Table of Contents

Key Points

- TMG’s revenue jumped 50% to $844.86 million in 2024, fueled by luxury real estate demand and a booming hospitality segment.

- Hospitality revenue surged 225% to $227.36 million, while real estate revenue climbed 14%, reflecting strong market growth and investor confidence.

- TMG expanded into Saudi Arabia, boosting total assets to $7.06B billion, reinforcing its leadership in Egypt’s real estate sector.

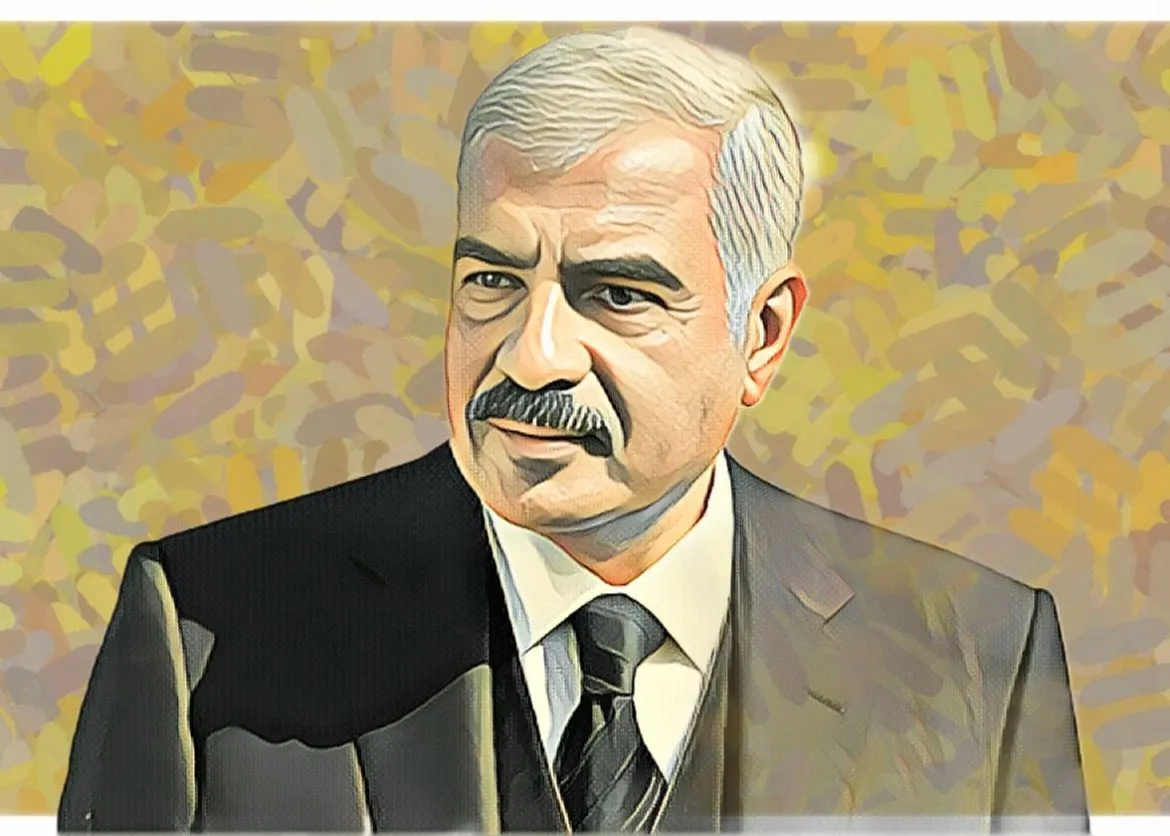

Talaat Moustafa Group (TMG) Holding, under Egyptian billionaire Hisham Talaat Moustafa, has reinforced its position as Egypt’s top developer with a record-breaking performance in 2024. The Cairo-based real estate giant has reported a remarkable financial performance for its full 2024 fiscal year, marked by a substantial increase in revenue and profitability.

According to its financial statement, TMG’s revenue surged by 50 percent year-over-year, climbing from EGP 28.4 billion ($562.78 million) in 2023 to EGP 42.67 billion ($844.86 million) in 2024. The company’s growth is attributed to the continued success of its real estate ventures and the booming hospitality sector.

Its hospitality segment experienced exponential growth, with revenue rising from EGP 3.54 billion ($70 million) in 2023 to EGP 11.5 billion ($227.36 million) in 2024, marking a 225 percent increase. Meanwhile, real estate development revenue climbed 14 percent from EGP 21.58 billion($426.55 million) to EGP 24.5 billion ($485.58 million), highlighting sustained demand for premium residential and commercial properties.

This revenue surge translated into an exceptional net profit increase of 332 percent, reaching EGP 14.47 billion ($286.40 million) in 2024, compared to EGP 3.34 billion ($66.28 million) the previous year, reflecting TMG’s strong financial performance and profitability.

TMG’s real estate dominance and expansion

Under Hisham Talaat Moustafa’s leadership, TMG has strategically expanded its footprint, including a major entry into Saudi Arabia’s lucrative real estate market, leveraging its decades of expertise in developing integrated urban communities.

With total assets reaching EGP356.7 billion ($7.06 billion) compared to EGP202 billion ($4 billion) during the same period last year, TMG’s financial position remains stronger than ever, ensuring continued growth and leadership in the industry. The board of the real estate company has also proposed the distribution of EGP515.16 million ($10.18 million) dividend, translating to EGP0.25 ($0.005) per share.

TMG’s outstanding 2024 results reaffirm its position as Egypt’s leading real estate developer, setting new records in sales, profitability, and market expansion. As it continues its strategic developments, including the SouthMed project and Saudi Arabian expansion, the company remains on track for further success in 2025.