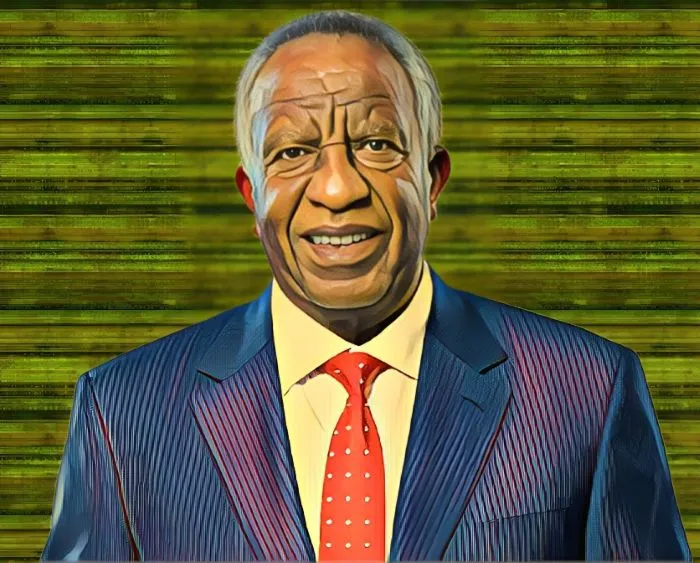

Peter Ndegwa leads Safaricom’s $300 million M-PESA upgrade

Peter Ndegwa said the upgrade will strengthen M-PESA’s backbone, making it more resilient and prepared for the future.

Skip to content

Skip to content

Peter Ndegwa said the upgrade will strengthen M-PESA’s backbone, making it more resilient and prepared for the future.

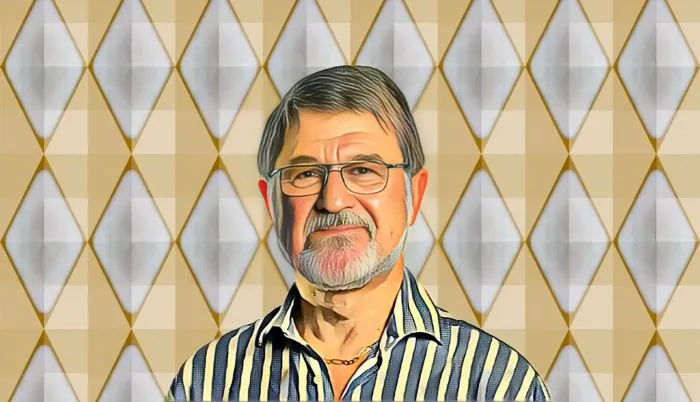

With over two decades of experience across industries, Unuigbe, CEO of Petralon Energy, is a leading energy mogul in Africa.

Pre-tax profit for the first quarter of 2025 surged to $62 million, marking a significant increase from the same period last year.

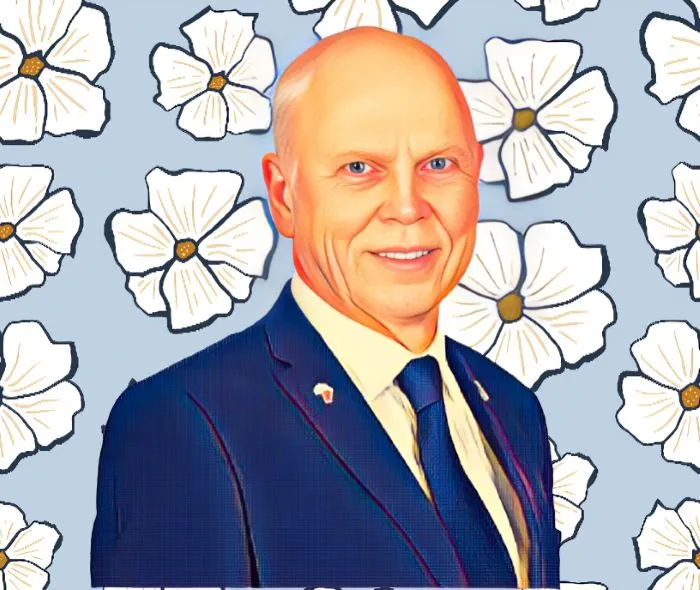

The rise in Jannie Mouton’s stake in Capitec Bank strengthens his position among South Africa’s billionaires.

While he hasn’t ruled out an interest in owning a football club in the future, he made it clear that no talks or plans have been initiated regarding Sheffield Wednesday.

AXIAN Energy, controlled by Hassanein Hiridjee, is set to build a solar-plus-storage facility in Senegal’s underserved Kolda region, boosting clean power access.

Aisha Abdulaziz called the NGX listing “a national moment,” citing Legend’s mission to build Africa’s most customer-focused, innovative internet company.

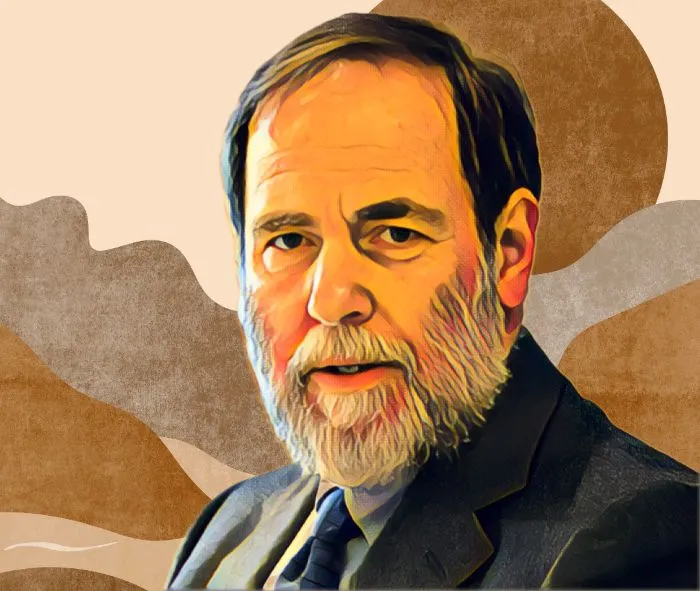

Ivorian banker Jean Kacou Diagou has raised his stake in NSIA Participations to 68.73%, strengthening his influence in Africa’s financial services sector.

From Libreville to Johannesburg, African leaders are driving a continental push toward digital growth and connectivity.

A court in Abidjan ruled him ineligible to run, citing his removal from the electoral list after losing Ivorian nationality upon becoming a French citizen in 1987.

This follows a strong recovery in Aspen's share price on the Johannesburg Stock Exchange (JSE).

The recent upswing is largely credited to the revaluation of his wide-ranging private investments.

Egypt’s richest man Nassef Sawiris left the UK for Italy, blaming “years of incompetence” by the Conservative government on tax policy.

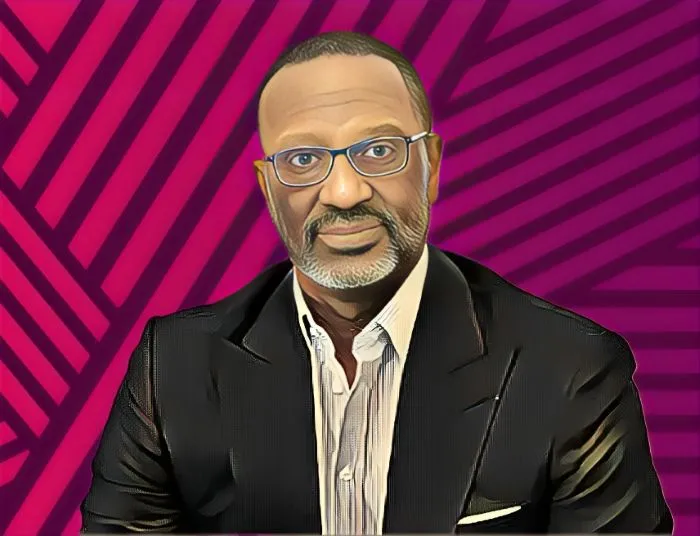

Otedola, chairman of FirstHoldCo and Geregu Power, holds an 11.8% stake in the Lagos-based financial group.

This highlights the company's commitment to regional expansion and aligns with the UAE's vision for sustainable, growth-driven urban development.

The bank seeks to recover $3.35 million in loans owed by Equatorial Nut Processors, controlled by Munga.