Table of Contents

Key Points

- Tlou Energy posted a $3.7 million half-year loss, more than doubling from the prior period, as it continued investing in its Lesedi Gas-to-Power project.

- A strategic partnership with Kala Data will see Tlou power a high-density computational facility for AI, blockchain, and machine learning, diversifying its revenue streams.

- Total assets rose to $81.4 million amid investments, as CEO Anthony Gilby stays optimistic about commercial production and Botswana’s energy shift.

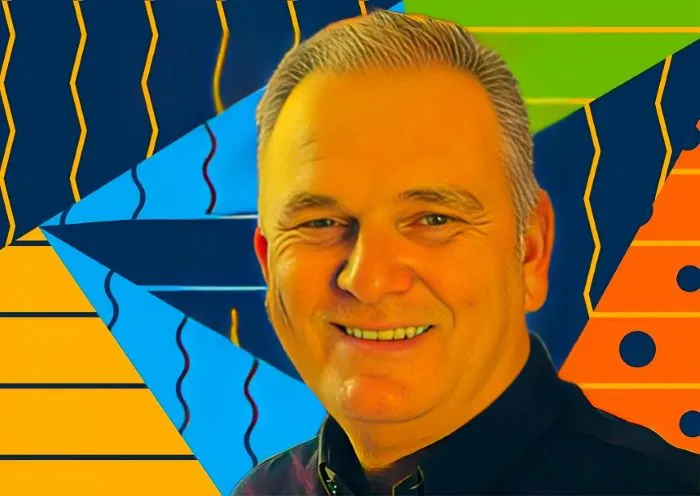

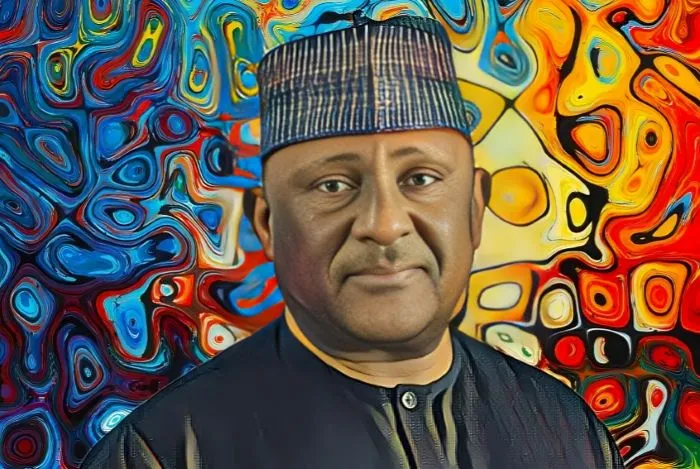

Tlou Energy Limited, an energy firm led by Botswana businessman Anthony Gilby, has reported a half-year loss of $3.7 million for the six months ended Dec. 31, 2024. The company, still in its exploration and evaluation phase, generated no revenue during the period but continued to invest heavily in its gas-to-power project.

Progress at the Lesedi Gas-to-Power project

The company’s results show a sharp increase in losses, rising 106.8% from $1.82 million in the previous half-year period. Despite this, Tlou made notable strides in its flagship Lesedi Gas-to-Power Project, which is expected to provide reliable baseload electricity for Botswana.

In the past six months, the company has nearly completed the Lesedi substation, worked on optimizing gas production, and prepared for the next phase of well drilling in early 2025—pending additional funding.

CEO Anthony Gilby remains optimistic about the company’s outlook. “We are on the verge of commercial production, and our infrastructure investments position us for strong growth in power generation and high-density computing services,” he said.

Strategic partnership with Kala Data

On March 11, 2025, Tlou announced a key partnership with Kala Data FZCO to develop a high-density computational facility at Lesedi, powered by its gas-generated electricity. The facility will support energy-intensive computing applications such as AI, machine learning, and blockchain services.

Kala will fund the project through an interest-free loan, with an initial profit split of 75/25 in its favor until the loan is repaid. After that, profits will be shared equally. This deal expands Tlou’s revenue streams beyond electricity generation, complementing its existing 10MW power supply agreement with Botswana Power Corporation and strengthening its commercial prospects.

Driving Botswana’s energy and digital transformation

Tlou Energy is playing a key role in Botswana’s shift toward energy self-sufficiency and digital infrastructure development. Focused on gas production, power generation, and computational services, the company is positioning itself at the intersection of energy and technology.

By the end of 2024, Tlou’s total assets had grown to $81.4 million from $77.5 million the previous year, reflecting ongoing investments in the Lesedi project. Total equity dipped slightly to $62.4 million from $62.6 million, but the company remains focused on scaling operations.

Under Anthony Gilby’s leadership, Tlou—where he holds a 4.9-percent stake valued at BWP63.7 million ($4.65 million)—is pushing forward with gas-fired power solutions and advanced computing facilities in Sub-Saharan Africa. With drilling expertise, government approvals, and infrastructure in place, the company is well-positioned for expansion in the coming years.