Table of Contents

Key Points

- Simbisa’s revenue grew 7% to $157.5 million, driven by higher spending, despite lower customer traffic across key markets.

- Headline earnings dropped 10.7% to $8.73 million as rising costs in Zimbabwe and Kenya pressured margins.

- The company expanded in Kenya, adding four stores, while maintaining a $0.0062 dividend per share, backed by a 39% cash flow increase.

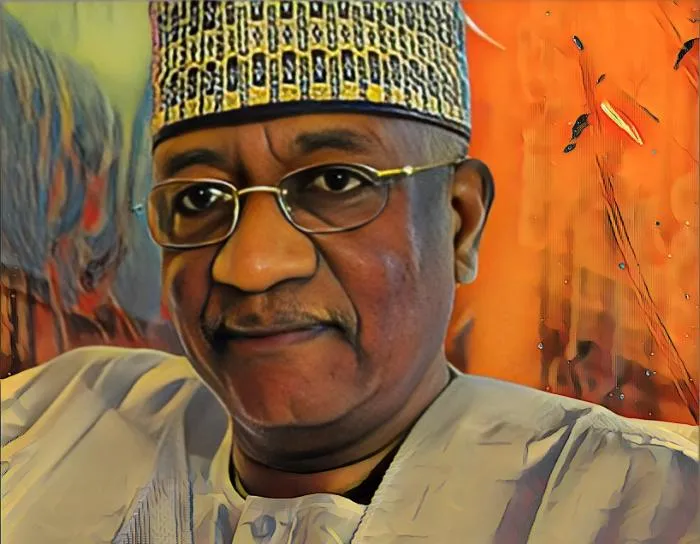

Simbisa Brands, Zimbabwe’s largest quick-service restaurant operator led by Zimbabwean business leader Addington Chinake, posted mixed results for the first half of its 2025 fiscal year. While sales were up, rising costs in its key markets put pressure on profitability. The company faced economic challenges that weighed on its bottom line, even as revenue continued to grow.

In its latest financial report, Simbisa recorded a 7 percent increase in revenue to $157.5 million, up from $146.75 million in the same period last year. Growth was driven by higher average spending per customer, particularly in Kenya, but overall customer traffic declined across multiple regions. At the same time, headline earnings fell 10.7 percent to $8.73 million, weighed down by rising operational costs, new taxes in Kenya, and electricity tariff hikes in Zimbabwe.

Kenya and Eswatini: A mixed performance

In Kenya, revenue grew 16 percent, fueled by a 26 percent increase in average customer spending. However, total customer visits declined 8 percent, reflecting the impact of new taxation policies and economic pressures. To counter this, Simbisa expanded its footprint in the country, adding four new outlets, bringing its total to 255 stores.

Eswatini saw a different trend. Revenue dropped 2 percent, as a 10 percent decline in customer traffic overshadowed a 9 percent rise in average spending. While profit margins held steady, weaker demand affected overall sales. In response, Simbisa plans to refurbish and modernize its Eswatini stores in the second half of the year to attract more customers.

Maintaining dividends despite cost pressures

In Zimbabwe, the company adjusted its pricing strategy, lowering prices to boost sales while accepting thinner margins to keep customers engaged.

Despite inflationary pressures and weaker consumer spending, Simbisa’s cash flow surged 39 percent to $29.35 million, enabling the company to maintain its interim dividend at $0.0062 per share, payable on Mar. 20, 2025.

The company also approved a $174,277 payout for its Employee Share Trust, reaffirming its commitment to staff welfare and shareholder returns.

Expansion plans to drive growth

Simbisa is pushing forward with its expansion strategy, particularly in East Africa, where demand for quick-service restaurants remains strong. As of Dec. 31, 2024, the company operated 611 outlets, adding 42 new stores over the past year.

In Zimbabwe, Simbisa runs 332 stores, including 103 Chicken Inn, 65 Pizza Inn, and 67 Bakers Inn outlets. Inflation and rising power costs have increased expenses, but the company remains financially solid, with total assets up 5.4 percent to $197.86 million and equity rising 7.2 percent to $93.18 million.

Looking ahead, Simbisa plans to renovate and upgrade stores in H2 2025, aiming to enhance customer experience, build brand loyalty, and sustain growth in an increasingly challenging economic environment.