Table of Contents

Key Points

- Afriland First Bank, led by Cameroonian businessman Paul Fokam, partners with IFC to unlock $60 million in SME funding in Cameroon.

- The deal includes incentives to boost lending to women-led businesses and expand financial access across underserved markets.

- IFC to support Afriland with advisory services and capital to drive private-sector growth and job creation in frontier markets.

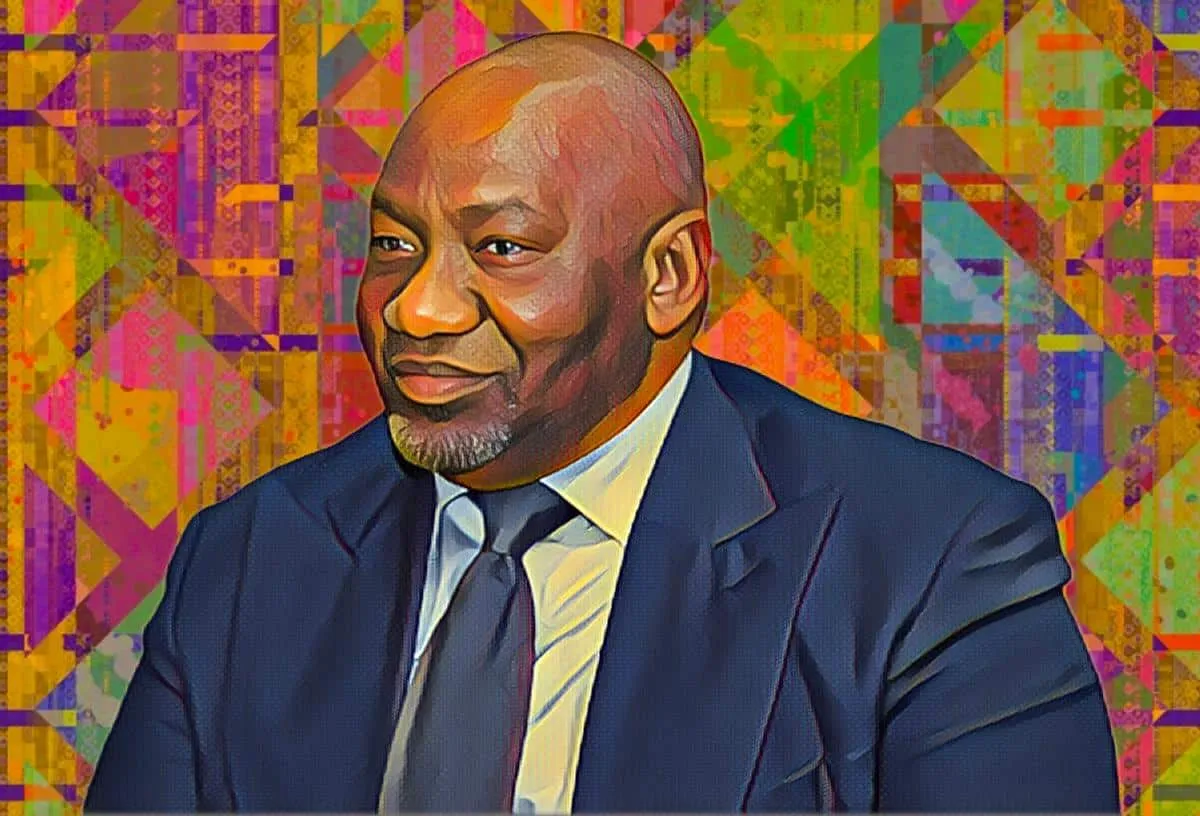

Afriland First Bank, the financial services group founded by Cameroonian businessman Paul Fokam, has entered into a new partnership with the International Finance Corporation (IFC) to expand lending to small and medium-sized enterprises (SMEs) in Cameroon. The move is designed to help close the funding gap faced by local businesses—especially those led by women—and support private-sector growth in the country.

Under the agreement, IFC will provide up to $60 million in financing, including $20 million from its own resources and an additional $40 million raised from other investors. A core focus of the initiative is to improve access to capital for women entrepreneurs, who often face the steepest hurdles when it comes to securing loans.

Afriland First Bank will also benefit from performance-based incentives through the Women Entrepreneurs Opportunity Facility (WEOF), receiving up to 0.07 percent of the total project value to encourage lending to women-owned or women-led businesses. This financial boost is expected to expand the bank’s SME loan book and strengthen its support for underfunded sectors of the economy.

In addition to capital, IFC will provide technical assistance to help Afriland improve its risk management, develop new financial products, and enhance how it delivers services to clients. These efforts are part of IFC’s wider goal to promote inclusive economic growth and create jobs by empowering institutions that drive real impact on the ground.

A broader push by IFC in Cameroon

The partnership with Afriland is one piece of IFC’s growing commitment to Cameroon. The institution has been stepping up investments across key sectors, including digital infrastructure, agriculture, climate finance, and urban development.

IFC is also backing renewable energy projects and advocating for a more transparent and climate-resilient business environment. By combining long-term capital with expert support, the organization aims to help both public and private actors build a stronger, more dynamic economy.

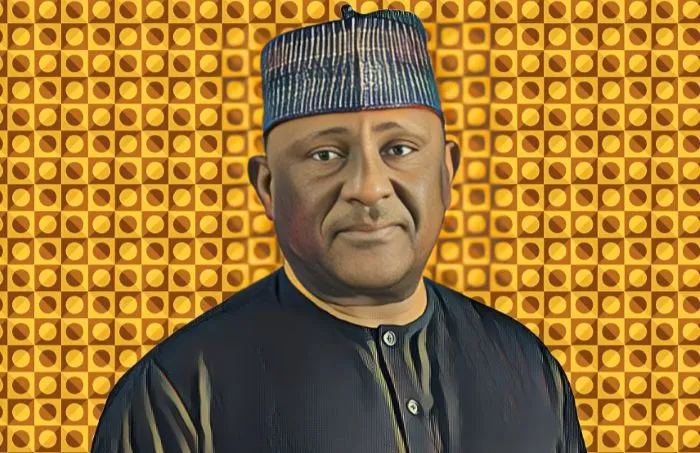

“This partnership will allow us to increase financing for small businesses, helping them thrive and play a greater role in Cameroon’s economic development. SMEs are the backbone of our economy,” said Célestin Guela Simo, CEO of Afriland First Bank.

Dahlia Khalifa, IFC’s Regional Director for Central Africa and Anglophone West Africa, added: “Through this partnership with Afriland First Bank, we will help bridge the financing gap for SMEs and empower entrepreneurs to innovate and grow. We are committed to accelerating sustainable development across Cameroon.”

Afriland First Bank: A homegrown banking giant

Founded in 1987 by Paul Fokam, Afriland First Bank has grown into one of the region’s leading financial institutions, with a footprint in nine African countries including the Democratic Republic of Congo, Equatorial Guinea, Liberia, South Sudan, Uganda, and Zambia.

The bank operates 87 branches, 218 ATMs, and 386 electronic payment terminals across Cameroon, serving more than 705,000 customers. It continues to expand its digital services to make banking more accessible and efficient.

Afriland’s growth reflects Fokam’s long-standing vision of financing Africa’s future through African-led institutions. A noted thinker and author on social science and economic development, Fokam has been a vocal advocate for economic self-determination across the continent.

In 2023, Afriland injected $2.7 billion into the Cameroonian economy, underscoring its central role in national development. The bank also signed a cooperation agreement with Gabonese financial group BGFI Holding Corporation, laying the groundwork for stronger cross-border trade, financial integration, and knowledge sharing.