Table of Contents

Key Points

- Pick n Pay closed 32 stores, including Hyde Park, as part of its restructuring plan, making way for Shoprite’s Checkers FreshX store in a prime Johannesburg location.

- Financial struggles persist as Pick n Pay reports a $171 million loss, and reviews 100 underperforming stores for closure, conversion, or rebranding.

- Shoprite’s expansion through Checkers FreshX strengthens its position in South Africa’s premium grocery market, directly challenging Woolworths Food in affluent areas.

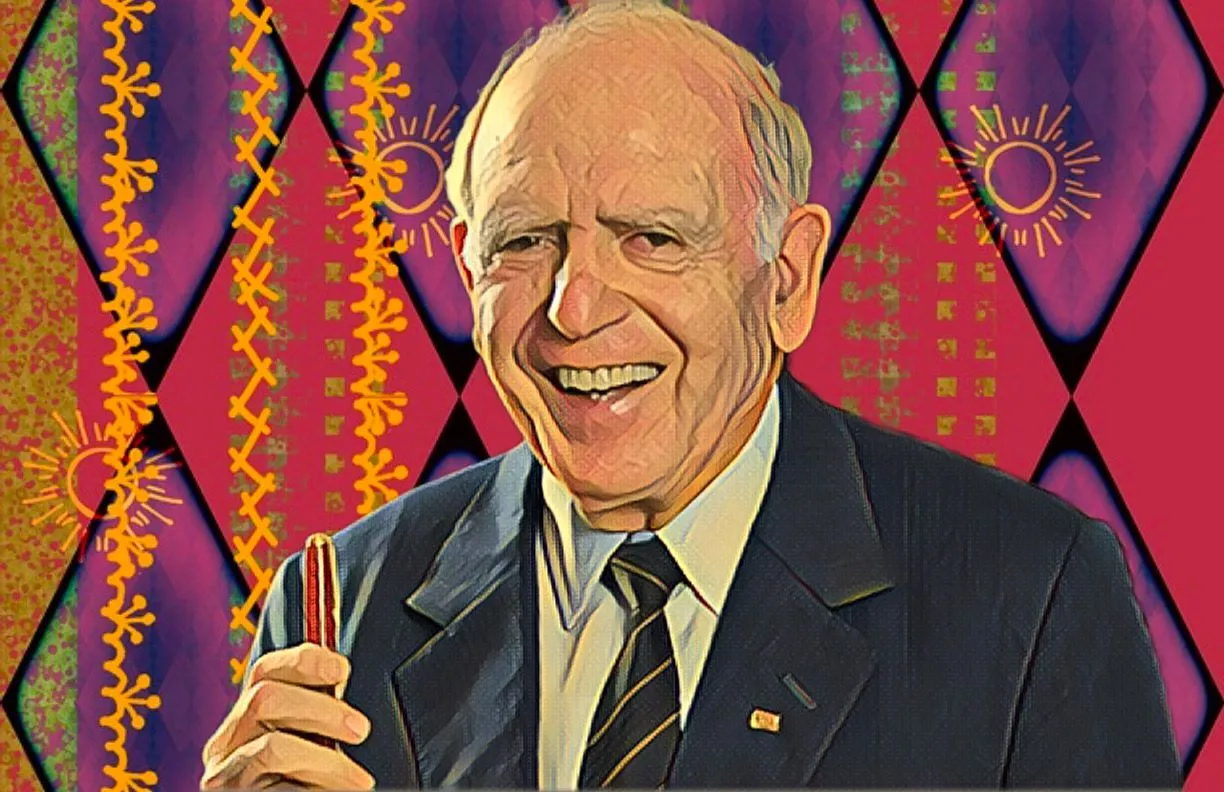

More than a year after the passing of its founder, Raymond Ackerman, Pick n Pay is ramping up store closures to reshape its retail footprint. As part of its "Store Estate Reset" strategy, the retailer has been shutting down underperforming locations, with one of the biggest moves happening in September 2024—its exit from Hyde Park Corner. The departure paved the way for Shoprite Group to take over the prime location with a flagship Checkers FreshX store.

Hyprop Investments, which owns the property, confirmed that Checkers FreshX—a premium grocery concept designed to rival Woolworths Food—will move into the space. This expansion strengthens Shoprite’s presence in northern Johannesburg’s high-end retail market, signaling its growing dominance in the sector.

Restructuring amid financial struggles

Pick n Pay has already closed 32 stores across South Africa—24 company-owned locations and eight franchises—while converting five into franchise outlets.

CEO Sean Summers said the company is assessing 100 underperforming stores to decide whether to close, convert, or rebrand them under the Boxer banner. While some locations have been kept due to improved profitability, Hyde Park was not among them.

The store had been struggling with an oversized footprint and an inefficient layout. Hyprop suggested reducing its floor space by 800m², but Pick n Pay opted not to renew its lease. This opened the door for Shoprite, which quickly secured the location as part of its push into high-end retail.

Pick n Pay’s legacy faces challenges

Despite having more than 2,000 stores across eight African countries, Pick n Pay is under financial strain. The Ackerman family remains deeply involved in the company’s turnaround, holding a 25.53 percent stake valued at over $290 million.

Founded in 1967 by Raymond Ackerman and his wife, Wendy, Pick n Pay grew from four Cape Town stores into one of South Africa’s largest retailers. Ackerman’s customer-first philosophy was at the heart of its success. Before his passing at 92 on Sept. 6, 2023, he handed leadership to his family, with his son, Gareth Ackerman, now serving as chairman. To steer the company back to stability, retail veteran Sean Summers returned as CEO.

But financial pressures persist. In 2024, Pick n Pay reported a R3.2 billion ($171 million) after-tax loss, largely due to impairments on store assets. In August, it raised R4 billion ($213 million) in an oversubscribed rights issue to stabilize operations.

South Africa’s grocery sector is shifting

Even with Summers at the helm, the company is struggling to regain its footing. In a trading update in January, Pick ‘n Pay confirmed the closure of 24 corporate-owned stores and eight franchise locations. The move follows a difficult fiscal year marked by heavy losses and asset impairments.

As South Africa’s grocery sector shifts, Pick n Pay is focusing on profitable locations and strengthening its franchise model. But the loss of its Hyde Park store—now occupied by Shoprite—reflects deeper changes in the country’s retail landscape.

With Checkers FreshX positioning itself as a direct competitor to Woolworths Food, Shoprite is making aggressive moves to dominate northern Johannesburg’s high-end market. The battle for grocery sector leadership in South Africa has never been more intense.