Table of Contents

Key Points

- Tullow Oil to sell Kenyan assets to Gulf Energy for $120 million as part of a debt reduction and refinancing strategy.

- Deal includes $80 million upfront and full transfer of liabilities; Tullow retains a royalty and 30% back-in option on future development.

- Tullow records $213 million in exploration write-offs, with $145 million tied to struggling Kenyan assets amid falling market capitalization.

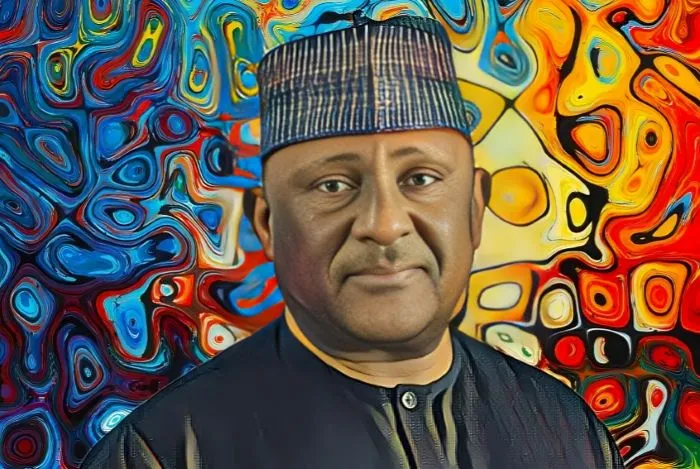

Tullow Oil Plc, the London-listed oil and gas explorer where Gabonese-Beninese oil magnate Samuel Dossou-Aworet holds a significant stake, has reached an agreement to sell its Kenyan assets to Gulf Energy Limited, a Kenyan energy and infrastructure company, for $120 million. This move is part of Tullow's ongoing strategy to streamline operations and reduce its debt.

According to a recent press release, the sale, arranged through Tullow's subsidiary Tullow Overseas Holdings BV, includes an upfront cash payment of $80 million. Additionally, the agreement transfers all past and future liabilities to Gulf Energy. Under the terms, Gulf Energy will acquire Tullow Kenya BV, the subsidiary that holds Tullow’s full working interests in Kenya.

The deal’s payment structure is divided into three stages: $40 million upon completion, another $40 million upon approval of a Field Development Plan (FDP) or by June 30, 2026—whichever comes first—and the remaining $40 million will be paid in quarterly installments between 2028 and 2033. Tullow will also receive royalties and retains a no-cost back-in option for 30% of future development phases, before any government participation.

Tullow targets debt reduction, refinancing

Tullow has been shifting its focus towards cash-generative assets in West Africa, moving away from development-heavy projects in East Africa. The Kenyan project, once a key part of Tullow’s plans in the region, has faced delays and escalating costs, making it less viable for the company as it focuses on reducing debt and stabilizing its financial position. Despite this, Tullow Oil’s shares showed little change after the announcement, continuing a trend of slight declines, with the company’s market capitalization falling below $300 million.

Richard Miller, Tullow’s CFO and Interim CEO, commented: “This announcement represents a key step in Tullow’s ongoing debt reduction efforts. With $80 million in immediate cash and reduced capital exposure, we retain a meaningful option on the future development of the project. Together with the $300 million we received from selling our assets in Gabon, this deal sets us up well for a successful refinancing. We are excited to work with Gulf Energy, a well-financed and credible partner, to create value for the people of Kenya.”

The deal, which qualifies as a significant event under the UK Listing Rules (UKLR 7), is still subject to final agreements, with further details to be disclosed when the binding agreement is signed. Tullow expects the full sale to be finalized in the coming months, with the first payment anticipated in 2025, pending regulatory approvals and guarantees for the later payments.

Tullow’s asset write-offs hit $213 million

With the sale of its Kenyan and Gabonese assets, Tullow remains active in Africa, concentrating on producing oil fields in Ghana and Côte d'Ivoire. Samuel Dossou-Aworet’s 16.8 percent stake in Tullow, valued at $40 million, has seen a notable decrease from $86 million in September 2024. Tullow’s financial struggles continue to mount, highlighted by a $145.4 million write-off in 2024 related to the underperforming Kenyan assets. This impairment reduced the value of its Kenyan assets to $112.2 million, down from $253.3 million at the end of 2023.

Additionally, Tullow recorded a total of $213 million in exploration write-offs in 2024, up sharply from $27 million the previous year. The largest portion of this write-off was tied to the Kenyan assets, where delays in the approval of the Final Development Plan (FDP) raised concerns about the project’s future. Other write-offs included $39 million in Argentina, $16 million in Côte d'Ivoire, and $10 million related to the Sarafina well in Gabon.