Table of Contents

Key Points

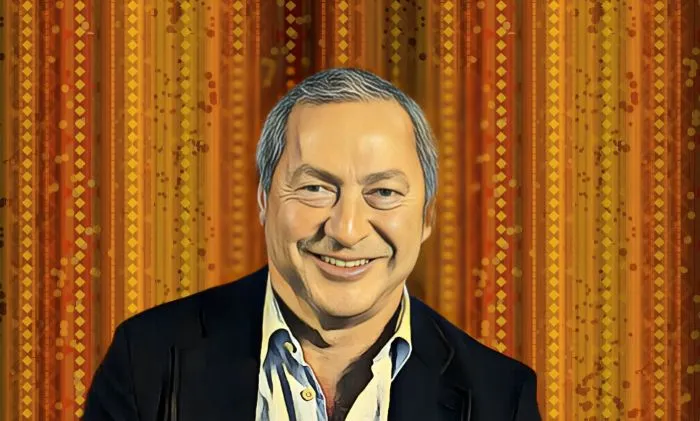

- Access Holdings, under Aigboje Aig-Imoukhuede, secured the final regulatory nod in the National Bank of Kenya’s acquisition, fueling East Africa’s banking expansion.

- The deal adds NBK’s 77 branches to Access Bank Kenya’s existing 23, marking a strategic boost in footprint and strengthening competition in Kenya’s banking sector.

- The acquisition, supported by employment safeguards, cements Access Holdings’ commitment to pan-African expansion through strategic market bridging.

Access Bank Plc, the flagship banking subsidiary of Nigerian financial giant Access Holdings, chaired by seasoned banker Aigboje Aig-Imoukhuede, has secured final regulatory approval for its acquisition of National Bank of Kenya (NBK) from KCB Group.

The Central Bank of Kenya (CBK) signed off on the deal after a series of regulatory clearances, marking a significant milestone in Access Holdings’ pan-African expansion drive and strengthening Access Bank’s push into Kenya’s highly competitive banking market.

Strategic expansion and regulatory backing

The transaction, which had been under review for months, strengthens Access Bank’s footprint in East Africa, adding NBK’s 77 branches across 28 Kenyan counties to Access Bank Kenya’s existing network of 23 branches in 12 counties. The acquisition also comes with employment safeguards, as Access must retain at least 80 percent of NBK’s 1,384 staff and all 316 employees at Access Bank Kenya for at least one year.

Despite the larger physical footprint, the combined entity will remain a Tier 2 player in Kenya’s banking landscape, with a 1.9 percent market share — trailing the country’s top lenders, including Equity Bank, Co-operative Bank, and Standard Chartered Kenya.

The deal, which also won approval from Kenya’s Competition Authority in October 2024 and the Central Bank of Nigeria, was further backed by Kenya’s National Treasury and Economic Planning Cabinet Secretary, ensuring smooth execution under the country’s Banking Act.

Leadership and continental ambitions

Founded in 1988, Access Bank has grown into one of Africa’s largest financial institutions, with more than 700 branches and 60 million customers across 22 markets, including the UK, Dubai, and now deeper roots in East Africa. Beyond its core banking operations, the lender maintains representative offices in China, Lebanon, and India, and has recently expanded to Hong Kong, with plans to enter Morocco.

Parent company Access Holdings, chaired by Aig-Imoukhuede, is also shoring up its capital base, recently securing approvals for a $228 million rights issue from the Central Bank of Nigeria and the Securities and Exchange Commission. The capital raise positions the group to meet new regulatory capital requirements ahead of the 2026 deadline. With the NBK deal now finalized, Access Holdings is cementing its pan-African banking ambitions, using strategic acquisitions to bridge markets and deepen its continental footprint.