Table of Contents

Key Points

- Adrian Gore's stake in Discovery has fallen by nearly $40 million due to a decline in market sentiment and cautious investor behavior.

- Discovery's stock has dropped 7.54% in the past two weeks, wiping out significant market value and impacting stakeholders, including Gore.

- Year-to-date, Discovery shares are down 2.45%, resulting in a loss for investors, including those holding significant stakes like Gore.

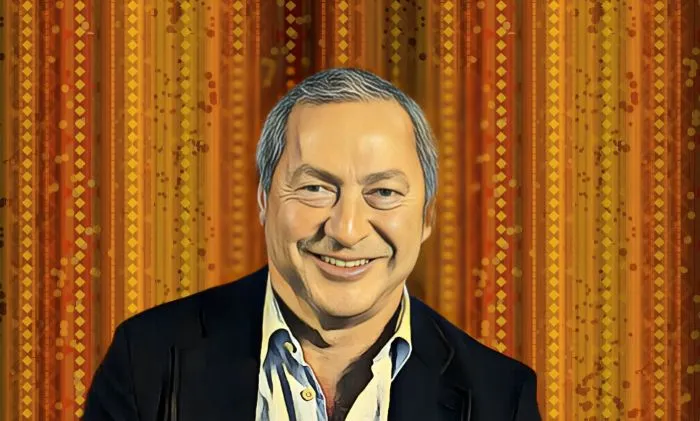

South African insurance magnate and Discovery co-founder Adrian Gore has taken a financial hit, with the value of his stake in the Sandton-based insurer falling by nearly $40 million. The decline comes as investor sentiment turns cautious amid global economic uncertainty and a broader pullback from financial stocks.

Adrian Gore’s stake sinks amid market woes

Gore, one of South Africa’s richest individuals, owns a 7.19 percent stake in Discovery—amounting to 48.6 million shares. Over the past two weeks, the value of that stake has dropped by R753.34 million ($39.83 million) as the company’s shares continue to slide on the Johannesburg Stock Exchange (JSE).

The dip comes shortly after a period of strong performance for Discovery’s stock. Between Feb. 13 and Mar. 7, Gore’s stake gained nearly $43 million, rising from R9.28 billion ($510.99 million) to R10.06 billion ($553.90 million). But much of that progress has now been erased, highlighting the pressure facing the insurer as market conditions remain shaky.

Discovery stock falls, market value hit

Founded in 1992 by Adrian Gore and Barry Swartzberg, Discovery started out as a medical insurance company. Over the years, it branched out into long-term and short-term insurance, asset management, and investment services. Gore has been at the center of it all, helping to grow Discovery into one of South Africa’s leading players in both health and financial services.

But it hasn’t all been smooth sailing lately. In the past two weeks, shares of the Sandton-based insurer have dropped by 7.54 percent — sliding from R205.49 ($10.87) on April 1 to R190 ($10.05) by April 13. That dip has wiped out a significant chunk of the company’s market value, which now sits at around $6.8 billion. Shareholders, including Gore himself, have taken a hit.

For Gore, the drop in Discovery’s stock has translated into a paper loss of R753.34 million ($39.83 million). His stake, once worth R9.99 billion ($528.43 million) earlier this month, has declined to R9.24 billion ($488.59 million). Still, despite the recent knock, Gore remains one of the most influential business figures in South Africa — and one of the richest investors on the JSE.

Discovery shares down 2.45% YTD

Discovery’s stock has taken a hit in recent months, weighed down by selling pressure on the local market. Since the start of the year, its shares on the Johannesburg Stock Exchange have slipped 2.45 percent. For investors, this means that a $100,000 investment in the insurer at the start of 2025 would now be worth $97,550, reflecting a loss of $2,450 in just a few months.