Table of Contents

Key Points

- The consortium, including Petrolin Group and Waltersmith, secures full ownership of Shell’s Nigerian onshore assets after regulatory approvals.

- The deal aligns with Shell’s strategy to mitigate security risks and environmental concerns, with an initial $1.3 billion payment and potential future payments.

- Aradel secures a major share in the new entity, reinforcing indigenous ownership in Nigeria’s oil and gas industry.

Renaissance Africa Energy Holdings, a consortium of leading energy firms, has officially taken full ownership of the Shell Petroleum Development Company of Nigeria (SPDC) after securing all necessary regulatory approvals and final green light from the Federal Government of Nigeria.

The $2.4 billion deal marks the transfer of Shell’s entire (100 percent) equity holding to Renaissance, which includes Gabonese tycoon Samuel Dossou-Aworet’s Petrolin Group, Abdulrazaq Isa’s Waltersmith Group, and Aradel Holdings Plc, led by Adegbite Falade. The sale was first announced in January 2024.

This acquisition aligns with Shell’s strategy to exit Nigeria’s onshore oil sector, where security risks, environmental concerns, and community unrest have posed persistent challenges. Under the terms of the deal, Shell will receive an initial payment of $1.3 billion, with up to $1.1 billion in potential future payments, bringing the total transaction value to $2.4 billion.

Renaissance boosts Nigeria’s energy future

Renaissance, a consortium of independent oil companies—including Aradel Holdings, ND Western, FIRST Exploration and Petroleum Development Company, and Waltersmith Group—has joined forces with Petrolin, a global energy player, to take over Shell’s onshore assets in Nigeria. This acquisition cements their position in the country’s oil and gas industry. The group has assured a smooth transition and is committed to working closely with SPDC’s experienced workforce and key stakeholders to sustain and grow operations.

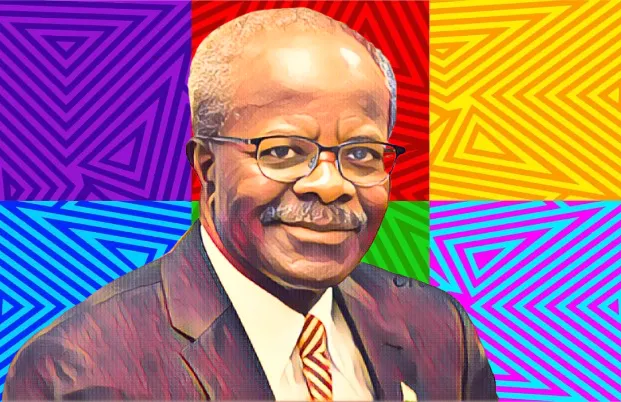

“This is a landmark moment for Nigeria's energy sector and heralds a new era for local participation,” said Adegbite Falade, CEO of Aradel Holdings. “It highlights the vital role that indigenous energy companies play in Nigeria's industrialization and development. As the leading integrated indigenous energy company in Nigeria with a proven track record of twenty years, we remain dedicated to upholding global standards and maintaining operational excellence. This will surely facilitate the rapid development of Nigeria’s vast oil and gas resources, further paving the way for the Country to achieve energy security and industrial development.’’

Aradel confirms 33.34 percent stake in Renaissance

Aradel has confirmed a 33.34 percent equity stake in Renaissance, comprising a direct 12.5 percent share and an additional 20.84 percent held through ND Western. The other partners in the consortium have yet to disclose their exact stakes.

This acquisition reshapes Nigeria’s oil industry, shifting key energy assets into the hands of local players with deep expertise in the Niger Delta. Renaissance is set to expand operations, diversify assets, and drive sustainable energy solutions for the country’s future.

The deal ensures SPDC’s full operational capabilities remain intact under new ownership. SPDC will continue to manage technical operations, systems, and processes for all companies in the SPDC Joint Venture (SPDC JV). Its staff will retain their positions as the transition unfolds.

The SPDC JV operates 15 oil mining leases for onshore petroleum production and three in shallow waters. As of December 31, 2022, the SEC reported 458 million barrels of oil equivalent (MMboe) in proved reserves under this transaction.

Skip to content

Skip to content