Table of Contents

Key Points

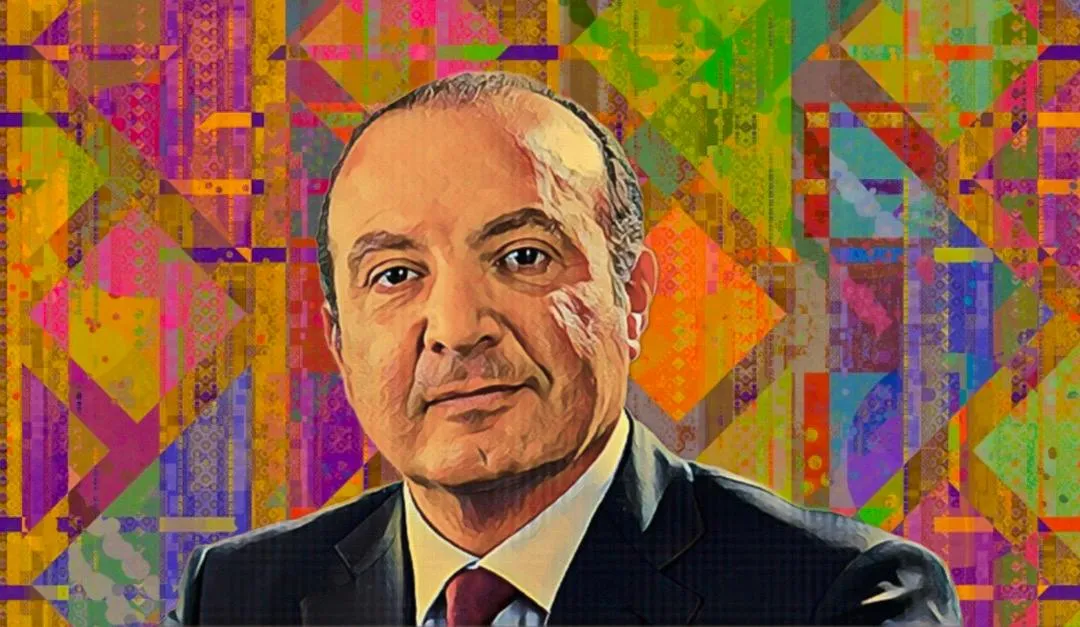

- Edita Food Industries secures board approval to double its issued capital to EGP 280 million ($5.53 million) using retained earnings.

- Net profit fell 6.1% to EGP 1.4 billion ($27.66 million) in 2024, hit by currency devaluation and rising costs, despite strong sales performance.

- Chairman Hani Berzi, with a 41.95% stake, leads Edita’s push beyond Egypt, reinforcing its market dominance in packaged snacks.

Edita Food Industries, the Cairo-based consumer goods giant led by Egyptian businessman Hani Berzi, has secured board approval to increase its capital by $2.76 million through a stock dividend funded from retained earnings. The move will double its issued capital to EGP 280 million ($5.53 million) as part of the company’s broader expansion plans.

Edita doubles Capital through retained earnings

The capital increase of EGP140 million ($2.76 million), approved at a recent Extraordinary General Meeting (EGM), will be fully funded from retained earnings, as confirmed in the company’s audited 2023 financial statements. These were certified during its Ordinary General Meeting on March 28, 2024.

Edita plans to distribute the increase across 700 million shares at a nominal value of EGP 0.20 ($0.004) per share. The measure is subject to shareholder approval at an upcoming EGM, with Chairman Hani Berzi expected to oversee the execution details. With this step, Edita is strengthening its financial position to support its growth strategy in Egypt’s highly competitive food industry.

Berzi’s Edita expands regional footprint

Edita Food Industries remains Egypt's dominant player in the packaged snack market, producing cakes, croissants, rusks, and wafers, and benefiting from a strong retail network.

Although the company saw significant revenue growth driven by price increases and higher sales in key product categories, its net profit decreased by 6.1 percent in 2024, falling from EGP 1.51 billion ($30 million) to EGP 1.4 billion ($27.66 million). The drop was mainly due to the devaluation of the Egyptian pound in March and rising operational costs.

Chairman Hani Berzi, who holds a 41.95 percent stake through Quantum Invest BV, continues to lead the company’s regional expansion, reinforcing Edita’s presence beyond Egypt. His stake, valued at over $160 million, cements his status as one of the country’s wealthiest business figures. With the latest boost, Edita is positioning itself for long-term growth, focusing on strategic investments and regional expansion while leveraging its strong brand and operational expertise.