Table of Contents

Key Points

- Gus Attridge’s stake has gained R344.44 million ($18.52 million) in just thirteen days, thanks to a 12.32% rebound in the company’s share price on the JSE.

- Driven by solid first-half revenue topping $1.2 billion and profit nearing $130 million, Aspen’s stock has regained momentum, boosting its market capitalization to nearly $4 billion.

- Despite a 0.72% year-to-date dip in share price, Aspen remains one of the JSE’s most valuable firms.

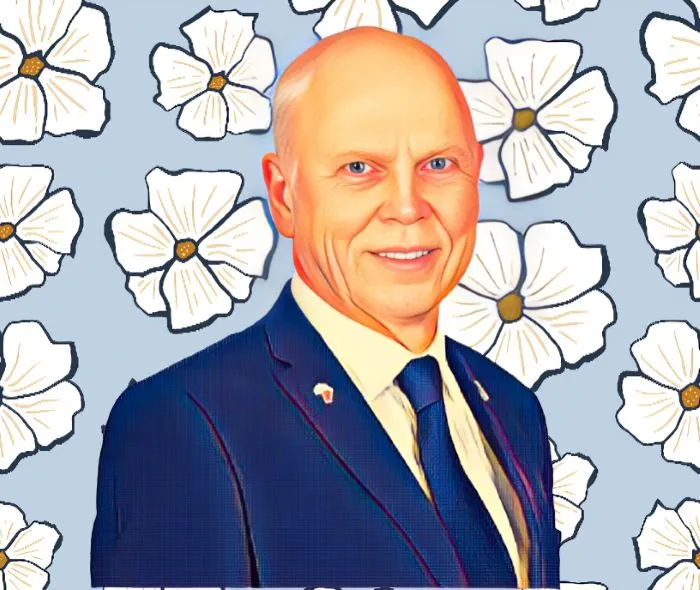

South African businessman Gus Attridge has seen a significant rebound in the market value of his stake in Aspen Pharmacare, Africa’s largest pharmaceutical company. This follows a strong recovery in Aspen's share price on the Johannesburg Stock Exchange (JSE).

Attridge, co-founder and group chief advisor of Aspen, holds a 4.3 percent stake in the company, which is equivalent to 19,188,850 shares. Over the past thirteen days, the value of his stake has surged by R344.44 million ($18.52 million), effectively reversing a recent decline in Aspen’s stock.

This recovery follows a sharp drop between March 12 and 30, when his stake lost $15.73 million, falling from R3.52 billion ($193.85 million) to R3.23 billion ($178.12 million).

Aspen Pharmacare rebounds

Aspen Pharmacare, founded 25 years ago by Attridge and Stephen Saad, has grown into Africa's largest pharmaceutical company, with manufacturing facilities in South Africa, Germany, France, and the Netherlands. Through a combination of strategic acquisitions and organic growth, the company has built a solid reputation in the global market, although it continues to face some challenges.

In the first half of its 2025 fiscal year, Aspen reported strong financial results, with revenue exceeding $1.2 billion and profit rising to almost $130 million. This growth was driven by solid performances across all business segments, especially in commercial pharmaceuticals, which benefited from both new acquisitions and internal expansion.

As a result of this positive performance, Aspen's stock has experienced a notable recovery on the JSE. Over the past 13 days, the share price has jumped by 12.32 percent, rising from R145.71 ($7.83) on April 9 to R163.66 ($8.8). This surge has lifted the company's market capitalization back to nearly $4 billion.

Aspen’s rally boosts Attridge’s wealth

Aspen Pharmacare’s recent rebound has added R344.44 million ($18.52 million) to Gus Attridge’s stake, pushing it from R2.8 billion ($150.33 million) on April 9 to R3.14 billion ($168.85 million). The uptick strengthens his standing as one of the major investors on the JSE.

Still, the stock is slightly down for the year, reflecting the broader uncertainty in global markets caused by ongoing trade tensions. Aspen’s share price has slipped 0.72 percent since January. That means a $100,000 investment at the start of the year would be worth about $99,280 today, a modest loss of $720.