Table of Contents

Key Points

- BUA Group partners with Alfa Laval to build a 1,000-ton-per-day palm oil refinery in Nigeria, enhancing local production and reducing imports.

- The facility supports Nigeria’s industrial self-sufficiency, creating jobs and fostering sustainable practices in agriculture and manufacturing.

- BUA Foods sees record growth in 2024, with profit more than doubling and revenue surging 109%, driven by strong product demand and strategic price adjustments.

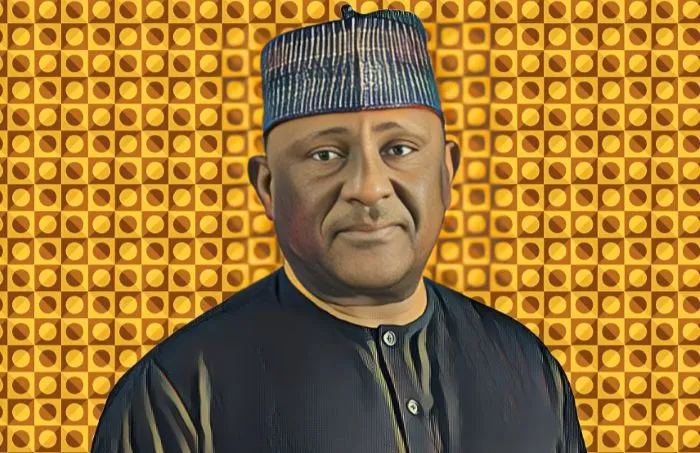

BUA Group, one of Africa’s fastest-growing industrial conglomerates owned by Nigerian billionaire Abdul Samad Rabiu, has partnered with the Food & Water Division of Swedish firm Alfa Laval to build a modern palm oil refinery in Nigeria.

The agreement, signed by Abdul Samad Rabiu, Founder and Executive Chairman of BUA Group, and Panjak Maheshwari, Vice President at Alfa Laval, marks a key step toward boosting Nigeria’s palm oil production. The new refinery and fractionation plant, which will have a capacity of 1,000 tons per day, is expected to enhance local processing and help reduce the country’s reliance on imported palm oil.

Facility backs jobs, local industry push

The facility will not only strengthen Nigeria’s push for industrial self-sufficiency but also support sustainable practices in agriculture and manufacturing. It’s part of a broader effort to add value locally, create jobs, and support economic growth in the palm oil sector.

This project is the latest in a string of bold moves by Abdul Samad Rabiu, Nigeria’s third-richest man with a net worth of $4.9 billion. In December 2024, BUA Group expanded its operations with the launch of a 2,400-ton-per-day Plaster of Paris (P.O.P.) and plasterboard plant in Port Harcourt.

Around the same time, the company also joined forces with Austria’s Starlinger & Co. to set up a world-class packaging facility capable of producing around 600 million polypropylene bags annually, a major investment in strengthening its supply chain.

The new palm oil refinery, coming on the heels of those developments, adds another layer to BUA Group’s growing footprint in Nigeria’s food and manufacturing industries. It also reinforces the role of BUA Foods Plc — the group’s food business unit — as a leader in the market.

BUA Foods boosts profit, revenue in 2024

BUA Foods runs several major operations, including sugar refining, oil milling, flour, pasta, and rice production. Together, Abdul Samad Rabiu and his son, Isyaku Naziru Rabiu, own a commanding 94.25 percent stake in the company, which is currently valued at $4.9 billion on the Nigerian Exchange (NGX). Abdul Samad holds 92.63 percent, while Isyaku owns 1.62 percent, equivalent to over 291 million shares.

The company delivered strong results for its 2024 financial year, with profit more than doubling from N112.1 billion ($72.9 million) in 2023 to N266 billion ($173 million). This growth was driven by steady demand for its products and strategic price adjustments.

Revenue surged by over 109 percent, rising from N729.44 billion ($484.8 million) to N1.53 trillion ($1.02 billion). Flour was a standout performer, bringing in N544.88 billion ($362.2 million), while sales of fortified sugar jumped by 67 percent to N567.39 billion ($377.1 million).

Other product lines, including non-fortified sugar, molasses, semolina, maize, pasta, and wheat bran, also made solid contributions to the company’s record-breaking performance. As BUA Foods continues to grow and expand its offerings, it remains well-positioned to meet Nigeria’s rising demand for affordable, high-quality food products.