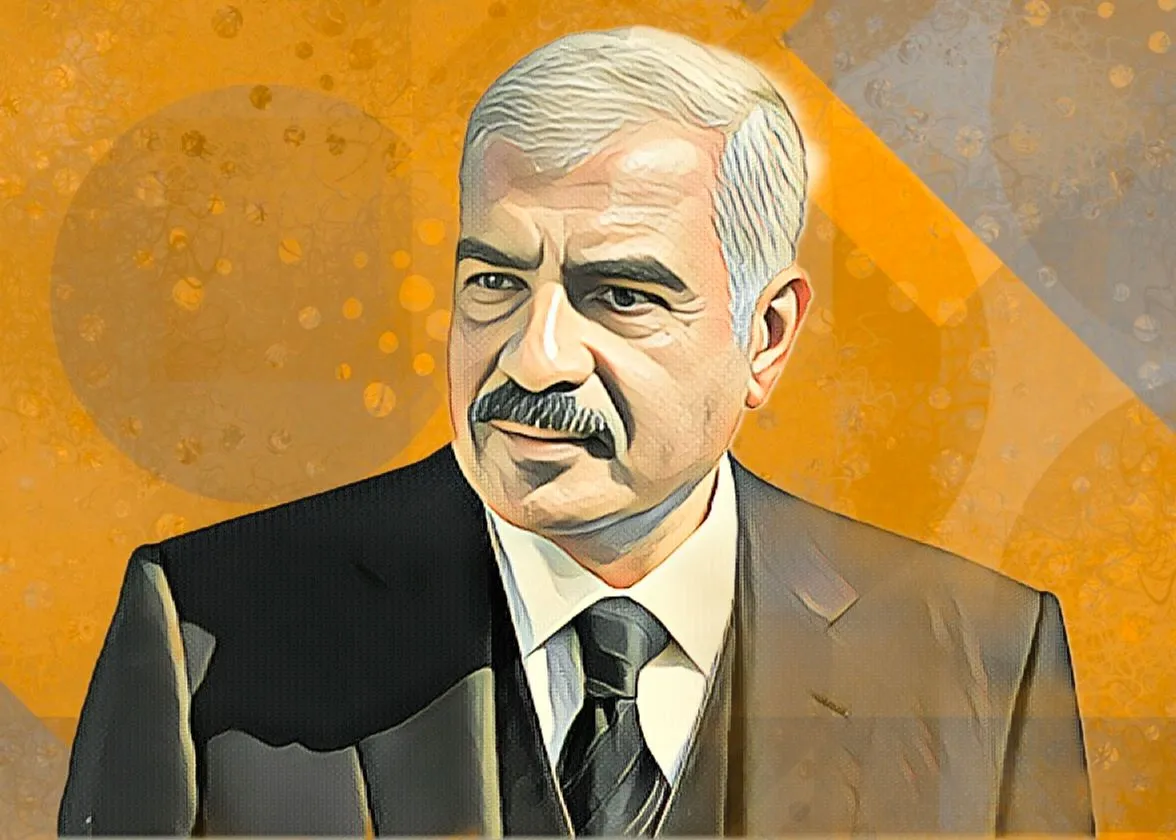

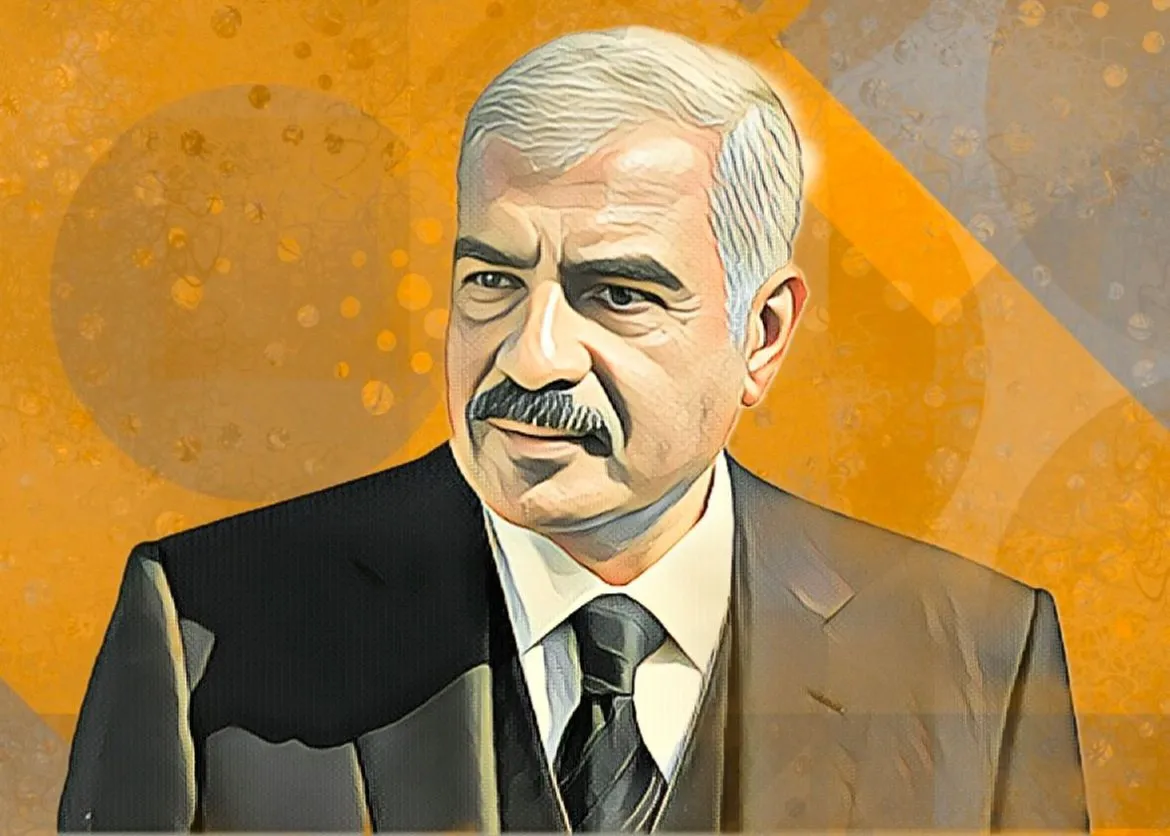

Hisham Talaat Moustafa’s stake falls by $110 million in 26 days

The setback comes on the heels of a more positive period earlier this year, when his stake grew by $54.87 million.

Skip to content

Skip to content

The setback comes on the heels of a more positive period earlier this year, when his stake grew by $54.87 million.

Under the agreement, Alameda will manage and operate a state-of-the-art hospital within TMG’s flagship Madinaty development in East Cairo.

The recovery follows a sharp decline between Jan. 1 and Feb. 7, when the market value of his stake dropped by EGP 2.84 billion ($56.48 million).

The company’s growth is attributed to the continued success of its real estate ventures and the booming hospitality sector.

Egypt’s TMG Holding posts record $10 billion sales in 2024, a 253% surge, driven by expansion into Saudi Arabia and major North Coast projects.

His plan focuses on housing, infrastructure, and international cooperation to address the crisis.

Even with this decline, Moustafa remains one of Egypt’s wealthiest individuals, backed by his significant holdings in TMG.

This funding supported the launch of a fully upgraded Children’s Emergency Department and a modern Blood Transfusion and Chemotherapy Center.

Hisham Talaat Moustafa’s stake, amounting to 890,566,601 shares, has gained EGP29.46 billion ($321.54 million) in market value since the beginning of the year.

Moustafa outlined a vision to attract 30 million annual visitors to Egypt, leveraging the country’s rich cultural heritage and untapped potential.

TMG Holding's SouthMED and Benan projects fuel $9.4 billion in sales, showcasing the strong demand for luxury coastal living in Egypt and Saudi Arabia.

This decline follows a previous gain of $89.6 million recorded between Sept. 16 and 29, when Moustafa’s stake rose from $1.25 billion to $1.33 billion.

This recovery follows a brief decline of EGP6.03 billion ($124.2 million) between July 9 and Aug. 1