Table of Contents

Key Points

- Tony Elumelu’s UBA stake dropped below $60 million as shares fell 12.4% in 35 days, erasing $9.5 million in value.

- UBA share price dropped 12.4% in recent weeks, cutting its market cap below $800 million.

- Elumelu remains a key NGX investor despite past losses, including a $17 million hit in 2024 due to naira devaluation.

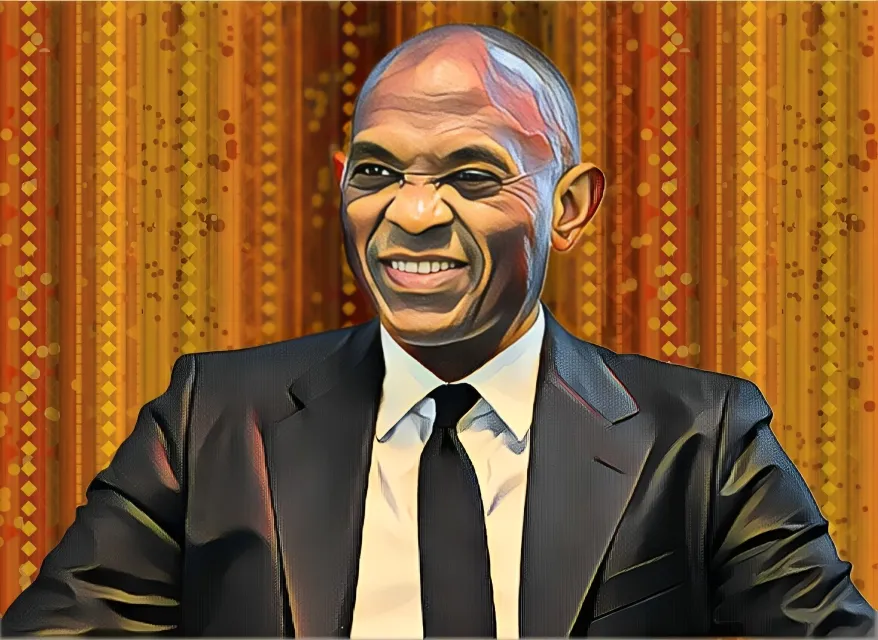

Nigerian businessman Tony Elumelu has taken a financial hit in recent weeks as a wave of sell-offs on the Nigerian Exchange (NGX) has pulled down United Bank for Africa’s (UBA) share price, dropping the value of his stake below $60 million.

Elumelu holds a 7.43 percent stake in UBA—about 2.54 billion shares—through entities like Heirs Holdings Limited, HH Capital Limited, and Heirs Alliance Limited. Over the past 35 days, his holdings have lost N12.46 billion ($9.5 million), with the decline worsened by the naira’s weakness against the dollar.

It’s not the first time he has taken a financial hit. In 2024, despite UBA’s stock rising 32.55 percent in local currency, the naira’s devaluation erased those gains, costing him $17 million in dollar terms.

UBA shares drop amid rising costs

UBA, a leading player in Nigeria’s financial services industry, operates across 24 countries spanning four continents, including major hubs such as the UK, the United States, France, and the United Arab Emirates. But its stock has struggled lately.

In the past 35 days, its share price has fallen 12.4 percent, sliding from N39.3 ($0.026) on Feb. 12 to N35.2 ($0.022). This decline has pushed the bank’s market capitalization below $800 million, erasing millions in shareholder value—including for Elumelu.

The drop comes even as Nigeria’s top banks report strong earnings for 2024. UBA posted a more moderate increase, with profit rising 16.9 percent in the first nine months of the year. Earnings climbed from N449.3 billion ($274.84 million) a year earlier to N525.31 billion ($320.9 million).

However, rising costs have put pressure on profitability. Operating expenses more than doubled from N237 billion ($154 million) a year ago to N553 billion ($360 million). While UBA has yet to release its full-year results, the numbers so far reflect the challenge of balancing growth with mounting expenses.

Elumelu’s UBA stake drops $9.5 million

As a result of the stock’s decline, the market value of Elumelu’s UBA stake has dropped from N99.92 billion ($66.3 million) on Feb. 12 to N87.46 billion ($56.8 million) at the time of writing, wiping out N12.46 billion ($9.53 million).

Despite this setback, Elumelu remains one of the most influential investors on the NGX and a key figure in Africa’s business world. His leadership in banking, energy, and investment continues to shape some of Nigeria’s prominent companies.