Table of Contents

Key Points

- Bamburi Cement reported a $7 million net loss in 2024, more than doubling its prior year’s deficit, following forex losses tied to the $84 million Hima Cement sale.

- Despite a tough year, Bamburi declared a special dividend of $0.141 per share from Hima’s sale proceeds but skipped a final dividend due to deepened annual losses.

- Amsons Group plans a $380 million expansion for Bamburi, aiming to boost Kenyan manufacturing, create jobs, and strengthen East African cement supply chains.

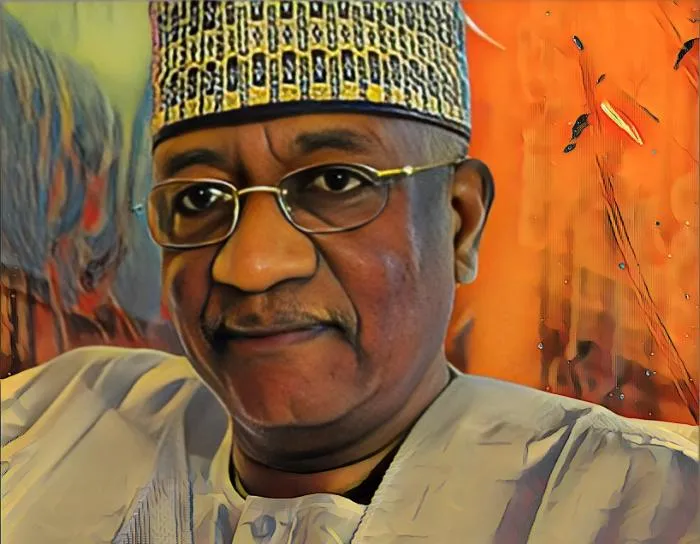

Bamburi Cement, Kenya’s largest cement producer, recently acquired by Tanzanian businessman Edha Nahdi’s Amsons Group, reported a net loss of $7 million for the financial year ending December 2024.

This significant loss was largely driven by a Ksh1.43 billion ($11.04 million) foreign exchange loss tied to the sale of its Ugandan subsidiary, Hima Cement. The subsidiary was sold for $84 million to a consortium led by Uganda’s Sarrai Group and Rwimi Holdings.

Bamburi faces revenue pressure amid market headwinds

According to a recent update, Bamburi posted a loss of Ksh905 million ($7 million), more than double the Ksh399 million ($3.08 million) loss recorded a year earlier.

Revenue fell slightly to Ksh21.9 billion ($169.12 million) from Ksh22 billion ($169.89 million) in 2023, as the company struggled with low market demand, severe weather disruptions, and political unrest. Operating profit also declined, dropping to Ksh700 million ($5.41 million) from Ksh1.02 billion ($7.88 million), highlighting the tough operating conditions throughout 2024.

Despite the setback, Bamburi issued a special dividend of Ksh18.25 ($0.141) per share, totaling Ksh6.63 billion ($51.2 million), which was tied to the sale of Hima Cement. However, the company refrained from declaring a final dividend as it closed the year in the red.

Edha Nahdi plots Bamburi expansion despite financial setback

The loss came shortly after Swiss multinational Holcim sold its 58.6 percent stake in Bamburi to Amsons Group for $100 million in December 2024, marking one of East Africa’s largest cross-border deals involving a Tanzanian investor. This acquisition was backed by KCB Group and completed through Amsons Industries (K) Ltd.

Undeterred by the recent losses, Nahdi has outlined an ambitious $380 million investment plan aimed at scaling up Bamburi’s footprint in Kenya, in line with both Kenya’s Vision 2030 blueprint and the African Continental Free Trade Area (AfCTA) objectives. The expansion is expected to create new jobs, improve production capacity, and strengthen regional trade.

Amsons Group bets big on East African cement market

Founded in 2008, Amsons Group has evolved from a local oil importer into one of Tanzania’s top industrial giants, with interests spanning fuel, LPG, transport, cement, and real estate. Under Edha Nahdi, the group has rapidly expanded across East Africa, capped by its $182 million acquisition of Bamburi Cement — a deal underscoring its growing regional influence.

Amsons has also earmarked an additional $400 million for upgrading Bamburi’s clinker and grinding facilities and constructing a new clinker plant in Kwale County, Kenya, as part of a wider regional growth strategy. With government backing from both Dar es Salaam and Nairobi, Nahdi remains confident in Bamburi’s long-term prospects, stating: “We are progressing well and are on track to become one of the leading cement manufacturers in East Africa by 2030.”