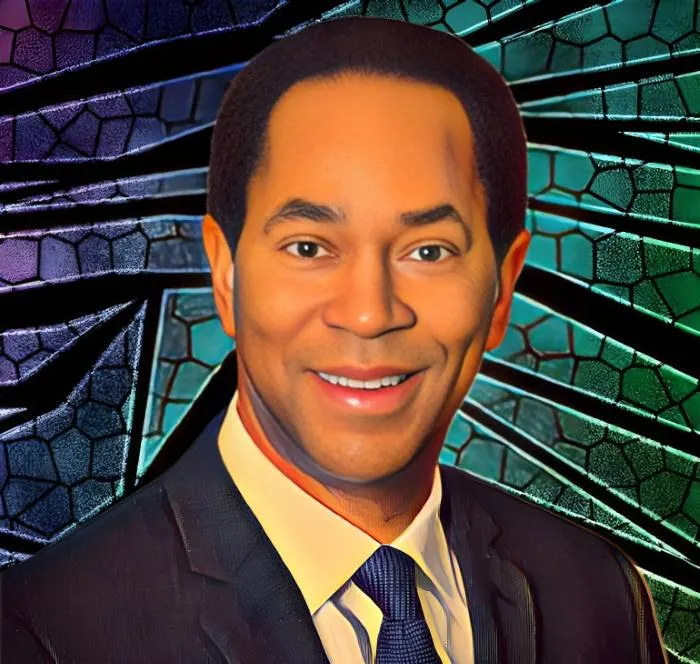

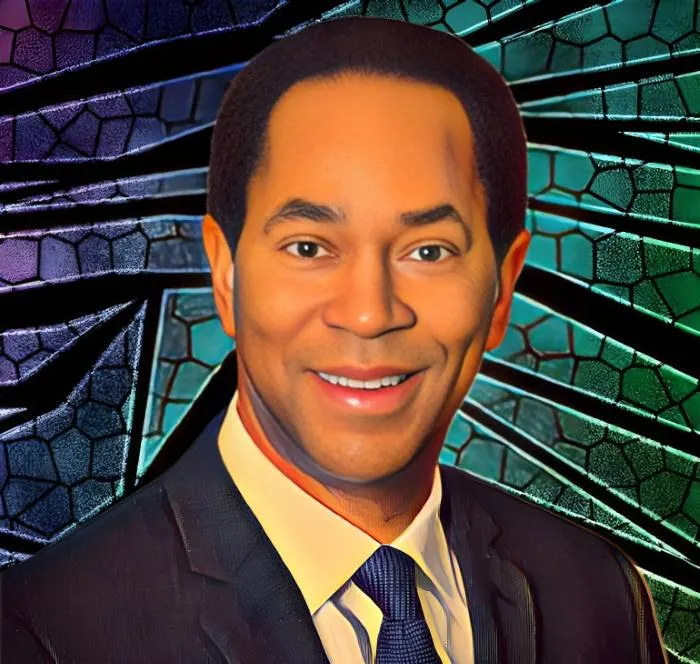

Craig Arnold-led Eaton declares $407.2 million dividend

Eaton, led by CEO Craig Arnold, announces a $407.2 million quarterly dividend, showcasing its strong financial performance and commitment to shareholder value.

Skip to content

Skip to content

Eaton, led by CEO Craig Arnold, announces a $407.2 million quarterly dividend, showcasing its strong financial performance and commitment to shareholder value.

Eaton shares have dropped 17.46% since the start of the year. A $100,000 investment in Eaton at the beginning of 2025 is now worth $82,540, reflecting a loss of $17,460.

The deal, subject to regulatory approval, will expand Eaton’s presence in the data center and industrial markets.

Net total sales totaled $83.67 billion, marking a 3.13% decline, though strong online and pro sales offer optimism amid ongoing challenges.

Over the last 21 days, Ellison’s shares in Lowe’s, amounting to 748,000 shares, declined by more than $12 million.

After a strong year in 2024, his stake in Lowe’s has gained over $8.5 million in value in just the past 16 days.

Eaton’s growth is also reflected in its strong financial results, including a 9-month net sales increase of 8.18 percent year-over-year.

The 50,000-square-foot cleanroom facility, set for completion by 2026, will enhance capabilities in semiconductor research, development, and commercialization.

Mark Mason’s $14.49 million pay reflects strategic leadership in Citigroup’s financial success.

This boost further solidifies his position among the wealthiest Black CEOs in the U.S. and top-ranking Black executives globally.

Total sales totaled $65.12 billion, marking a 3.92% decline, though strong online and pro sales offer optimism amid ongoing challenges.

The recent surge builds on an earlier gain of $43.57 million from Sept. 6 to Oct. 23, when the value of his holdings climbed from $210.04 million to $253.6 million.

Electrical and aerospace segments propel growth, vehicle sales lag, CEO Arnold confident as profitability rises 24 percent.

Eaton maintains a quarterly dividend of $0.94 per share following record Q2 earnings, underscoring long-term growth and shareholder commitment.

Eaton CEO Craig Arnold’s Holdings surge above $250 million amid stock rally.

Black CEO Craig Arnold's net worth drops as his stake in the power management company falls below $150 million.