Capitec to pay $47.6 million to three South African shareholders

Capitec to pay $47.6 million to three South African shareholders

Skip to content

Skip to content

Capitec to pay $47.6 million to three South African shareholders

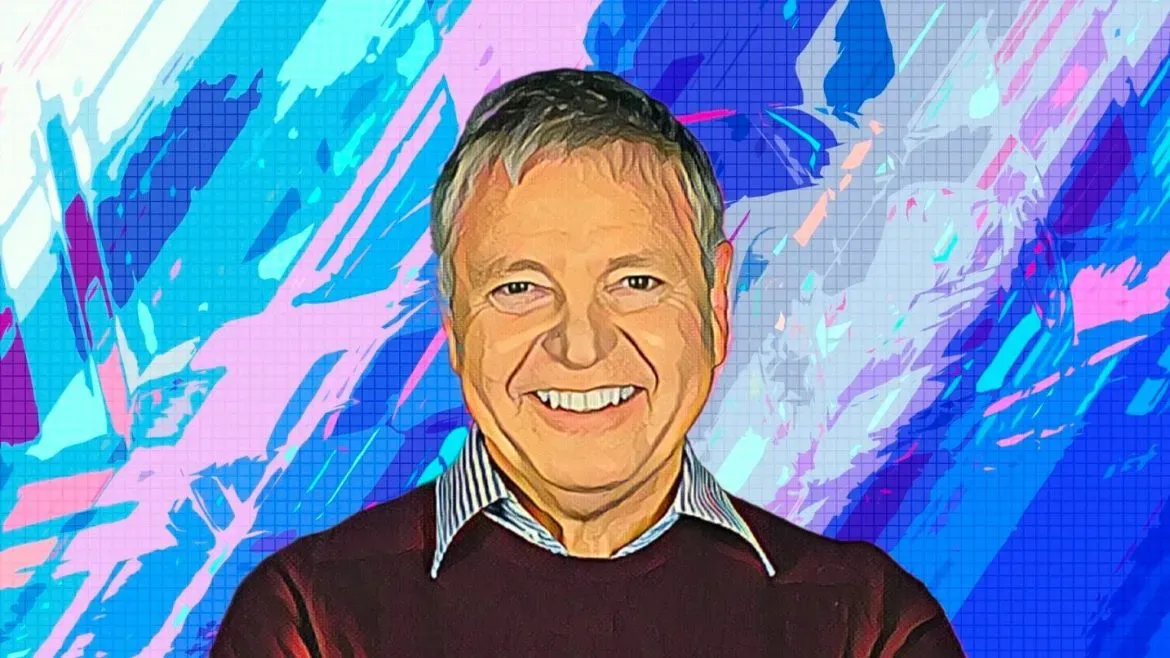

This reflects his role in steering the bank through a period of significant growth, strengthening its position as a leader in the country’s financial sector.

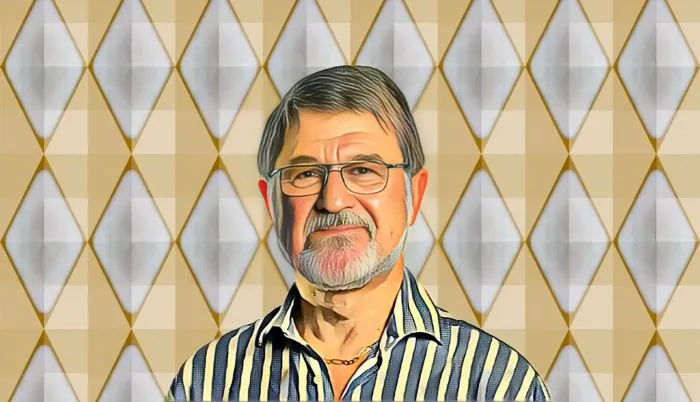

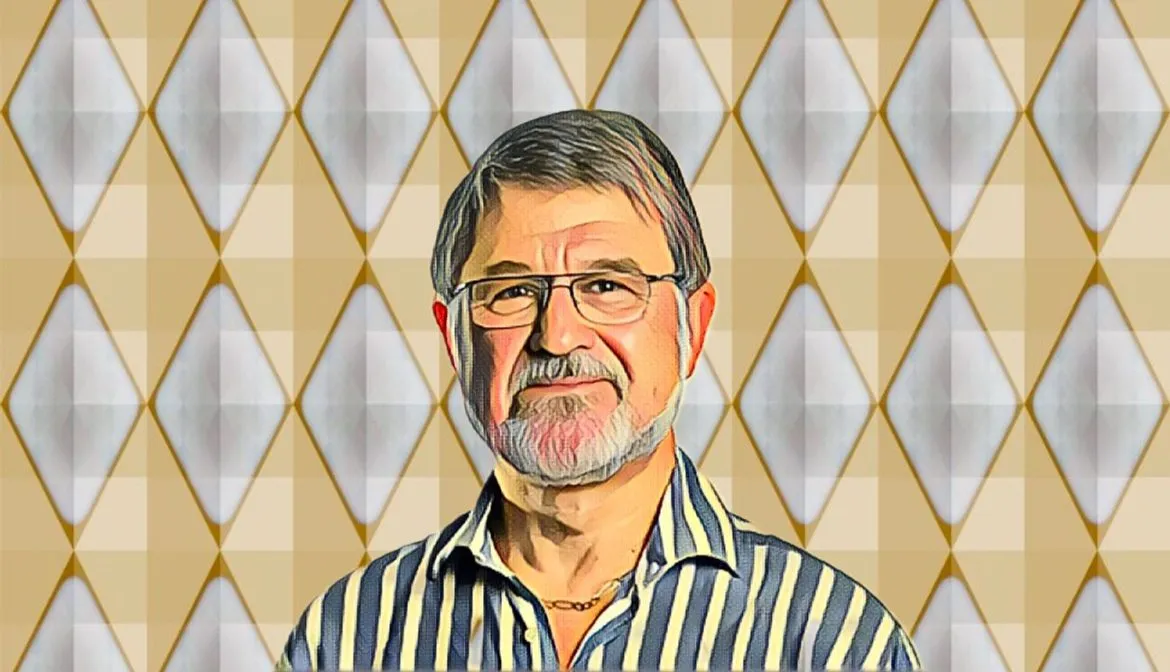

The rise in Jannie Mouton’s stake in Capitec Bank strengthens his position among South Africa’s billionaires.

This follows a recent rally in the share price of the retail banking giant on the Johannesburg Stock Exchange (JSE).

This marks the end of more than a decade-long tenure in which he played a key role in transforming Capitec into the country’s leading digital bank.

This latest increase builds on an earlier gain of $185 million between Jan. 28 and Feb. 10, when his stake climbed from $2.08 billion to $2.27 billion.

Jannie Mouton’s Capitec Bank stake, which was valued at $1 billion on Feb. 26, has now dropped to $979.41 million.

Capitec Bank shares have edged up 1.07 percent since Jan. 1, despite an early dip in January.

This decline comes after a strong 2024 performance that saw Mouton’s stake gain $350 million, soaring from over $650 million to beyond $1 billion.

This decline has reduced the market value of his stake to $2.05 billion as the bank contends with broader market challenges.

Capitec Bank's decision to close the accounts of Zimbabwean Exemption Permit holders has sparked widespread concern, complicating the financial stability of thousands amidst ongoing legal uncertainty.

Capitec Bank's decision to cap Capitec Pay commission fees at $0.37 per transaction aims to support businesses and boost South Africa’s expanding e-commerce sector.

Capitec’s strong returns have solidified its position as one of the JSE’s top performers in 2024, offering a 56.29 percent return year-to-date.

Despite the sanctions, Capitec maintained cooperation in its remedial measures to address compliance weaknesses and enhance its AML framework.

South African billionaire's net worth surges as bank shares hit record highs.

Capitec Bank collaborates with Cisco to enhance digital infrastructure and improve customer experience.