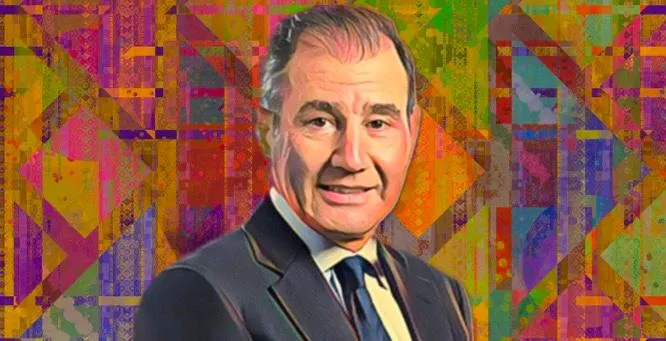

Ivan Glasenberg makes first Glencore share purchase in a decade

Ivan Glasenberg increases stake in Glencore after decade-long gap. His stake is worth around $3.7 billion, making him Glencore’s largest individual shareholder.

Skip to content

Skip to content

Ivan Glasenberg increases stake in Glencore after decade-long gap. His stake is worth around $3.7 billion, making him Glencore’s largest individual shareholder.

This decline follows a steeper loss earlier this year, when his stake dropped by $817.53 million between Jan. 24 and Feb. 23.

His holdings have declined by £647.19 million ($817.53 million) in the past month as Glencore’s stock fell under market pressure.

This marks a partial recovery after a challenging year in which his stake dropped by nearly $2 billion.

Glencore's share price slump wipes out $1.9 billion from Ivan Glasenberg's stake.

The recent surge in Glasenberg’s fortune translates to an average daily gain of $37.6 million since May 1.

The $240-million decline is primarily attributed to the recent decrease in the market value of his 9.81-percent stake in Glencore.

Glasenberg’s rising fortune further cements his position among the world’s richest individuals.

In recent times, Glencore shares are up 1.4 percent, rising from £4.28 ($5.39) on March 21 to £4.34 ($5.47) at the time of drafting this report.

Despite recording substantial year-to-date losses totaling $687 million, Glasenberg’s recent ascent in wealth has been notable.

Ranked 318th among the world’s wealthiest, Glasenberg has slipped from 302nd since Feb. 3.

Despite the challenges in the production sector, Glencore experienced a positive turn in its share price, surging by 2.49 percent over the past 24 hours to £4.25 ($5.42).

The $860-million year-to-date wealth loss is attributed to the sustained dip in the market value of his 9.81 percent stake in Glencore.

Glasenberg’s wealth is derived from his 9.81-percent stake in Glencore, a Swiss multinational commodity trading and mining company.

The $254-million year-to-date decline in his wealth is attributed to the sustained dip in the market value of his stake in Glencore.