Table of Contents

Key Points

- Dangote Cement posted an 86% profit increase, rising to $130 million for Q1 2025, despite a 6.7% decline in group volumes.

- Revenue grew 21.7%, driven by a 53.7% rise in Nigeria, with EBITDA up 49.2%, boosting profitability and margin.

- The company strengthened its export business, with a 21.2% increase in export volumes, enhancing its pan-African trade footprint.

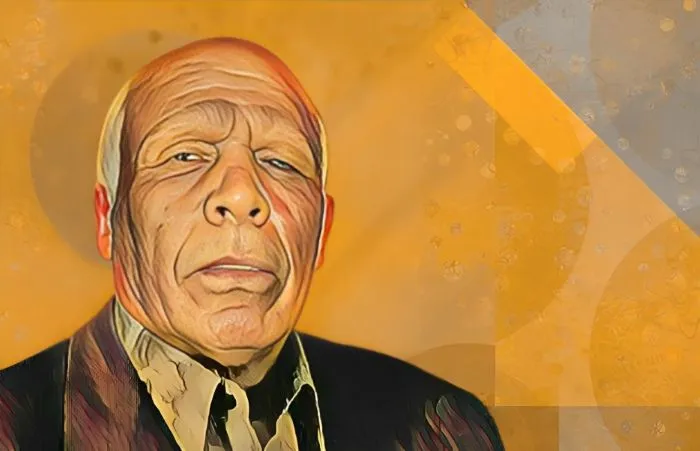

Dangote Cement Plc, the cement giant majority-owned by Africa’s wealthiest man, Aliko Dangote, posted strong financial results for the first quarter of its 2025 fiscal year, with profit rising to $130 million for the three months ending March 31, 2025.

Dangote Cement posts 86% profit increase

According to the company's recently released financial report, profit jumped from N112.7 billion ($70.1 million) to N209.25 billion ($130.2 million). This growth was driven by a price increase in the second half of 2024, which carried over into the new year, even as the company faced a 6.7 percent decline in group volumes, dropping to 6.6Mt, due to weaker demand and inflationary pressures across key markets.

Despite these challenges, Dangote Cement saw its revenue grow by 21.7 percent, reaching N994.7 billion ($618.3 million), up from N817.35 billion ($508.4 million). A key contributor was a 53.7 percent rise in revenue in Nigeria, bolstered by strategic pricing. The company also posted a substantial improvement in profitability, with group EBITDA rising by 49.2 percent to N461.6 billion ($287 million), and EBITDA margin strengthening to 46.4 percent. In Nigeria, the EBITDA margin grew from 49.7 percent to 56.7 percent, reflecting strong cost management.

Dangote Cement boosts exports amid inflation

Arvind Pathak, CEO of Dangote Cement, commented: “We made significant strides on our sustainability journey this quarter, focusing on increasing the use of alternative fuels, expanding waste heat recovery infrastructure, and advancing our decarbonization goals. As we move forward, our priority remains on driving sustained profitability, expanding our export reach, and continuing strategic long-term investments. These steps are critical to ensuring our long-term growth and delivering value across our African operations.”

The decline in volumes was mainly due to softer demand and inflationary pressures, but the company continued to enhance its export business. Notably, export volumes increased by 21.2 percent, with eight clinker shipments to Ghana and Cameroon during the quarter. This marks significant progress in its goal to grow its pan-African trade footprint.

Dangote Cement strengthens financial footprint

With an annual production capacity of 52 million tonnes, Dangote Cement remains Africa’s largest cement producer. Aliko Dangote holds an 87.45 percent stake, equating to 14.65 billion shares, further strengthening his control over the company. Over the past year, a series of share buybacks increased Dangote’s stake from 86 percent to 87.45 percent.

The company has played a crucial role in transforming Nigeria from a cement importer to a leading exporter in Sub-Saharan Africa. Beyond Nigeria, Dangote Cement operates in markets including South Africa, Senegal, Zambia, Ethiopia, Tanzania, Congo, Cameroon, Ghana, Sierra Leone, and Côte d'Ivoire.

Thanks to its solid financial performance, Dangote Cement saw a rise in total assets from N6.4 trillion ($4 billion) as of Dec. 31, 2024, to N6.445 trillion ($4.01 billion) as of Mar. 31, 2025. Its total equity grew from N2.17 trillion ($1.35 billion) to N2.38 trillion ($1.48 billion), while retained earnings climbed from N1.027 trillion ($639 million) to N1.24 trillion ($771 million) over the same period.