Table of Contents

Key Points

- Marvin Ellison's stake in Lowe’s drops by $12.44 million, with his holdings falling from $200.78 million to $188.34 million due to a 6.2% drop in share price.

- Despite the setback, Ellison’s 0.132% stake in Lowe’s still keeps him among the wealthiest Black executives in the U.S.

- Lowe’s faces stock performance challenges, with shares down 6.2%, but its year-to-date performance remains positive, showing a modest 2.02% gain.

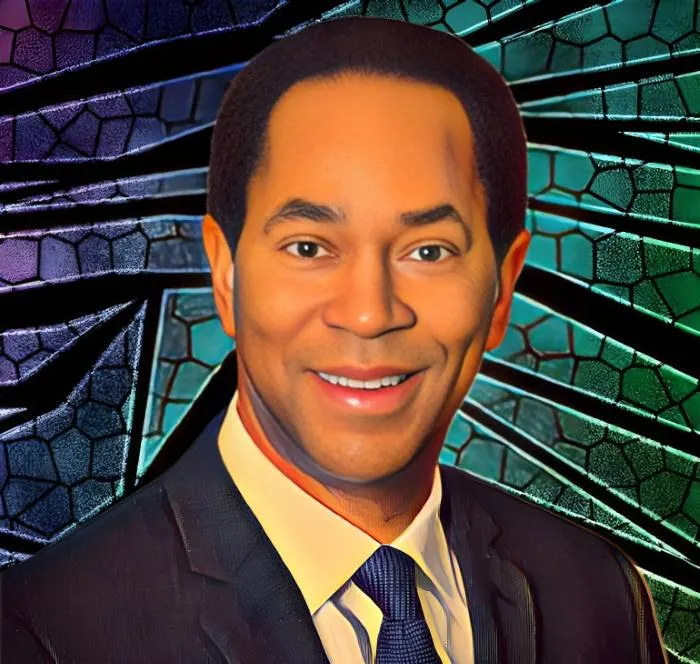

Wealthy Black executive, Marvin Ellison, the CEO of Lowe’s Companies, has recorded a notable decline in the value of his stake in the home improvement giant. Over the last 21 days, Ellison’s holdings, amounting to 748,000 shares, declined by more than $12 million.

As one of the wealthiest Black executives in corporate America, Ellison's portfolio performance is often in the spotlight, but the latest dip, leaving his investment in Lowe’s below the $200 million mark, highlights the volatility even the most seasoned leaders face in the stock market.

Ellison's Lowe’s stake declines by $12.44 million

As of Jan. 27, 2024, Ellison’s stake in Lowe’s was worth $200.78 million. Since then, its value has dropped to $188.34 million, following a 6.2 percent decrease in Lowe’s share price, which fell from $268.42 to $251.79 per share on the New York Stock Exchange (NYSE).

Despite this setback, Ellison’s investment remains substantial. His 0.132% stake in Lowe’s positions him as one of the richest Black individuals in the U.S. This decline follows an earlier gain of $8.55 million between Jan. 7 and 24, when his shares rose from $184.43 million to $192.98 million.

Lowe’s continues to face market challenges

The decline in Ellison’s wealth comes as Lowe’s, one of the largest home improvement retailers in the world, struggles with stock performance. The company, which employs around 300,000 associates across the U.S. and Canada and operates 1,747 stores, saw its market capitalization dip below $145 billion as share prices fell.

Lowe’s year-to-date performance is still in positive territory, with shares up 2.02 percent, translating into modest returns for investors. A $100,000 investment at the beginning of 2024 would now be worth $102,020, reflecting a gain of $2,020.