Table of Contents

Key Points

- The Togolese unit of Coris Bank International has grown its total assets from $685 million in 2021 to $845 million in September 2024.

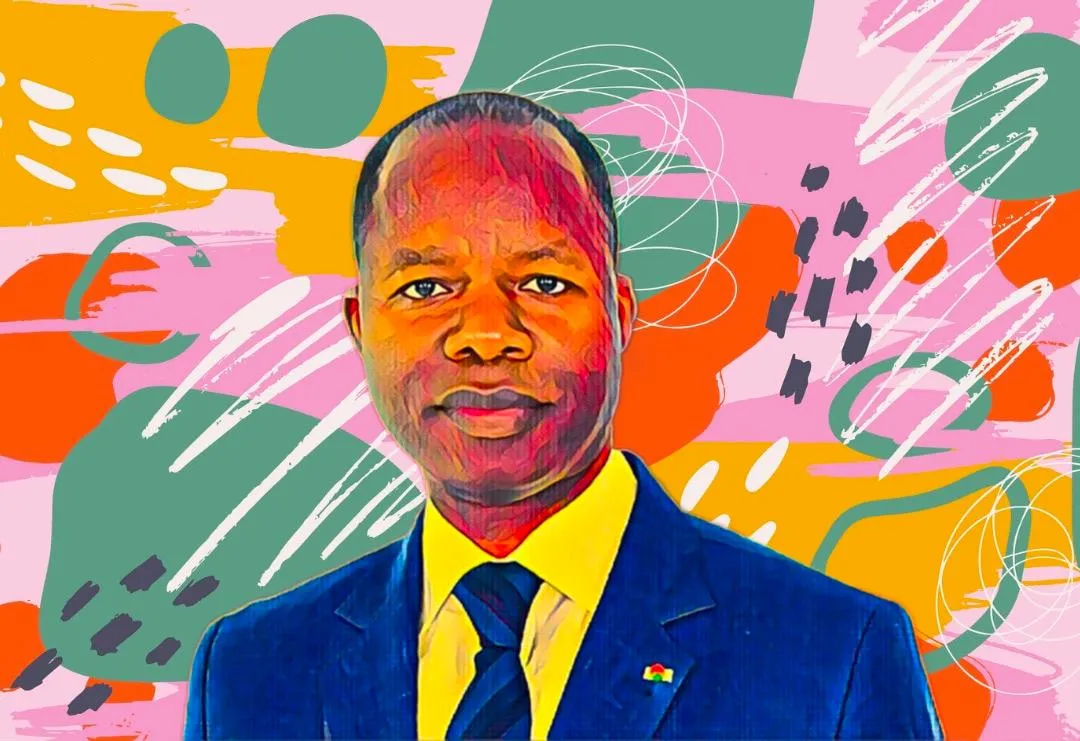

- Led by Idrissa Nassa, Coris Bank has acquired banking assets in Côte d’Ivoire, Chad, and Guinea, with plans to enter Mauritania.

- Idrissa Nassa acquired Total Energie Burkina Faso and backed gold projects with over $147 million in financing through Coris Bank and Nioko Resources.

Coris Bank International, the Burkina Faso-based banking group led by Idrissa Nassa, has seen the total assets of its Togolese unit, Coris Bank Togo, surge to $845 million. The steady growth reflects the group’s commitment to strengthening its West African footprint.

Coris Bank Togo’s assets up 23% since 2021

Since 2021, Coris Bank Togo’s total assets have grown from CFA428 billion ($685 million) to CFA528 billion ($845 million) as of September 2024. This increase has strengthened its position among Togo’s top lenders, driven by innovation, diverse services, and a growing customer base. The bank now serves over 79,000 customers and has 196,000 users on its e-money platform.

To boost financial inclusion in West Africa, Coris Bank International launched its e-money service, Coris Money, in July 2022 through its Togolese subsidiary. The platform has since become a key part of the bank’s operations in Togo. Customer deposits have risen to CFA310 billion ($496 million), while net loans stand at CFA206.9 billion ($331 million).

Coris Bank strengthens West African footprint

Founded in 2008 by Idrissa Nassa, Coris Bank International has grown from a small financial institution with just $3 million in capital to a major banking group managing assets worth $9 billion. Its network spans Côte d’Ivoire, Mali, Togo, Senegal, Benin, Niger, and Guinea-Bissau.

Under Nassa’s leadership, the group has aggressively expanded. In 2021, it launched Coris Bank International Guinea, which quickly became a key player in the country’s banking sector. In 2023, Coris acquired Standard Chartered’s consumer banking business in Côte d’Ivoire. More recently, it took over Société Générale’s subsidiary in Chad and is eyeing a potential acquisition of Société Générale Mauritanie, signaling its intent to deepen its presence in the region.

Idrissa Nassa’s bold moves in energy, mining

Beyond banking, Nassa has been making bold moves in mining and infrastructure across West Africa. His recent acquisition of Total Energie in Burkina Faso, the country’s largest fuel retailer, marks a strategic push into the oil sector.

This follows Coris Bank’s role in the Kiaka Gold Project, where it provided a $100 million credit facility to West African Resources Limited as part of a larger $265 million secured loan.

Through Nioko Resources Corporation, Nassa has also invested heavily in the mining industry. Earlier this year, he secured a $47 million stake in Orezone Gold, helping advance the development of the Bomboré gold mine—one of Burkina Faso’s largest mining projects.