Table of Contents

Key Points

- Bassim Haidar rejects Trump’s $5 million visa plan, saying high taxes will deter investors despite promises of economic growth and job creation.

- Trump proposes replacing EB-5 visa with a $5 million ‘gold card’, aiming to attract high-net-worth investors and boost U.S. tax revenue.

- Haidar’s global empire spans fintech, telecoms, and cannabis, with businesses generating over $1.6B annually across Africa, the Middle East, and beyond.

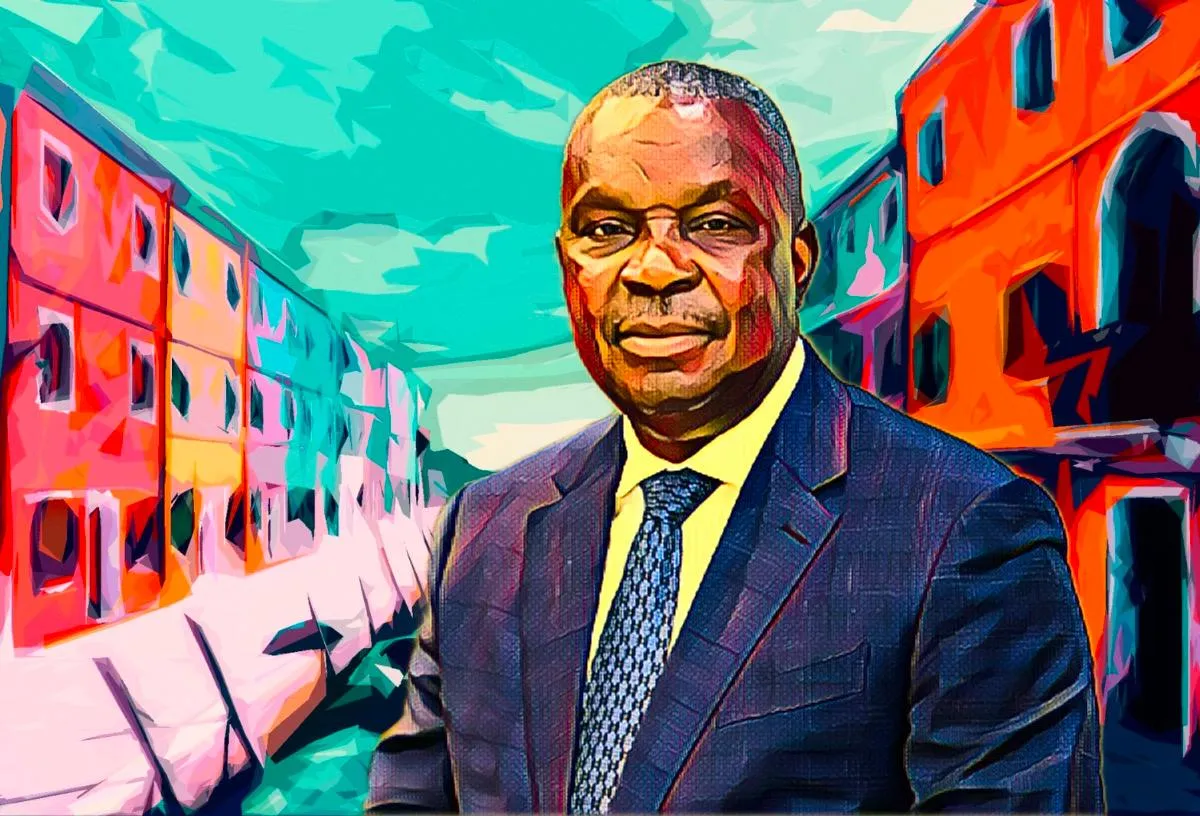

Nigerian-Lebanese businessman Bassim Haidar has dismissed U.S. President Donald Trump’s proposed “gold card” visa, which offers a pathway to citizenship for a $5 million investment. Haidar believes the plan won’t attract a wave of global investors, citing concerns over higher taxes.

Trump has pitched the initiative as a way to strengthen the U.S. economy, arguing it would generate significant tax revenue and create jobs. But Haidar, one of the world’s ultra-high-net-worth individuals, remains unconvinced.

"I don’t think this will have much impact," said Haidar, founder of the fintech firm Optasia. "Getting a U.S. green card isn’t difficult if you meet certain criteria. Paying $5 million for a visa and then being taxed on your global income just doesn’t make sense."

Trump pushes for new investor visa

Announcing the plan on Tuesday, Trump said he wants to replace the EB-5 immigrant investor visa, which requires a minimum $800,000 investment, with the gold card initiative. The EB-5 program, created by Congress in 1990, allows foreign investors to apply for permanent residency if they invest in U.S. businesses and create at least 10 full-time jobs.

The proposal comes as the European Union urges member states to scale back or eliminate residency-by-investment programs. Critics argue these schemes drive up real estate prices, offer little economic benefit, and create risks of tax evasion and corruption.

Commerce Secretary Howard Lutnick defended the gold card plan, calling the EB-5 program ineffective and prone to fraud. He said raising the investment threshold to $5 million would bring in higher-quality investors who can make meaningful contributions to the U.S. economy.

Bassim Haidar’s business empire spans fintech, telecoms

Born to Lebanese parents in Nigeria, Bassim Haidar has built a global business empire spanning medicinal cannabis, fintech, telecoms, logistics, energy, and engineering. He launched his first company at 20 and now oversees a multi-sector conglomerate generating more than $1.6 billion in annual revenue.

His early success came from co-founding GMT, a top procurement, finance, and logistics provider in West Africa. He later launched Optasia—formerly Channel VAS Group—which provides mobile financial services, airtime credit, handset loans, and big data analytics. The company, which started in Cameroon in 2012, is now headquartered in Dubai and operates across Africa, the Middle East, Asia, and Latin America.

Haidar’s global ventures and political giving

In 2023, Haidar bought a $25 million five-bedroom flat near Chelsea’s Sloane Square in London. That same year, he revealed plans to sell Optasia or take it public on an international stock exchange to focus on new ventures.

These include SafriCanna, a South African medicinal cannabis company exporting to Europe, and a “buy now, pay later” platform aimed at African small and medium-sized businesses. So far, no sale or listing has been announced.

Beyond business, Haidar has also been an active political donor. In 2024, he gave £300,000 ($380,000) to the UK’s Conservative Party, adding to previous contributions, including £323,780 ($411,300) in 2023 and £75,000 ($95,300) to London mayoral candidate Moz Hossain.