Table of Contents

Key Points

- Sasol’s H1 2024 revenue fell 10.41% to $6.65 billion due to lower crude prices and weak refining margins.

- EBIT dropped 40% to $518.58 million, impacted by $338.41 million in impairment charges at Secunda and Sasolburg refineries.

- Net debt rose to $4.46 billion, exceeding sustainability limits, prompting Sasol’s board to withhold an interim dividend.

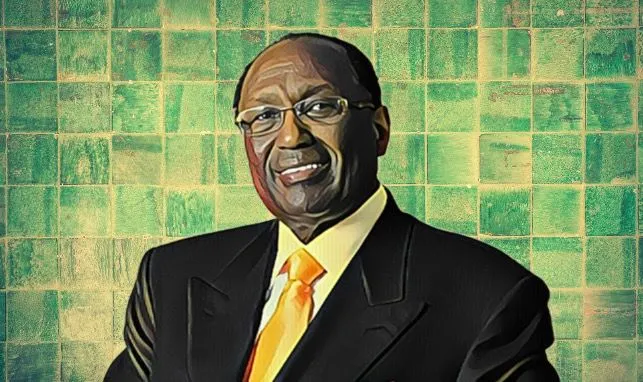

Sasol, the Gauteng-based energy and chemicals group led by South African executive Simon Baloyi, reported a 10.41 percent drop in revenue for the first half of its 2025 fiscal year. The company’s revenue fell to R122.1 billion ($6.65 billion) for the six months ending Dec. 31, 2024, as lower crude prices and weak refining margins weighed on performance.

Market headwinds hit earnings

The decline in revenue from the previous year’s R136.29 billion ($7.44 billion) was driven by a combination of weaker oil prices, a 5 percent drop in sales volumes, and softer market demand. Sasol’s operating profit took a bigger hit, falling 40 percent to R9.5 billion ($518.58 million), largely due to R6.2 billion ($338.41 million) in impairment charges at its Secunda and Sasolburg refineries.

The company’s Southern Africa energy division was particularly hard-hit, with its fuel operations recording a loss of R998 million ($54.38 million), a stark contrast to the R9.55 billion ($520.37 million) profit reported a year earlier. Meanwhile, its international chemicals business showed resilience, with the Americas unit swinging to a R657 million ($35.8 million) profit from a R1.87 billion ($101.89 million) loss in the previous period.

Debt pressures persist

Despite weak earnings, Sasol managed to improve cash flow from operations by 20 percent to R17.6 billion ($960.41 million), thanks to cost-cutting measures and better working capital management. Free cash flow also improved, narrowing to a deficit of R1.1 billion ($60.03 million) from R6.45 billion ($351.96 million) in the prior period.

However, the company’s debt burden remains a concern. Net debt (excluding leases) climbed to R81.8 billion ($4.46 billion) from R73.7 billion ($4.02 billion) in June 2024, surpassing Sasol’s debt sustainability threshold of R73.6 billion ($4 billion). As a result, the board decided not to declare an interim dividend.

Looking ahead

Sasol, which operates in 33 countries and employs more than 30,000 people, is a key player in South Africa’s energy and chemicals sector. Known for its synthetic fuels technology, the company has long played a vital role in the region’s fuel supply and industrial production.

Since taking over as CEO in April 2024, Baloyi has been steering Sasol through economic headwinds, including regional instability and global financial pressures. The company remains focused on strengthening its balance sheet, improving operational efficiency, and managing market volatility. While the near term remains uncertain, Sasol is pushing ahead with strategic initiatives aimed at stabilizing its financial position and positioning the business for growth.

Skip to content

Skip to content