Table of Contents

Key Points

- The refinery slashed Nigeria’s ex-depot petrol price by 7.3%, bringing total reductions in 2025 to 13.16%.

- Dangote’s refinery boosts local supply, reducing Nigeria’s reliance on imported fuel to an eight-year low.

- Dangote’s $23 billion refinery nears full 650,000 b/d capacity, strengthening Nigeria’s position in global oil markets.

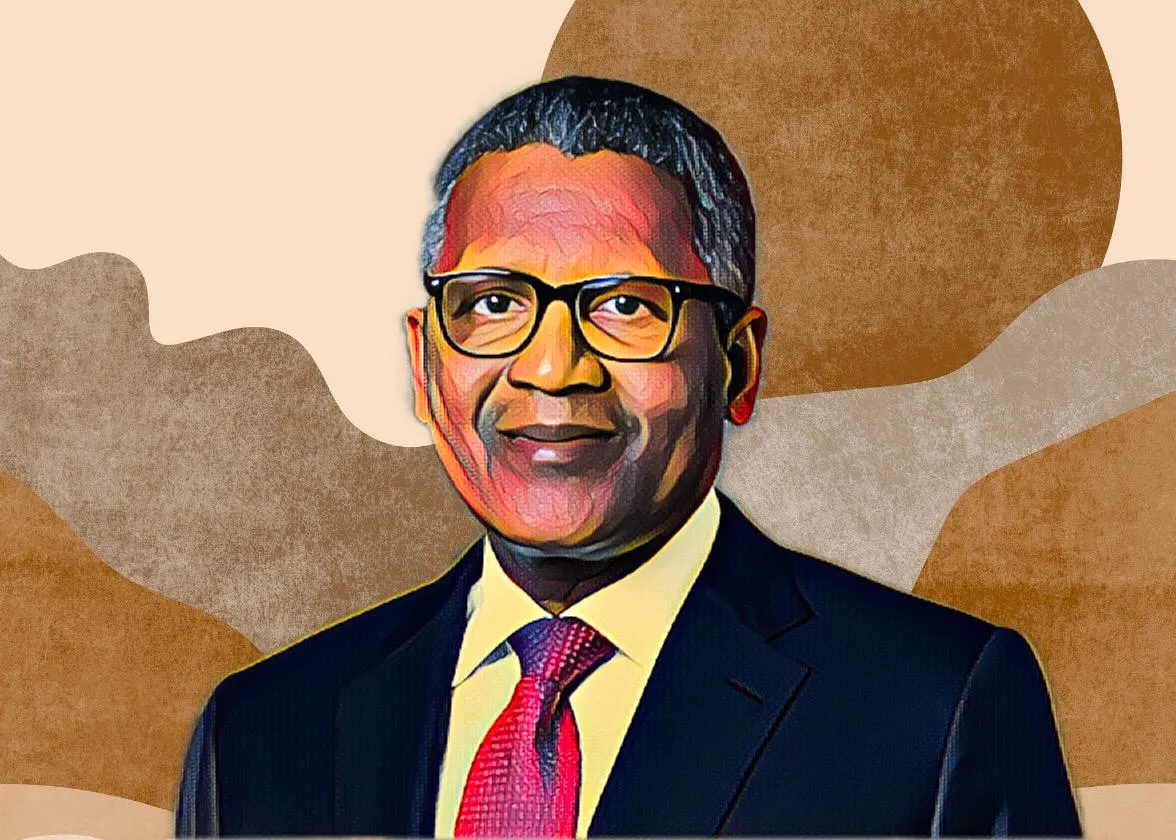

Aliko Dangote, Africa’s richest man and the mastermind behind the continent’s largest oil refinery, has lowered petrol prices in Nigeria for the second time this month, easing costs for millions of consumers.

His Dangote Petroleum Refinery announced on Wednesday that it was cutting the ex-depot price of Premium Motor Spirit (PMS), commonly known as petrol, by another 7.3 percent. With this latest adjustment, the total reduction since the start of 2025 stands at 13.16 percent.

Effective February 27, the ex-depot price will drop by N65 ($0.043), from N890 ($0.59) to N825 ($0.55) per liter—a significant shift in the country’s fuel market. This follows an earlier price cut on Feb. 1, when the refinery lowered prices by N60 ($0.04), citing a decline in global crude oil prices and improved market conditions.

The company said the move aligns with Nigeria’s broader economic recovery efforts under President Bola Ahmed Tinubu and aims to ease financial pressure on consumers ahead of Ramadan. “This price adjustment is meant to provide much-needed relief to Nigerians while supporting President Tinubu’s economic policies,” the refinery said in a statement.

A refinery reshaping Nigeria’s energy market

The $20 billion Dangote Petroleum Refinery, which began operations last year, has quickly become the backbone of Nigeria’s energy sector. By significantly reducing the country’s dependence on imported fuel, it has forced European refiners to find new markets and positioned Nigeria as a net exporter of refined products such as jet fuel, naphtha, and fuel oil.

Since its launch, production has steadily increased. By mid-2024, the refinery was processing 350,000 barrels per day (b/d). That figure climbed to 500,000 b/d in January 2025 and is set to reach full capacity of 650,000 b/d next month, making it the seventh-largest refinery in the world.

The impact on Nigeria’s fuel market has been immediate. The country’s reliance on imported gasoline has dropped to an eight-year low, according to energy intelligence firm Vortexa. Meanwhile, S&P Global reports that Nigeria has begun exporting refined petroleum products to neighboring markets—a major shift for a country that once depended almost entirely on imports to meet domestic fuel demand.

Price cuts and market competition

Dangote’s latest price reduction is expected to heighten competition among fuel marketers, many of whom still rely on imports. The company has assured the public that there will be a steady supply of petroleum products, with sufficient reserves to meet domestic demand and export needs, further strengthening Nigeria’s position in the global oil market.

At retail stations operated by Dangote’s fuel partners, petrol prices will vary based on regional logistics and transportation costs. At MRS Holdings stations, petrol will sell for N860 ($0.57) per liter in Lagos, N870 ($0.58) in the South-West, N880 ($0.585) in the North, and N890 ($0.59) in the South-South and South-East. At AP (Ardova Petroleum) and Heyden stations, the price will be N865 ($0.576) in Lagos, N875 ($0.583) in the South-West, N885 ($0.588) in the North, and N895 ($0.596) in the South-South and South-East.

A $23 billion-dollar gamble that’s paying off

Building the refinery was an enormous challenge. Initially projected to cost $10 billion, expenses soared to more than $23 billion due to engineering, logistics, and financing hurdles. Yet Dangote’s vision for a self-sufficient Nigeria—one less vulnerable to the volatility of global fuel markets—is becoming reality.

Beyond meeting domestic needs, the refinery has started exporting diesel and aviation fuel to countries such as Cameroon, Angola, Ghana, and South Africa. In a move that underscores its growing influence, it recently supplied jet fuel to Saudi Aramco, the world’s largest oil producer.

Despite his vast business empire, Dangote remains actively involved in refinery operations, frequently visiting the facility and working alongside his leadership team. Edwin Devakumar, the refinery’s managing director, has suggested that full production capacity is within reach, which would further cement its dominance.

To sustain operations, Dangote is expanding the refinery’s crude storage capacity by 41.67 percent—adding eight new tanks, four of which are nearing completion—to hold up to 3.4 billion liters of crude oil.

A turning point for Nigeria’s energy future

For decades, Nigeria—Africa’s largest oil producer—was forced to import nearly all its fuel despite its vast crude oil reserves. The Dangote Refinery is rewriting that story. By reducing import dependency and boosting foreign exchange earnings, it is not only reshaping Nigeria’s economy but also making waves in the global energy sector.

As fuel prices continue to drop, the impact will be felt across industries, from transportation to manufacturing, easing costs for businesses and households alike. Whether competitors will follow suit or whether this move will force a long-overdue restructuring of Nigeria’s fuel market remains to be seen.

But one thing is clear: Dangote isn’t just selling fuel—he’s changing Nigeria’s economic future.

Skip to content

Skip to content