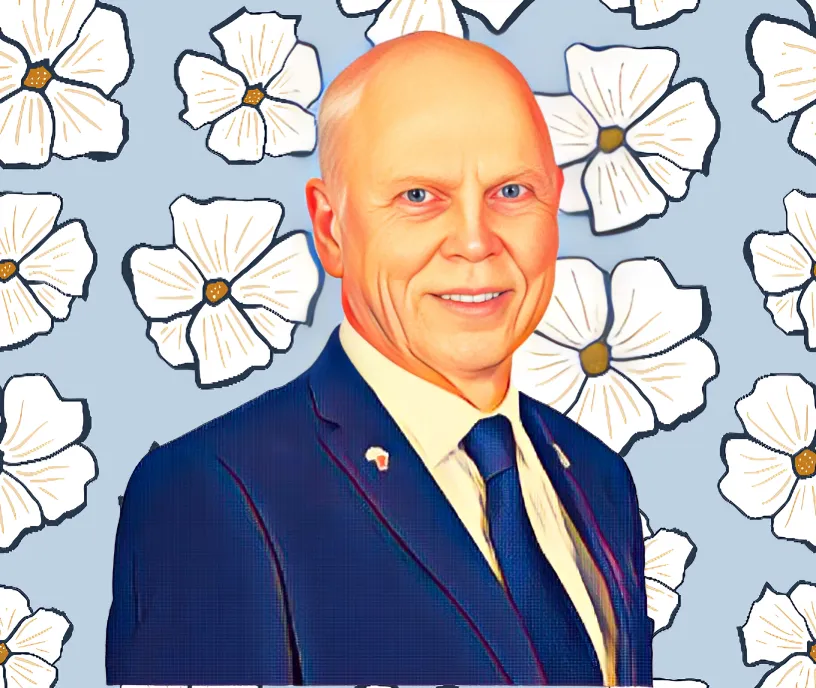

Aradel, led by Ladi Jadesimi, completes acquisition of Olo marginal fields

This strategic move strengthens Aradel’s upstream portfolio and advances its multi-field cluster development strategy in the Niger Delta.

Skip to content

Skip to content

This strategic move strengthens Aradel’s upstream portfolio and advances its multi-field cluster development strategy in the Niger Delta.

GB Corp. stock has risen 19.91% in the past five weeks, boosting the Ghabbour family’s stake value by $45.73 million.

The agreement strengthens Oando’s presence in Nigeria’s oil and gas sector and deepens its long-standing partnership with Afreximbank.

The partnership will make the series available on Amazon Prime Video, Amazon Music, Fire TV Channels, and Echo devices.

This comes barely two months after the company closed 32 stores as part of its restructuring plan.

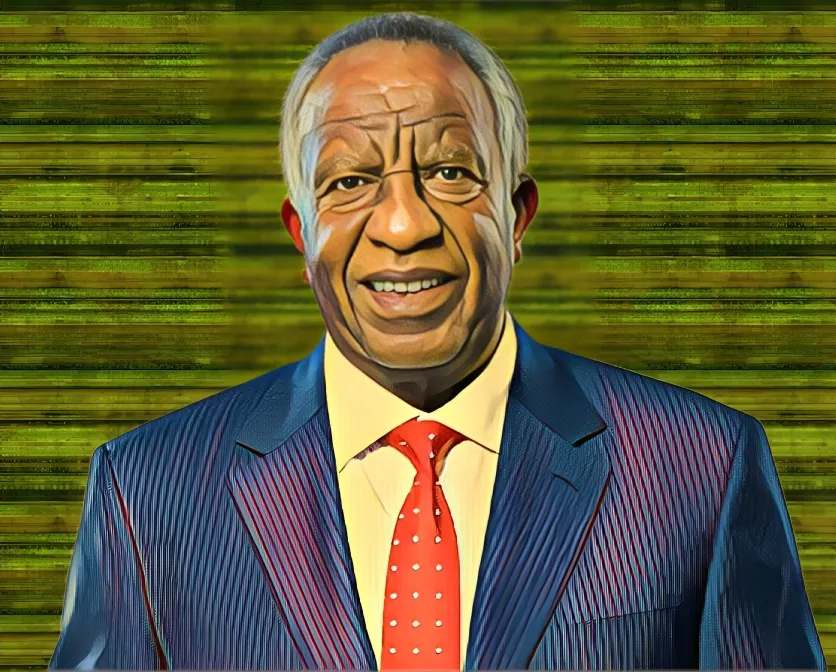

Attridge, co-founder and group chief advisor of Aspen Pharmacare, holds a 4.3-percent stake in the company.

Eaton shares have dropped 17.46% since the start of the year. A $100,000 investment in Eaton at the beginning of 2025 is now worth $82,540, reflecting a loss of $17,460.

ArcelorMittal SA, the country’s largest steel producer, has faced growing challenges from rising production costs, cheap imports, and unreliable rail services.

This downturn follows a $44 million gain in January, which had lifted his stake to R10.26 billion ($550.1 million).

The funds will go toward installing new equipment at Astron Energy’s 100,000-barrel-per-day crude oil refinery near Cape Town.

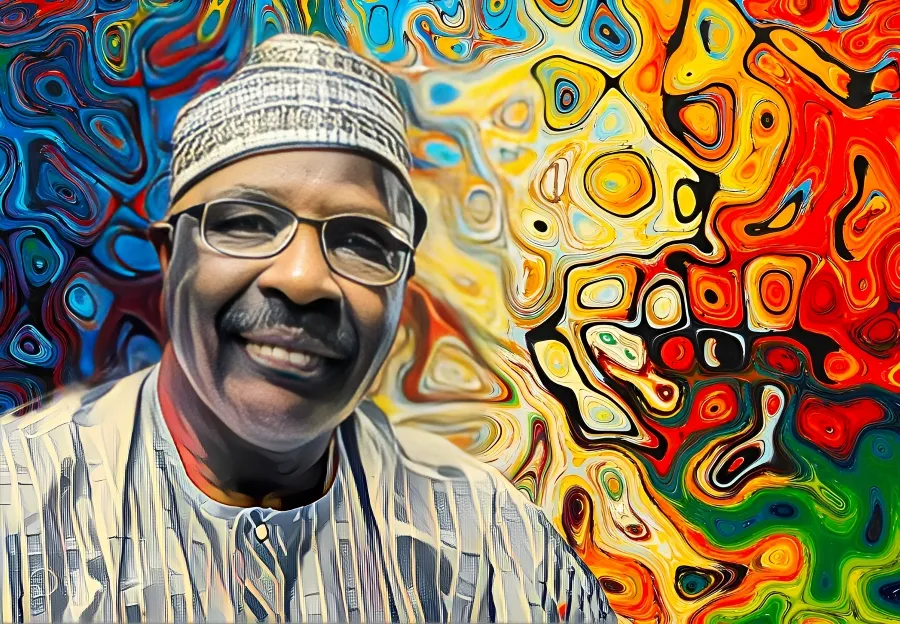

As the founder and chairman of Zenith Bank, Ovia holds a 16.2-percent stake, totaling 5,082,800,739 shares.

Under the agreement, Alameda will manage and operate a state-of-the-art hospital within TMG’s flagship Madinaty development in East Cairo.

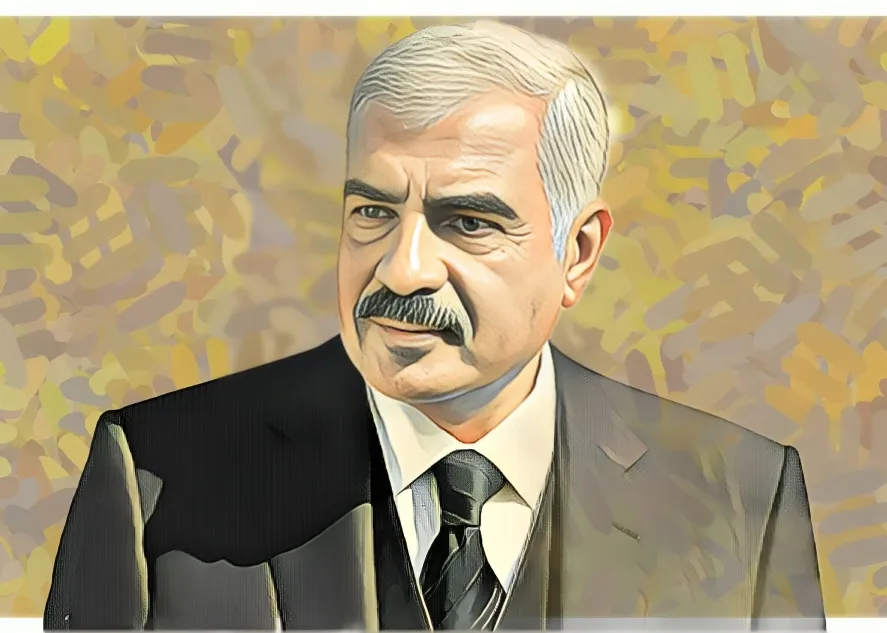

IHS Holding, led by Sam Darwish, raised $1.6 billion to strengthen its balance sheet amid currency volatility and evolving market conditions.

From his early days in tea cultivation to owning one of South Africa’s largest private property portfolios, his story is one of grit, vision, and calculated ambition.

Madinet Masr Housing and Development (MNHD has announced plans to launch commercial projects, marking a significant shift in its business strategy.

His influence extends beyond banking, shaping industries such as insurance, agriculture, and education.