Table of Contents

Key Points

- South Africa’s mining tycoons shape global commodity markets and influence policies while diversifying into finance, energy, and infrastructure.

- Leaders like Patrice Motsepe and Ivan Glasenberg expand into fintech, clean energy, and critical minerals to navigate shifting market dynamics.

- Tycoons including Cyril Ramaphosa and Bridgette Radebe leverage industry expertise to drive policy, transformation, and economic inclusion.

South Africa’s mining tycoons are more than just business titans—they are the architects of an economy built on some of the world’s richest mineral reserves. From gold and platinum to coal and diamonds, these industry heavyweights have not only shaped global commodity markets but also steered the country’s industrial and financial landscape. Their influence extends far beyond the mines, reaching into banking, infrastructure, and energy—sectors that form the backbone of Africa’s most industrialized economy.

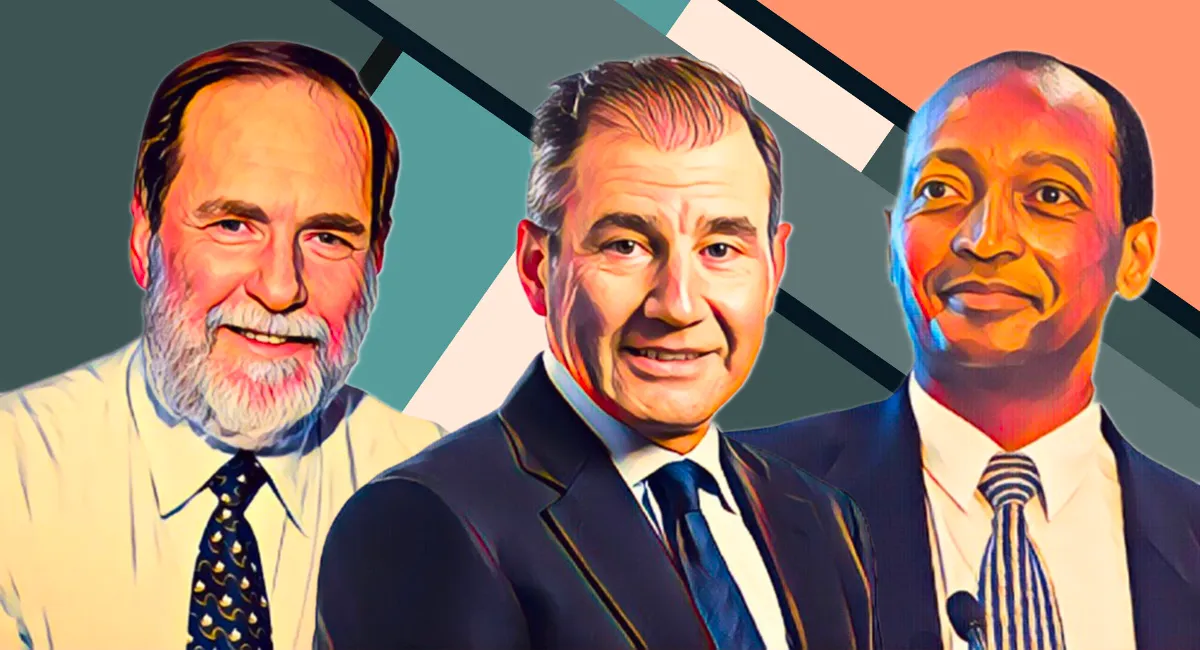

At the top of this elite circle are figures like Ivan Glasenberg, Nicky Oppenheimer, and Patrice Motsepe, whose fortunes are deeply tied to the extraction and trade of South Africa’s most prized resources. Glasenberg’s Glencore has a dominant footprint in global mining, the Oppenheimer dynasty’s legacy continues to shape the diamond industry, and Motsepe, Africa’s first Black billionaire, has redefined the sector through African Rainbow Minerals, championing a more inclusive and diversified industry.

But their power isn’t confined to boardrooms and mine shafts. Many of these billionaires play a decisive role in politics, philanthropy, and economic development. Cyril Ramaphosa and Bridgette Radebe have moved seamlessly between business and governance. Others, like Desmond Sacco and Brian Menell, have expanded their reach through investments that fuel economic growth and social impact initiatives.

As South Africa grapples with shifting commodity prices, regulatory challenges, and global economic uncertainty, these mining giants remain at the center of its financial future. Their wealth—built on the minerals that drive industries worldwide—reflects both the country’s resource-driven prosperity and the ongoing struggle to create a more equitable economy.

In this report, Billionaires.Africa profiles the 15 wealthiest figures in South Africa’s mining sector, exploring their legacies, investment strategies, and the evolving role of mining in shaping the nation’s future.

- Nicky Oppenheimer

Net Worth: $12.1 billion

Nicky Oppenheimer, South Africa’s second-richest person and Africa’s third wealthiest, has expanded his business interests well beyond diamonds. Since selling his family’s 40% stake in De Beers to Anglo American for $5.2 billion in 2012, he has built a diverse investment portfolio through Oppenheimer Generations. His firm manages global investments across private equity, technology, and agriculture, with stakes in Tana Africa Capital, 4DI Capital, and Stockdale Street. Oppenheimer’s interests also extend to aviation and conservation. He owns Fireblade Aviation, a high-end private jet service, and controls vast conservation holdings, including Tswalu Kalahari—South Africa’s largest private game reserve—and Shangani Ranch, a key player in Zimbabwe’s beef exports. Through the Brenthurst Foundation, he actively promotes economic policy and sustainable development across Africa.

- Ivan Glasenberg

Net Worth: $6.96 billion

Ivan Glasenberg built his fortune at Glencore, the world’s largest commodity trading and mining company. As CEO from 2002 to 2021, he steered the company through major deals, including the $29 billion acquisition of Xstrata in 2013, cementing its dominance in global resources. Though he stepped down as CEO, he remains one of Glencore’s largest shareholders, holding a 9.93 percent stake worth $4.96 billion. Beyond mining, Glasenberg has served on the boards of Minara Resources, United Company Rusal, and Century Aluminum. In 2024, he made an unexpected move into the consumer sector by acquiring Italian bicycle manufacturer Pinarello, marking his first venture outside commodities.

- Patrice Motsepe

Net Worth: $2.8 billion

Patrice Motsepe, South Africa’s wealthiest Black billionaire, built his fortune in mining and has since expanded into finance and energy. As the founder of African Rainbow Minerals (ARM), he holds a 45.9 percent stake in the company, which has major investments in gold, platinum, copper, and coal. Motsepe’s influence extends beyond mining. Through his investment firm African Rainbow Capital (ARC), he owns a stake in TymeBank, one of South Africa’s fastest-growing digital banks. ARC’s portfolio includes nearly 50 companies, among them Sanlam Investment Holdings and African Rainbow Energy and Power, which focuses on renewable energy. A committed philanthropist, he joined The Giving Pledge in 2013 and has donated millions to uplift communities across South Africa.

- Christo Wiese

Net Worth: $1.6 billion

Christo Wiese, a South African 83-year-old billionaire and retail magnate, is reigniting his early ties to diamond mining through Trans Hex Group. Best known for his stake in Shoprite Holdings, Africa’s largest retailer, Wiese first entered the diamond industry in 1976 but exited to finance the acquisition of Pepkor, a pivotal move in his retail empire. Now, his mining unit is exploring the Kaapvaal Craton, a diamond-rich region which geologists believe has shaped South Africa’s mining legacy for over 2.5 billion years. Co-owned by his son-in-law, Trans Hex aims to diversify into phosphate, lithium, gold, and platinum using advanced technology. Despite his net worth plunging from $7 billion to $1.6 billion after the 2017 Steinhoff crisis, Wiese remains undeterred, citing employment creation and foreign currency generation as key benefits of his mining resurgence.

- Desmond Sacco

Net Worth: $1.1 billion

Desmond Sacco, a seasoned geologist and mining magnate, chairs Assore Group, one of South Africa’s leading mining firms. He owns 32 percent of Assore and a 50 percent stake in Assmang Limited, a joint venture with African Rainbow Minerals, giving him control over major iron ore, manganese, and chrome operations. His investments also extend into gemstones. He holds a 12.7 percent stake in Gemfields Group, one of the world’s top producers of emeralds and rubies, which owns the prestigious Fabergé brand. Through The Sacco Foundation, he funds education, poverty alleviation, and healthcare initiatives, cementing his legacy in both business and philanthropy.

- Cyril Ramaphosa

Net Worth: $450 million

Cyril Ramaphosa, South Africa’s president since 2018, built his fortune before re-entering politics. A former anti-apartheid activist and trade unionist, he played a pivotal role in South Africa’s transition to democracy. After leaving politics in 1996, he founded Shanduka Group, investing in mining, McDonald’s South Africa, and financial services, amassing a net worth of $450 million. Returning to politics in 2012, he became deputy president under Jacob Zuma before taking office in 2018. Re-elected in 2024 despite the ANC losing its parliamentary majority, Ramaphosa remains a key figure in shaping South Africa’s political and economic landscape.

- Brian Menell

Net Worth: $300 million

Brian Menell, a South African mining magnate, is the founder of TechMet, a critical minerals investment firm backed by the U.S. International Development Finance Corporation (DFC) and private investors like Mercuria Energy. In 2024, TechMet raised $200 million in equity, pushing its valuation past $1 billion. Since launching TechMet in 2017, Menell has focused on metals essential for clean energy, including lithium, vanadium, and rare earth elements. His global portfolio spans projects in the U.S., Brazil, and the UK, where the company recently invested $67 million in a lithium supply chain initiative.

- Bridgette Radebe

Net Worth: $50 million

Bridgette Radebe, South Africa’s first Black female mining entrepreneur, built Mmakau Mining into a significant player in gold, platinum, and chrome extraction. She also played a key role in her brother Patrice Motsepe’s African Rainbow Minerals. Beyond mining, Radebe has held leadership roles in African Rainbow Capital Investments, Shaft Sinkers, and Sappi Limited. Through the New Africa Mining Fund, she supports Black-owned and junior mining companies, shaping the future of Africa’s mining industry.

- Saki Macozoma

Net Worth: $25 million

Saki Macozoma, a former anti-apartheid activist and Robben Island prisoner, has risen to become a leading figure in South Africa’s corporate and investment sectors. He chairs Vodacom South Africa and Safika Holdings, a major investment firm he co-founded in 1995. Macozoma made history in 1996 as Transnet’s first Black managing director and later held leadership roles at Standard Bank, Liberty Holdings, and STANLIB.A key player in South Africa’s mining industry, he co-established Ntsimbintle Holdings, which controls the country's largest manganese mine, Tshipi Borwa. His influence extends to Volkswagen South Africa, Mondi Plc, and Mokala Manganese, among others. Beyond business, Macozoma remains active in civil society, advising the Eastern Cape Premier and chairing the KwaZulu-Natal Philharmonic Orchestra.

- Gary Nagle

Net Worth: $12 million

Gary Nagle, a leading South African business executive, has cemented his status as a key figure in the global mining industry. As CEO of Glencore since 2021, he has driven the Swiss multinational to record profits, with revenue soaring from $203.75 billion in 2021 to $230.94 billion in 2024. A Glencore veteran since 2000, Nagle played a pivotal role in the company’s expansion, notably contributing to Xstrata’s London listing in 2002. His leadership spans continents, from Colombia to Australia and South Africa, where he previously headed Glencore’s Ferroalloys division. Holding a 0.016% stake in the company, valued at $12.09 million, Nagle continues to shape the global mining landscape, reinforcing Glencore’s dominance.

11. Loucas Pouroulis

Net Worth: $10 million

Loucas Pouroulis, a seasoned mining tycoon, has strengthened his influence in the platinum group metals (PGM) sector through Tharisa Plc, the South African resource group he leads. In a $27 million all-share deal, Tharisa increased its stake in Karo Mining Holdings from 26.8 percent to 66.3 percent, securing control of a major PGM mining complex in Zimbabwe’s Great Dyke. The acquisition aligns with Tharisa’s strategy to expand its diversified metals portfolio, as the Karo project gears up to produce 150,000 ounces of PGMs annually. Amid global supply disruptions, particularly due to Western sanctions on Russia—a major palladium producer—Pouroulis positions Tharisa as a key supplier in the evolving metals market. The Karo project, valued at $770.4 million, boasts a 20-year life of mine, further cementing Pouroulis’ footprint in the sector.

- Lucky Kgatle

Net Worth: $9 million

Lucky Kgatle, a seasoned mining executive, is the Founder & CEO of Tlou Holdings, driving strategic investments in Africa’s critical sectors. With over 20 years of leadership experience, he previously served as Senior Vice President at Sasol Mining, overseeing 40 million tonnes of annual coal production and a workforce of 13,000. He led a R3.2 billion ($174.4 million) business transformation, boosting productivity by 11 percent and achieving R150 million ($8.2 million) in cost savings. A board member across multiple Sasol entities, he played a key role in South Africa’s mining policy through the Minerals Council. Holding degrees in Industrial Engineering and an MBA from GIBS, Kgatle now steers Tlou Holdings toward both conventional and green energy investments, focusing on future-critical minerals like copper, nickel, lithium, and cobalt.

- Quinton van der Burgh

Net Worth: $8 million

Quinton van der Burgh is a South African entrepreneur with a vast portfolio in mining, fintech, real estate, and aviation. He has developed over 47 mines and manages one of Africa’s largest privately-owned mining portfolios, comprising 48 companies. Through Q Global Commodities (QGC), he oversees critical mineral projects across Sub-Saharan Africa, including lithium, copper, graphite, and rare earth elements—key to the global energy transition. His philanthropic efforts, including the QVDB Foundation and #ActOfGenerosity, focus on clean water access and financial aid. He also co-authored 100 Making A Difference, featuring global philanthropists.

- Neal Froneman

Net Worth: $3 million

Neal Froneman, a titan in the mining sector, has cemented his legacy through strategic leadership and industry foresight. As CEO of Sibanye-Stillwater, he spearheaded its rise into a global mining powerhouse, specializing in platinum group metals, gold, and base metals. Holding a 0.12 percent stake (3.28 million shares) valued at nearly R54 million ($2.94 million), his influence extends across the industry. Beyond Sibanye-Stillwater, Froneman played key roles in Lonmin Plc, DRDGOLD, and Delview Three, shaping South Africa’s mining landscape. As he nears retirement, he leaves behind a revitalized Sibanye-Stillwater, having steered it back to profitability through aggressive cost-cutting and strategic acquisitions. His impact also reaches education, serving on The Wits Foundation Board.

- Sipho Nkosi

Net Worth: $3 million

Sipho Nkosi, a pioneering force in South Africa’s corporate landscape, has shaped industries spanning mining, energy, and finance. As the former CEO of Exxaro Resources, he led its transformation into a sustainability-driven powerhouse, diversifying into renewables and championing environmental responsibility. Nkosi also played a pivotal role in Sasol’s strategic shift as its first black chairman. Beyond mining, he co-founded Eyesizwe Holdings, a key player in coal assets, and Talent10 Holdings, an innovation-focused investment firm. His influence extends to Tranter Holdings, Sanlam, and Tronox Holdings, where he drives strategic growth and economic transformation. A staunch advocate for black ownership, Nkosi’s leadership continues to shape South Africa’s corporate and social progress.

Skip to content

Skip to content