Top 10 richest families in Africa

Africa’s wealthiest families shape industries, from Nigeria’s Dantatas to South Africa’s Ruperts, leaving lasting economic legacies through strategic investments.

Skip to content

Skip to content

Africa’s wealthiest families shape industries, from Nigeria’s Dantatas to South Africa’s Ruperts, leaving lasting economic legacies through strategic investments.

Sibanye-Stillwater narrows 2024 loss to $311 million under Neal Froneman, showing signs of recovery amid weak metal markets and operational restructuring.

From fixing roofs in Addis Ababa to developing sub-Saharan Africa’s first Marriott hotel, Tafesse has become one of Ethiopia’s top businessmen.

The move boosts his direct stake in East Africa’s largest lender at a time when the bank continues to post strong results and maintain its market dominance.

BOC Kenya, led by Ngugi Kiuna, targets independent growth after the collapse of its acquisition deal with Carbacid, refocusing on market expansion.

Eaton, led by CEO Craig Arnold, announces a $407.2 million quarterly dividend, showcasing its strong financial performance and commitment to shareholder value.

Capitec to pay $47.6 million to three South African shareholders

This reflects his role in steering the bank through a period of significant growth, strengthening its position as a leader in the country’s financial sector.

The performance underlines the leading retail bank’s ability to deliver in a challenging global economic environment.

Hilton Schlosberg transformed Monster Beverage from a struggling juice company into a $57 billion giant.

In 2024, ArcelorMittal SA paid Eskom $171 million for electricity as rising costs, weak demand, and imports pressured the steelmaker.

Richemont backs YNAP with a $114 million credit line to bolster digital luxury expansion, following EU approval of Mytheresa’s acquisition of YNAP.

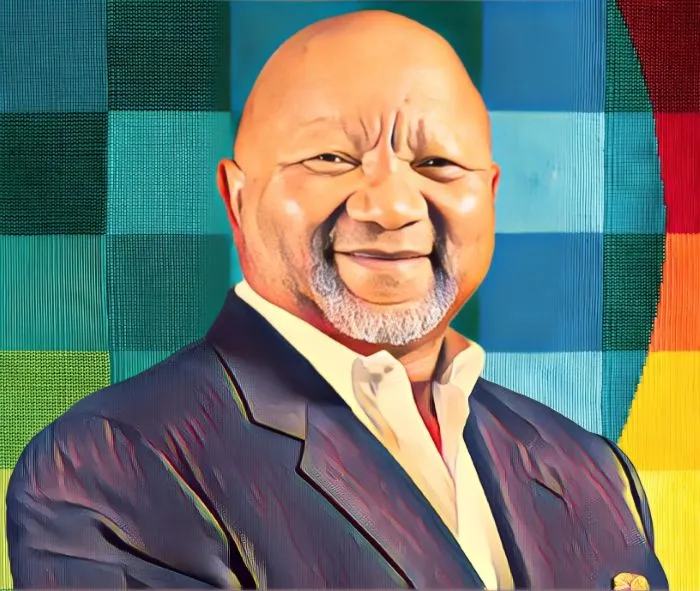

Africa’s self-made billionaires, rising from humble roots, are reshaping economies and pioneering industries from telecoms to energy and manufacturing.

Mohamed El-Kettani has transformed Attijariwafa Bank into Morocco’s top private lender and a $15-billion African banking powerhouse spanning 27 countries.

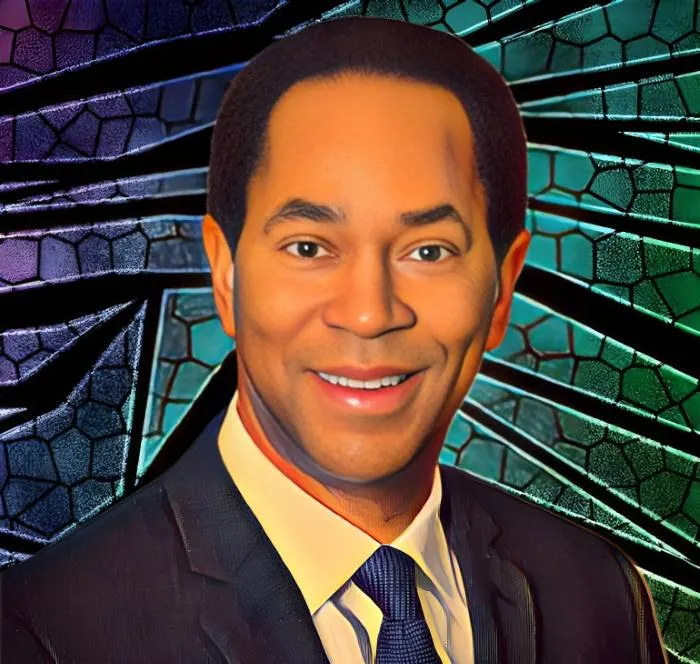

South African entrepreneur Mzi Khumalo built Capital Alliance into an $8 billion asset manager, blending sharp business acumen with social impact.

Revenue for the period grew from $80.64 million in 2023 to $111.9 million in 2024, a 39 percent increase.