Arnaud Lagesse's Phoenix acquires $80 million stake in Seychelles Breweries from Diageo

The agreement strengthens the relationship between Diageo and Phoenix Beverages—a subsidiary of the Mauritius-based IBL Group.

Skip to content

Skip to content

The agreement strengthens the relationship between Diageo and Phoenix Beverages—a subsidiary of the Mauritius-based IBL Group.

Revenue dropped from MUR347.94 million ($7.5 million) to MUR232.4 million ($5 million), while finance costs surged to MUR63.1 million ($1.36 million).

While revenue edged higher, the group’s profit took a hit, weighed down by new tax levies and weaker contributions from its agro business.

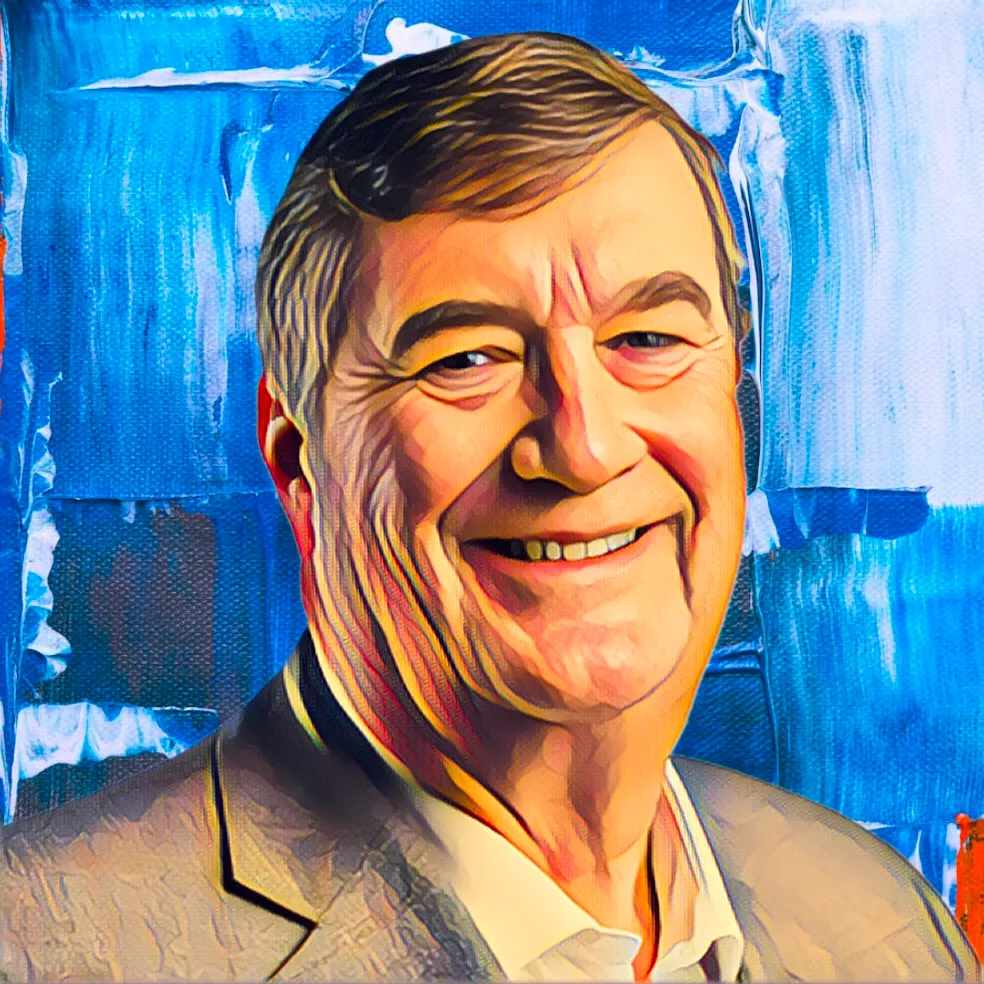

From leading Mauritius’ largest conglomerate, IBL Group, to investments in Kenya’s retail sector through Naivas International.

Explore his influential connections to seven key companies, ranging from MCB Capital Markets to the Blue Penny Museum.

Noel’s passing comes over two years after his retirement as the CEO of MCB Group.

Ribet owns a 3.32-percent stake in BMH Limited.

Mayer founded Evaco Group as a real estate development company in 2001.

IBL Group is a leading conglomerate with more than 200 brands.

Lagesse and his siblings own a 16.8-percent joint stake in IBL Group.

Noel owns 0.55 percent of Mauritius’ largest banking group, MCB Group Limited.

The Mauritian Lagesse family and the Dalais family both control a portion of Alteo Limited through related entities.

The transaction highlights Naivas’ intrinsic value as Kenya’s largest supermarket chain.

Ribet controls a significant 3.32-percent stake in the company worth $1.71 million.

The Espitalier-Noel family is one of the wealthiest families in Mauritius.

The Mauritius-based group is led by Espitalier-Noel, who has a 9.92-percent beneficial stake in the company.