Table of Contents

Key Points

- Absa faces sanction for failing to meet Financial Intelligence Centre Act (FIC) customer due diligence and reporting standards, following 2022 inspection.

- The Prudential Authority sanctioned Absa for lapses in monitoring foreign and domestic politically exposed persons and delayed suspicious transaction reporting.

- Despite penalties, Absa is strengthening internal controls and expanding operations, including a planned Dubai office and a partnership with PepsiCo’s Kgodiso Fund.

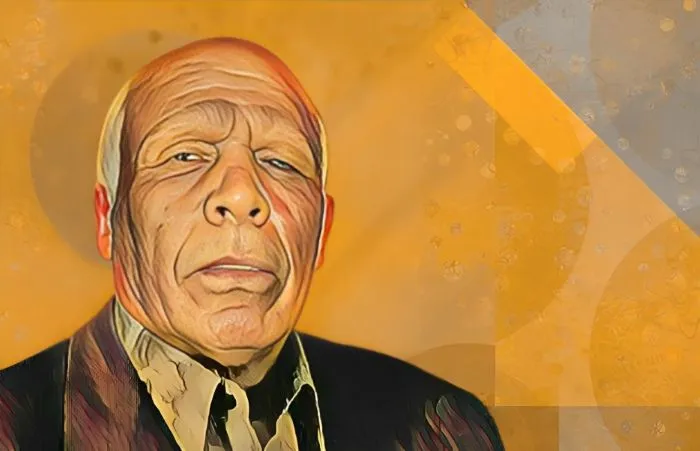

Absa Group, the Johannesburg-based financial services provider chaired by South African businessman Sello Moloko, is facing administrative sanctions from the Reserve Bank's Prudential Authority (PA) for failing to comply with the Financial Intelligence Centre (FIC) Act. This follows an inspection in 2022, which uncovered gaps in Absa's adherence to important regulatory standards.

On Friday, Apr. 25, the Prudential Authority, responsible for overseeing South Africa’s financial institutions, announced the sanctions. The penalties stemmed from Absa's failure to meet customer due diligence and reporting requirements under the FIC Act.

Sanctions and penalties

Absa's shortcomings were mainly in its customer due diligence processes, especially concerning foreign prominent public officials (FPPO) and politically exposed persons (PEPs). The bank failed to conduct proper due diligence on four FPPO client files and two PEP files tied to state-owned enterprises. Additionally, Absa did not carry out enhanced due diligence on three domestic prominent influential persons (DPIPs) and five FPPO client files.

In response, the PA issued a caution to Absa, urging the bank to avoid repeating these mistakes, alongside a reprimand and a R10 million ($0.54 million) fine. The fine breaks down into R7 million ($0.37 million) for the failure to perform due diligence and R3 million ($0.16 million) for not reporting suspicious activities within the required timeframes.

Despite the sanctions, Absa has been cooperative with the PA's investigation and has taken corrective actions. The bank is strengthening internal controls and refining its monitoring processes to ensure compliance with regulatory expectations.

Failure to report suspicious transactions

Absa also fell short in meeting FIC Act Directive 5 of 2019, which mandates the timely reporting of suspicious transactions. The bank failed to report two non-suspicious transaction alerts past the 15-day deadline and left over 8,500 alerts from its automated monitoring system unaddressed beyond the required 48-hour window.

Four of those alerts were not resolved for much longer than the prescribed period. In light of these violations, the PA has instructed Absa to implement corrective measures to improve its compliance. While the bank has shown cooperation, it must continue addressing its internal control and reporting system gaps.

Absa’s strategic resilience

Under Sello Moloko’s leadership, Absa Group is working to solidify its position as a pan-African leader. Serving more than 12 million customers across 10 African countries, the bank has committed R100 billion ($5.4 billion) towards green finance initiatives by 2025, a first among South African banks.

Looking ahead, Absa plans to open a Dubai office in early 2026 to capitalize on growing trade and investment flows between Africa and the Middle East. The bank is also advancing a partnership with PepsiCo’s Kgodiso Fund to expand South Africa’s mobile marketplace for farmers, further supporting agricultural trade and financial inclusion.