financial services across Africa.