Table of Contents

Key Points

- South Africa’s real estate sector drives economic growth, with a market projected to hit $1.23 trillion in 2025, led by residential demand.

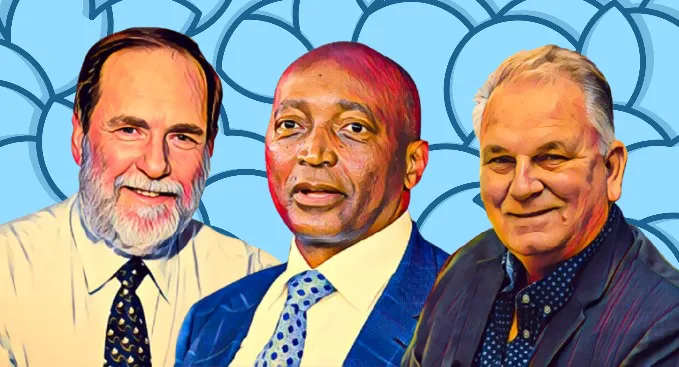

- Business leaders like Patrice Motsepe and Stephen Brookes are reshaping cities through strategic investments in mixed-use developments and green projects.

- Prominent figures such as Barry Stuhler and Des de Beer continue to shape South Africa’s commercial real estate through global investments and innovation.

South Africa's real estate market is more than just a significant contributor to the economy; it's a vibrant, ever-evolving sector that plays a vital role in shaping the nation's future.

From thriving city centers to expanding suburban areas, demand for both residential and commercial properties is growing steadily. This growth is fueled by rapid urbanization, rising economic activity, and a middle class that continues to expand. The combination of local and international investment has turned South Africa’s real estate market into a central driver of the economy, creating jobs and supporting a wide range of industries.

At the heart of this transformation are South Africa’s business leaders, whose investments and innovations are reshaping the property landscape. These entrepreneurs aren’t just building developments; they’re reshaping cities like Johannesburg, Cape Town, and Durban into modern hubs of opportunity. Their efforts, through strategic acquisitions and ambitious projects, have earned them recognition as industry pioneers.

The potential for further growth is evident, with South Africa’s real estate market projected to reach a remarkable $1.23 trillion in 2025 according to Statista. Residential properties alone are expected to account for $850 billion of this total, driven by the increasing demand for homes in urban areas. Government policies aimed at addressing the housing shortage, particularly affordable housing, are further fueling this expansion, alongside the rise of mixed-use developments that combine residential, commercial, and retail spaces.

South African business leaders driving this growth include Patrice Motsepe, Stephen Brookes, and Steven Herring, whose investments in retail, office spaces, and mixed-use developments are leaving a lasting impact on South Africa's cityscapes. Their success has not only built their wealth but has also contributed significantly to the country’s economic development and job creation.

In addition to these prominent leaders, others like Barry Stuhler and Des de Beer have led transformative projects in the commercial and retail sectors, while Kiriakos Anastasiadis and Steven Herring continue to expand their influence through real estate investment trusts (REITs). These visionaries are helping shape the future of South Africa’s real estate market, ensuring that it remains a key driver of economic growth and urban development.

In this article, Billionaires.Africa shines a spotlight on some of South Africa’s most influential businessmen, whose investments and efforts are reshaping the real estate industry and changing the country’s urban landscape for the better. Their work is playing a pivotal role in driving the growth and transformation of cities across South Africa.

- Patrice Motsepe

Patrice Motsepe, Africa’s first Black billionaire, is a major force in the country's real estate industry. Known primarily for his success in mining through African Rainbow Minerals, Motsepe has steadily expanded his portfolio to include significant real estate holdings. In 2016, he took a 20 percent stake in Val de Vie Investments, a luxury residential development in Western Cape, marking his foray into high-end real estate. He has since made key investments in the V&A Waterfront, Modderfontein Estate, and plans to develop a luxury hotel in Sandton. Additionally, he owns the Hidden Valley wine vineyard, valued at $5 million. Through African Rainbow Capital, Motsepe further strengthens his position in the property market, with stakes in ARC Property Development and Majik, reflecting his ongoing support for entrepreneurs in the sector. Beyond business, Motsepe is committed to social causes through the Motsepe Foundation, focused on alleviating poverty and promoting education.

- Stephen Brookes

Stephen Brookes, the visionary founder of Balwin Properties, has cemented his status as a key player in South Africa’s real estate sector. With a 36.1 percent stake in Balwin Properties valued at nearly $20million, he has driven the company’s expansion into sustainable, large-scale residential developments. His influence extends through subsidiaries like Balwin Energy, focused on green solutions, and Balwin Education, integrating learning spaces into housing projects. Beyond real estate, Brookes is committed to social impact through the Balwin Foundation, supporting education and skills development in South Africa.

- Barry Stuhler

Barry Stuhler, a pioneering figure in South Africa’s real estate sector, co-founded Resilient REIT alongside Des de Beer, shaping the country’s property investment landscape. With over 30 years of experience, he played a key role in expanding Property Fund Managers’ portfolio from 65 to 120 properties, boosting its market capitalization from R425 million ($22.55 million) to R1.2 billion ($63.7 million). Stuhler holds a 10.19 percent stake in Malta-based Lighthouse Properties, a global real estate firm with assets across Europe. He has also been instrumental in Capital Property Fund, Resilient REIT, and Fortress Real Estate Investments, which collectively manage billions in assets. His leadership extended to Pangbourne Properties and Property Fund Managers before their mergers. Despite retiring in 2020 and relocating to Sydney, Stuhler's legacy remains entrenched in South Africa’s property sector through his strategic investments and board roles across major real estate firms.

- Des de Beer

Des de Beer, a South African property mogul, has played a key role in shaping the country’s real estate landscape. As the co-founder of Resilient REIT, he has guided the company to become a major retail property investor, managing a portfolio worth R14.5 billion ($764 million) across South Africa, France, and Nigeria. Beyond Resilient, de Beer is a significant force in global real estate investments. He owns a 16.14 percent stake in Lighthouse Properties, a JSE-listed investment firm with assets spanning France, Portugal, and the UK. He also co-founded NEPI Rockcastle, a dominant player in Central and Eastern Europe’s retail market, with a portfolio valued at €5.8 billion ($6.3 billion). His influence extends to Hammerson Plc, a British real estate giant, where he previously held a stake through Resilient REIT, securing a R250.2 million ($13.16 million) profit from its sale. Additionally, he has interests in Trellidor Holdings, a South African security solutions firm operating in Ghana and the UK. With a track record of strategic investments and expansion, de Beer remains one of the most influential figures in South Africa’s real estate and investment sectors.

- Steven Herring

Steven Herring, a key figure in South Africa’s property sector, leads Heriot REIT and Heriot Properties Ltd., overseeing a portfolio valued at R9.26 billion ($510.58 million). With over two decades of experience, he specializes in industrial and retail property investments, securing long-term leases with blue-chip tenants. Herring holds an 87.23 percent stake in Heriot REIT, worth over $166.42 million, and has played a pivotal role in democratizing real estate ownership. His investments extend beyond Heriot REIT, with significant holdings in Safari Investments RSA Ltd., Tembisa Mall, Phokeng Mall, Fin Properties Pty Ltd., and Tiger Stripes Investments Ltd. A recipient of the Johnnie Walker Jewish Entrepreneurial Award in 2011, Herring remains one of the wealthiest investors on the Johannesburg Stock Exchange (JSE), shaping South Africa’s commercial real estate landscape.

- Kiriakos Anastasiadis

Kiriakos Anastasiadis, the controlling shareholder of Acsion Limited, has built a powerful property empire with investments in retail, hospitality, and commercial properties. Holding a 77.48 percent stake in Acsion, valued at over $90 million, Anastasiadis has overseen the development of major properties like Mall@Reds and Moutsiya Gardens. His influence extends beyond Acsion, with holdings in multiple private entities and ventures, making him a key figure on the Johannesburg Stock Exchange and in South Africa’s property industry.

- Laurence Rapp

Laurence Rapp, CEO of Vukile Property Fund, has built a $2.11 billion portfolio, with a focus on retail real estate across South Africa and Spain. Leading the Johannesburg-based REIT, Rapp has strategically grown the fund, with 60 percent of its assets in Spain and 40 percent in South Africa. Known for his proactive asset management and market expertise, Rapp has driven Vukile’s success, transforming it into a specialist retail venture. His leadership continues to strengthen Vukile's position in the evolving real estate sector.

- Martin Slabbert

Martin Slabbert co-founded New Europe Property Investments (NEPI) in 2007, focusing on retail properties in Central and Eastern Europe. As CEO, he helped establish NEPI as a leading regional player. After resigning in 2015, he co-founded Prime Kapital, a private equity real estate developer targeting opportunities in the same region in addition to Southern Africa. His leadership continues to shape the real estate sector, driving growth and development in Central and Eastern Europe.

- Victor Semionov

Victor Semionov, CFO of Prime Kapital, co-founded the company alongside Martin Slabbert, focusing on real estate investments in Eastern Europe. Semionov has played a key role in securing funding for large-scale projects, including Avalon Estate in Romania, which comprises 800 residential units. His financial expertise and leadership have been integral in driving Prime Kapital’s success, with the firm focusing on high-impact, sustainable developments. Semionov continues to shape the company’s strategy, positioning Prime Kapital as a leader in the region's real estate development sector.

- Norbert Sasse

Norbert Sasse, CEO of Growthpoint Properties, leads South Africa’s largest publicly traded property firm, overseeing a diverse portfolio spanning office, retail, and industrial assets. As a key figure in the real estate sector, he founded the SA REIT Association and plays a pivotal role in industry regulations. Under his leadership, Growthpoint has cemented its market dominance, driving sustainable growth and innovation. Sasse also serves on multiple boards, reinforcing his influence in shaping South Africa’s commercial property landscape.