Table of Contents

Key Points

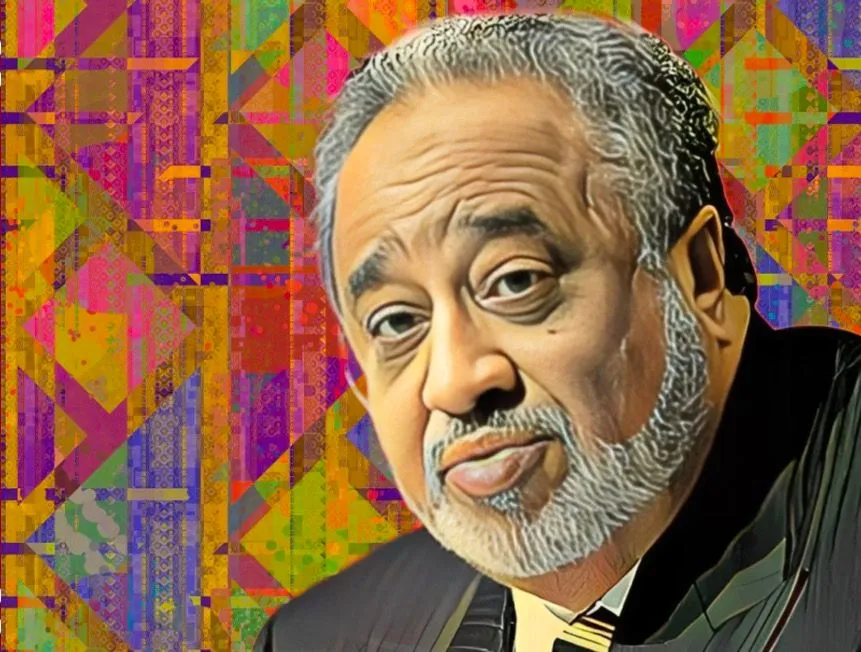

- Mohammed Al-Amoudi’s stake in Preem surged to $4.77 billion, boosting his net worth past $10 billion, after Bloomberg’s latest portfolio reassessment.

- Preem partnered with AI firm Imubit to enhance refinery efficiency and cut emissions, aligning with Sweden’s carbon-neutral goals.

- Preem’s 2024 net profit plunged 83% to $97.24 million due to weaker refining margins, lower revenue, and rising financial costs.

Mohammed Al-Amoudi, Ethiopia’s richest man, has seen the value of his stake in Preem, Sweden’s largest petroleum and biofuel company, soar to $4.77 billion. This surge has significantly boosted his net worth, which now stands above $10 billion.

According to Bloomberg’s latest reassessment of his investment portfolio, Al-Amoudi’s stake in Preem is now valued at $4.77 billion. This follows an updated analysis on Oct. 30, 2023, which had already added $2.5 billion to his holdings in the company.

Preem’s newly published 2024 annual report provided fresh insights into its valuation, driving up the value of Mohammed Al-Amoudi’s stake. Since the start of 2025, his shareholding has climbed from $3.4 billion to $4.77 billion, adding $1.25 billion to his net worth. That boost has pushed his fortune from $8.73 billion at the beginning of the year to $10.1 billion.

Preem taps AI to improve refining, cut emissions

As Sweden’s leading petroleum and biofuel company, Preem operates about 505 petrol stations and runs two advanced oil refineries. It has built a strong reputation for refining, distributing, and selling gasoline, diesel, heating oils, and renewable fuels. The company also produces lubricants at its Gothenburg facility, further cementing its position in the industry.

Preem is also leaning into digital transformation. It was among the first companies in Sweden to adopt Microsoft Copilot and has been expanding its artificial intelligence (AI) strategy. Rather than limiting AI to IT, its leadership is working to integrate the technology across all operations to stay ahead of the curve.

As part of this push, Preem has teamed up with Imubit, a global leader in closed-loop AI optimization, to accelerate its sustainability efforts. Imubit’s Closed Loop AIO technology will help the company cut emissions and improve efficiency—aligning with Sweden’s broader goal of a carbon-neutral future.

Through this partnership, Preem will roll out Imubit’s AI-powered Optimizing Brain™ solution at its Lysekil refinery. The technology is designed to enhance the efficiency of the refinery’s Fluid Catalytic Cracking (FCC) unit, improving fuel yields while reducing emissions and fuel waste.

Preem reports lower profit and revenue

Preem ended 2024 with lower revenue and profit for the second straight year, as weaker refining margins and a tough market environment weighed on its performance. The company's latest annual report shows revenue fell 5.04 percent to SEK130.77 billion ($12.77 billion) from SEK137.71 billion ($13.44 billion) the previous year, due to a decline in petroleum product sales.

Sales in its Supply & Refining segment dropped to SEK125.45 billion ($12.27 billion) from SEK132.24 billion ($12.93 billion) in 2023, as lower crude oil prices and weaker refining margins cut into earnings. A mix of falling revenue, reduced gross profit, and financial hedge losses of SEK233 million ($22.76 million) led to a sharp decline in operating profit.

Preem's operating profit tumbled to SEK2.15 billion ($209.97 million), down from SEK7.91 billion ($772.51 million) the previous year. Higher financial expenses and lower contributions from associated companies added to the strain.

Net profit took an even bigger hit, plunging 83.34 percent to SEK995 million ($97.24 million) from SEK5.97 billion ($583.44 million) in 2023. The drop was fueled by weaker refining margins, rising financial costs, and broader economic uncertainty.