Table of Contents

Key Points

- Kenya’s richest banker, James Mwangi, saw his holding in East Africa’s largest lender decline as shares fell 4.37% over the past month.

- The lender’s market cap dipped below $1.4 billion as investors adjusted portfolios ahead of earnings reports and final dividend announcements.

- Regional subsidiaries contributed nearly 50% of the bank’s $317.4 million profit in the first nine months of 2024, fueling strong earnings.

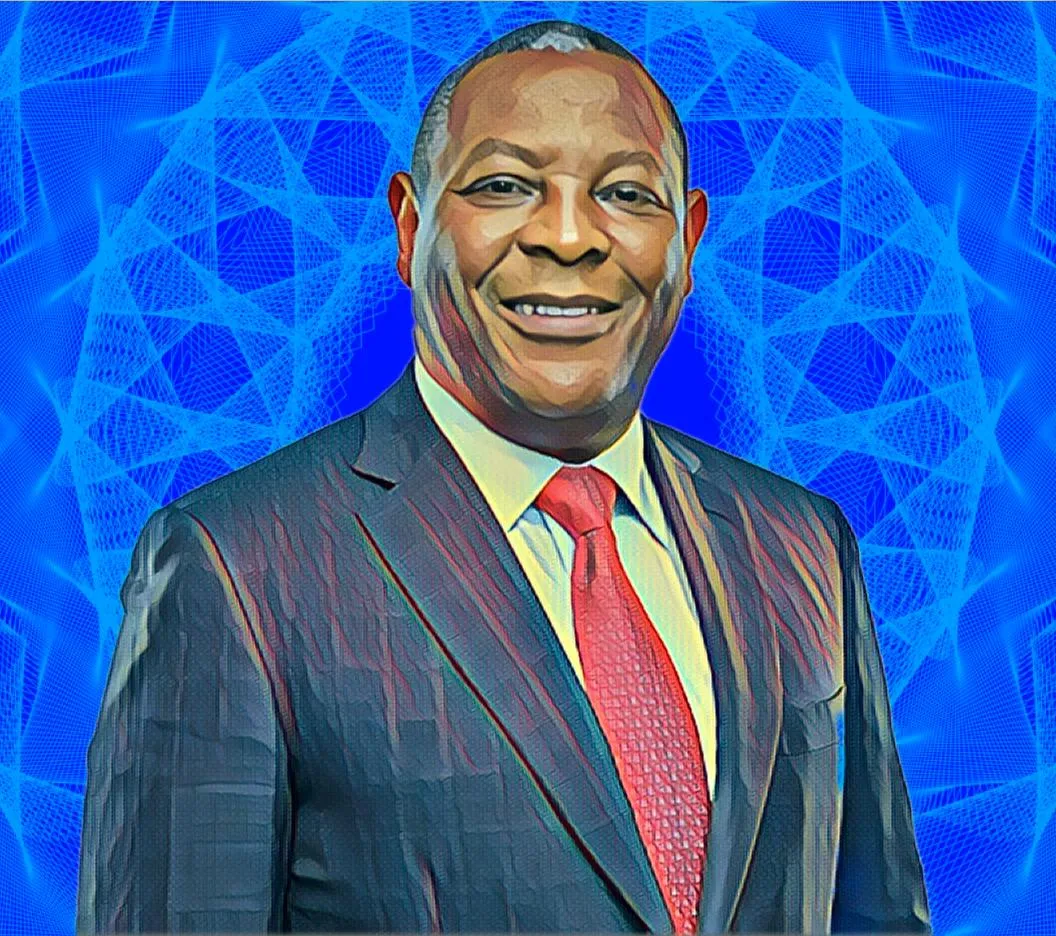

After gaining more than a million dollars in the first three weeks of 2025, Kenya’s richest banker, James Mwangi, has seen his stake in East Africa’s biggest lender, Equity Group Holdings Limited, drop by $3 million over the past month, wiping out earlier gains.

James Mwangi's Equity Group stake down $3 million

Mwangi, who serves as CEO and Managing Director of Equity Group, holds a 3.39-percent stake—equivalent to 127,809,180 shares—in East Africa’s largest lender.

Over the past 31 days, the market value of his holding has declined by Ksh389 million ($3 million), according to data from the Nairobi Securities Exchange (NSE), as investors adjust their portfolios to manage risk.

The $3 million dip in his stake follows a modest increase of $1.2 million recorded between Jan. 1 and Jan. 22, when the market value of his shares rose from $67.3 million to $68.5 million.

Equity Group shares dip 4.37 percent

Equity Group has cemented its position as a leading Pan-African financial services provider, expanding across Uganda, Tanzania, South Sudan, Rwanda, and the Democratic Republic of the Congo. Under Mwangi’s leadership, the lender has grown into a dominant force in East and Central Africa’s banking sector.

After some early-year gains, Equity Group’s share price on the NSE has fallen 4.37 percent over the past month, dropping from Ksh49.15 ($0.38) on Jan. 22 to Ksh47 ($0.36) at the time of writing. This decline has pulled the bank’s market capitalization below $1.4 billion, as investors remain cautious ahead of annual earnings reports and final dividend announcements.

With this drop in share price, the market value of James Mwangi’s 3.39-percent stake has fallen from Ksh8.89 billion ($68.5 million) to Ksh8.5 billion ($65.53 million). Despite the pullback, Mwangi remains Kenya’s wealthiest banker and one of the richest individuals in the country.

Equity Group’s expansion fuels profit growth

As investors await the full-year financial results, Equity Group’s nine-month (9M 2024) report shows strong earnings. Profit for the first nine months of 2024 rose 13.09 percent, from Ksh36.2 billion ($280.67 million) in the same period of 2023 to Ksh40.94 billion ($317.4 million).

Nearly half—49.78 percent—of these earnings came from the bank’s regional subsidiaries, highlighting the success of its expansion strategy.

The profit increase was driven by a 13.32-percent rise in interest income, which grew from Ksh111.13 billion ($861.45 million) to Ksh125.93 billion ($976.2 million), alongside a 5.8-percent increase in non-interest income, from Ksh57.8 billion ($448.07 million) to Ksh61.15 billion ($474.06 million), despite inflation and fluctuating interest rates.