Table of Contents

Key Points

- Mzi Khumalo built Capital Alliance into an $8 billion asset manager, redefining black empowerment in South Africa’s post-apartheid financial sector with sharp leadership.

- After founding Metallon Corporation, Khumalo expanded across Africa’s mining sector, acquiring and revitalizing underperforming gold assets in Zimbabwe and beyond.

- Beyond finance and mining, Khumalo fused entrepreneurship with philanthropy, funding scholarships through his foundation and family-owned wildlife reserve.

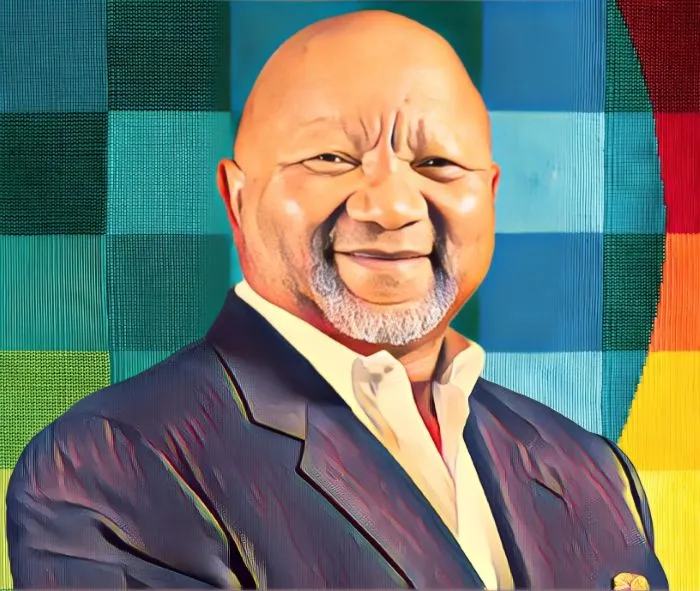

Mzi Khumalo’s name might not ring as loudly as the companies he has built, but few South African entrepreneurs have shaped the continent’s business landscape quite like him.

A freedom fighter turned financier, Khumalo is best known for founding Capital Alliance Holdings, an asset management firm that, under his leadership, grew into a $8 billion titan before being sold. But his journey from a township in KwaMashu to boardrooms across Africa is as compelling as the businesses he has built.

From Robben Island to the boardroom

Born in 1955 and raised in apartheid-era South Africa, Khumalo’s early life was shaped by hardship. His father passed away when he was just a child, leaving his mother to raise ten children alone in KwaMashu, a township outside Durban. As a young boy, Khumalo showed entrepreneurial instincts early, making money by buying and selling oil cans and later small quantities of fuel.

But in the turbulent 1970s, Khumalo’s ambitions extended beyond business. He joined the African National Congress and became a member of its military wing. In 1978, his political activism led to his arrest and a 20-year sentence on Robben Island, where he served 12 years alongside some of South Africa’s most iconic anti-apartheid leaders, including Nelson Mandela.

After his release in 1990, Khumalo pivoted from politics to business — a move that would shape both his fortune and South Africa’s corporate scene.

Building a financial empire

Khumalo’s big break came when he founded Capital Alliance Holdings, a financial services company that flourished under his leadership. Capital Alliance was not just another asset manager; it became a symbol of black empowerment and entrepreneurial excellence in post-apartheid South Africa.

By the time the company was sold, it had built a formidable $8 billion portfolio of assets under management, cementing Khumalo’s reputation as one of the country’s sharpest financial minds. But finance was only the beginning.

Mining, infrastructure, and beyond

In 2002, Khumalo founded Metallon Corporation, a mining, and investment firm that became one of his hallmark ventures. Starting in South Africa, he expanded into Zimbabwe by acquiring Lonmin’s gold assets for $15.5 million, establishing Metallon as Zimbabwe’s largest gold producer and a key player in Africa’s natural resources and infrastructure space.

Khumalo’s strategy was simple but effective: acquire underperforming businesses, overhaul their operations and governance, and scale them into profitable enterprises. His hands-on style and appetite for overlooked, high-risk regions became his signature.

Beyond mining, Khumalo diversified through his holding company, Gold and General, with interests spanning oil, gas, and telecommunications. His ventures have partnered with global heavyweights like AllianceBernstein and Anglo American, contributing not just jobs and taxes, but schools, hospitals, roads, and conservation programs across Africa.

Investing with purpose

For Khumalo, success has never been purely financial. Throughout his career, he has emphasized the importance of social returns alongside shareholder value.

Whether through the Mzi and Khosi Khumalo Foundation, which funds scholarships for underprivileged South African youth, or his family-owned wildlife reserve focused on protecting endangered species, Khumalo has woven philanthropy into his business ethos.

His leadership style — a mix of operational discipline, sharp investment instincts, and deep social commitment — has set him apart in Africa’s business community.

A lasting legacy

From his early days on the streets of KwaMashu to boardrooms in Johannesburg, London, and Harare, Khumalo’s journey is a testament to resilience and vision. Today, through Gold and General and Metallon Corporation, his investments stretch across Africa’s mining belts and urban centers. He has built a reputation not only as a dealmaker but as a business leader committed to Africa’s growth.

While the companies he has built may bear different names, the common thread is unmistakable: Khumalo’s belief that Africa’s future lies in homegrown industries, responsible entrepreneurship, and financial empowerment. Mzi Khumalo’s story is not just one of personal triumph, but of an enduring commitment to unlocking Africa’s economic potential. A freedom fighter turned financier, his name is etched into the continent’s business history.