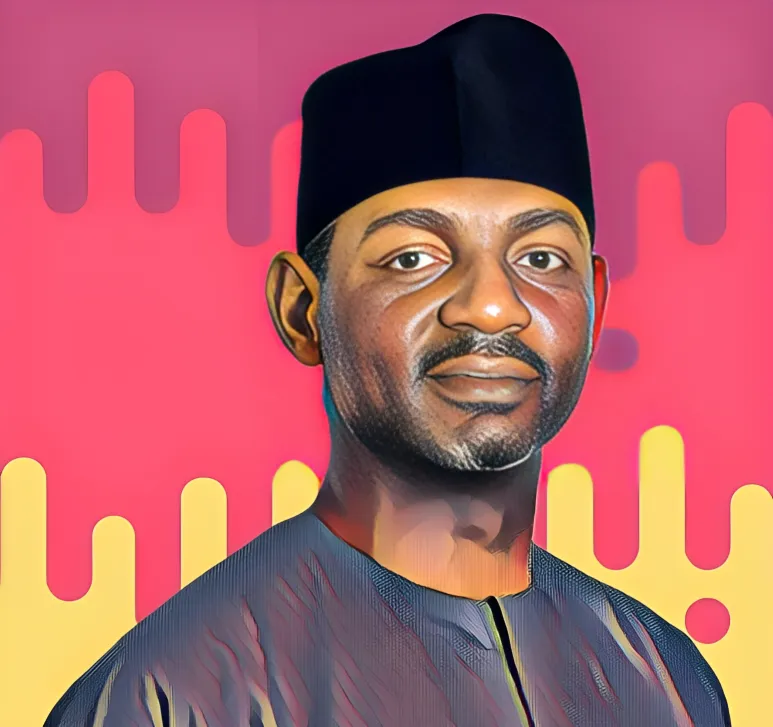

Aliko Dangote scales up $10 million food relief effort in Nigeria

The program is aimed at helping low-income families cope with the harsh economic climate and rising cost of living.

Skip to content

Skip to content

The program is aimed at helping low-income families cope with the harsh economic climate and rising cost of living.

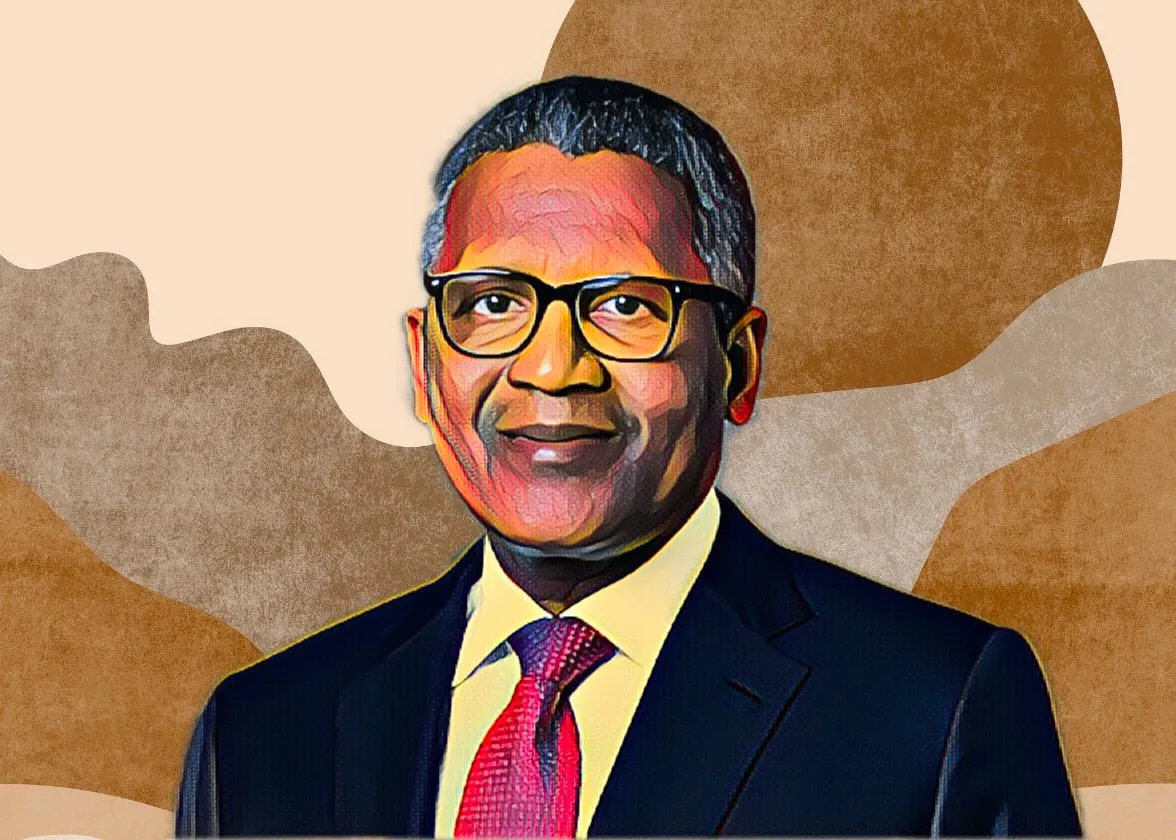

This comes despite global interest in his $20 billion Dangote Oil Refinery, one of Africa’s most ambitious projects.

The growth was fueled by higher sales of Premium Motor Spirit (PMS), Automotive Gas Oil (AGO), Aviation Turbine Kerosene (ATK), and lubricants.

Beyond the local market, the refinery has expanded its reach across Africa, supplying diesel and aviation fuel to Cameroon, Angola, Ghana, and South Africa.

Dangote's empire thrives on diversification, with investments spanning cement, sugar, and oil refining, ensuring stability and long-term growth amid economic fluctuations.

Billionaires.Africa shares 10 key lessons from African billionaires, practical insights to help entrepreneurs overcome challenges, seize opportunities, and build lasting businesses.

With a production capacity of 2,000 tonnes per day, the new plant is expected to create hundreds of jobs for Burkina Faso’s youth.

Even billionaires make costly mistakes—overleveraging, overexposure, disruption, misjudgment, and poor due diligence can erase fortunes in months.

With deep pockets and a sharp eye for opportunity, billionaire-backed banks are making a mark in corporate finance, wealth management, and financial inclusion.

The decision follows a major policy shift by NNPC, which scrapped the naira-for-crude oil swap deal just ten days ago.

Aliko Dangote plans to build Nigeria’s largest seaport at the Olokola Free Trade Zone and resume work on a delayed 6-million-ton cement plant in Ogun.

The move is expected to drive up operational costs and could lead to higher fuel prices.

“I will be here very soon,” Dangote said, addressing fellow billionaire Femi Otedola. “And I want to congratulate you on this groundbreaking ceremony.”

Inside Africa’s richest man’s payday from his cement empire, Dangote Cement Plc.

Revenue from its Nigerian unit rose from N1.29 trillion ($860.6 million) to N2.19 trillion ($1.46 billion), helped by higher cement prices.

This aligns with Nigeria’s broader economic recovery efforts under President Bola Ahmed Tinubu and aims to ease financial pressure on consumers.