Table of Contents

Key Points

- Dangote Petroleum Refinery temporarily halts petroleum sales in naira to avoid mismatch between sales revenue and crude oil obligations priced in U.S. dollars.

- The NNPCs removal of the naira-for-crude deal creates challenges for local refiners, including Dangote’s $23 billion mega refinery.

- Policy shifts and rising costs may impact Nigerians at the pump as Dangote adapts to changing market conditions and fluctuating crude supply dynamics.

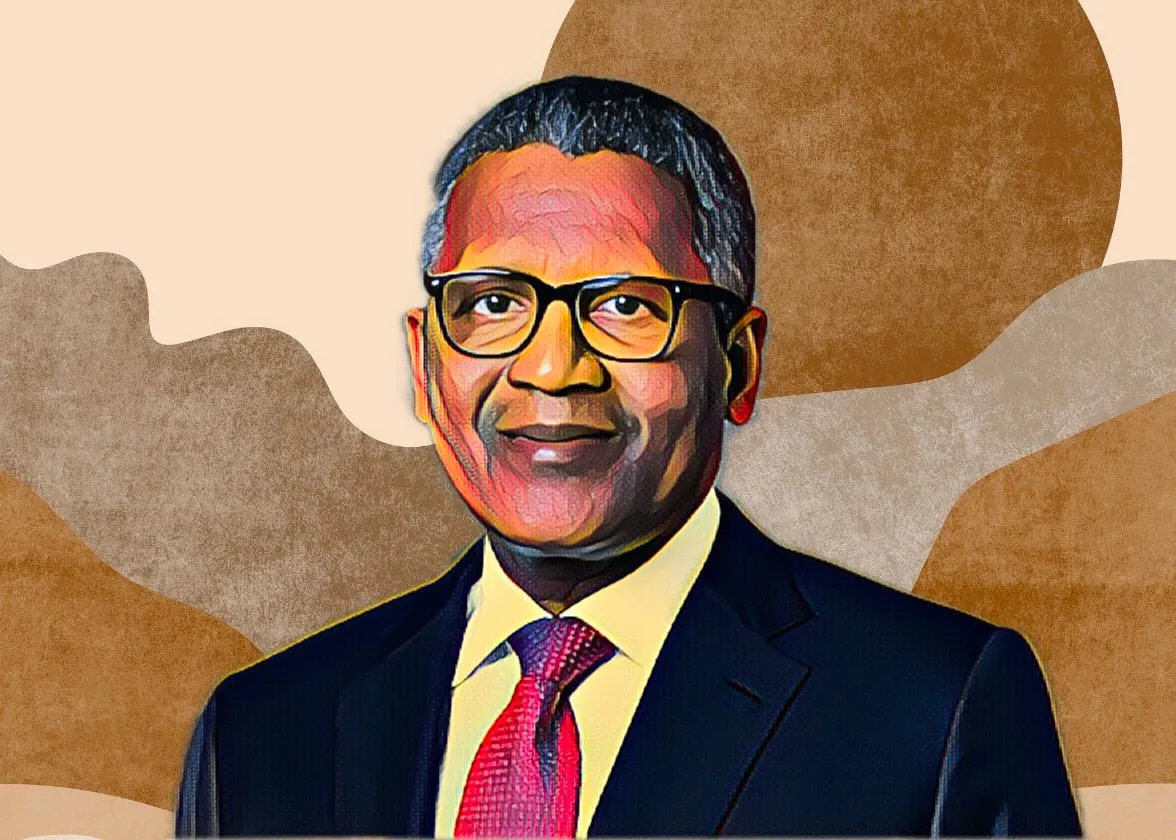

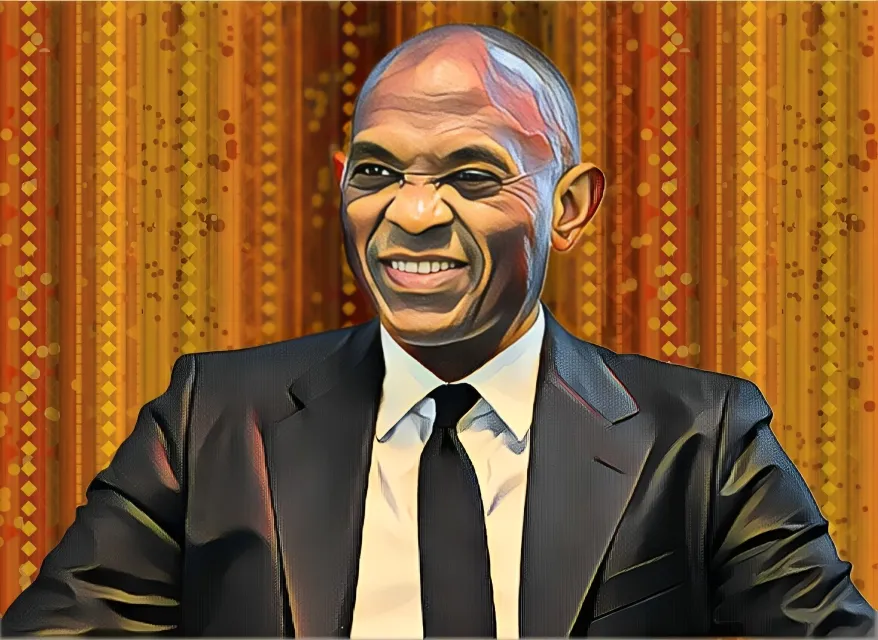

The Dangote Petroleum Refinery, Africa’s largest refinery owned by the continent’s richest billionaire Aliko Dangote, has temporarily stopped selling petroleum products in naira. The move comes as the refinery looks to avoid a mismatch between its sales revenue and crude oil purchase obligations, which are currently priced in U.S. dollars.

The decision follows a major policy shift by the Nigerian National Petroleum Company (NNPC) Limited, which scrapped the naira-for-crude oil swap deal just ten days ago. That abrupt change has created new hurdles for Dangote’s $23 billion mega refinery and other local refiners that rely on domestic crude supplies.

Dangote refinery halts naira sales temporarily

In a recent statement, Dangote Petroleum Refinery explained: “We wish to inform you that, Dangote Petroleum Refinery has temporarily halted the sale of petroleum products in Naira. This decision is necessary to avoid a mismatch between our sales proceeds and our crude oil purchase obligations, which are currently denominated in U.S. dollars.”

The company added that, so far, its petroleum sales in naira have exceeded the value of naira-denominated crude it has received. As a result, it must temporarily adjust its sales currency to match crude procurement costs. “We remain committed to serving the Nigerian market efficiently and sustainably. As soon as we receive an allocation of Naira-denominated crude cargoes from NNPC, we will promptly resume petroleum product sales in Naira,” the statement said.

Dangote adapts to policy shifts

The NNPC’s decision to scrap the naira-for-crude deal ten days ago has left refiners scrambling. Introduced on Oct. 1, 2024, the agreement was meant to boost local refining, ease pressure on Nigeria’s foreign exchange reserves, and reduce fuel imports. Now that it’s gone, refiners must turn to international suppliers and pay in dollars—driving up costs and adding more strain on fuel prices.

For Dangote, the challenge isn’t just sourcing crude—it’s navigating an ever-changing policy landscape. His refinery has the scale and financial muscle to secure alternative supplies, but smaller refiners may struggle to keep up. If costs continue to rise, Nigerians could soon feel the impact at the pump.

The timing of NNPC’s move is hard to ignore, coming just two weeks after the Dangote Petroleum Refinery lowered the ex-depot price of petrol by another 7.3 percent—bringing the total reduction since early 2025 to 13.16 percent. Whether policymakers will reconsider remains to be seen, but for now, Dangote’s refinery must once again adapt to an unpredictable business climate.

Skip to content

Skip to content