Manu Chandaria: Kenyan industrialist behind billion-dollar conglomerate

At 96, Chandaria is still at the helm, guiding Comcraft into its next phase with plans to take key subsidiaries public.

Skip to content

Skip to content

At 96, Chandaria is still at the helm, guiding Comcraft into its next phase with plans to take key subsidiaries public.

EFCC declares Aisha Achimugu wanted in a $150.3 million fraud probe involving offshore oil assets, money laundering, and 136 suspicious bank accounts.

Africa’s wealthiest families shape industries, from Nigeria’s Dantatas to South Africa’s Ruperts, leaving lasting economic legacies through strategic investments.

Sibanye-Stillwater narrows 2024 loss to $311 million under Neal Froneman, showing signs of recovery amid weak metal markets and operational restructuring.

From fixing roofs in Addis Ababa to developing sub-Saharan Africa’s first Marriott hotel, Tafesse has become one of Ethiopia’s top businessmen.

This upswing has further cemented her position among Morocco’s wealthiest individuals.

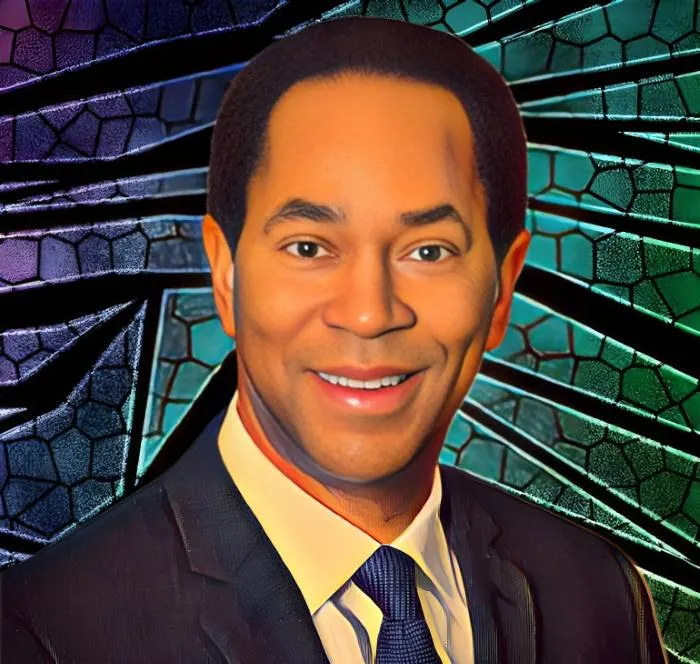

With over two decades of experience across industries, Unuigbe, CEO of Petralon Energy, is a leading energy mogul in Africa.

The move boosts his direct stake in East Africa’s largest lender at a time when the bank continues to post strong results and maintain its market dominance.

Aspen shares dive 30% amid $148.7 million mRNA tech dispute, stoking investor fears over financial stability.

BOC Kenya, led by Ngugi Kiuna, targets independent growth after the collapse of its acquisition deal with Carbacid, refocusing on market expansion.

Pre-tax profit for the first quarter of 2025 surged to $62 million, marking a significant increase from the same period last year.

Eaton, led by CEO Craig Arnold, announces a $407.2 million quarterly dividend, showcasing its strong financial performance and commitment to shareholder value.

Capitec to pay $47.6 million to three South African shareholders

In just two months, his holdings have lost N10.16 billion ($6.32 million) due to the recent decline in stock price.

This reflects his role in steering the bank through a period of significant growth, strengthening its position as a leader in the country’s financial sector.

The PIC has pledged its support by agreeing to accept a standby offer for 41.6 million Barloworld shares, which translates to 21.93 percent of the company’s total issued shares.