Table of Contents

Key Points

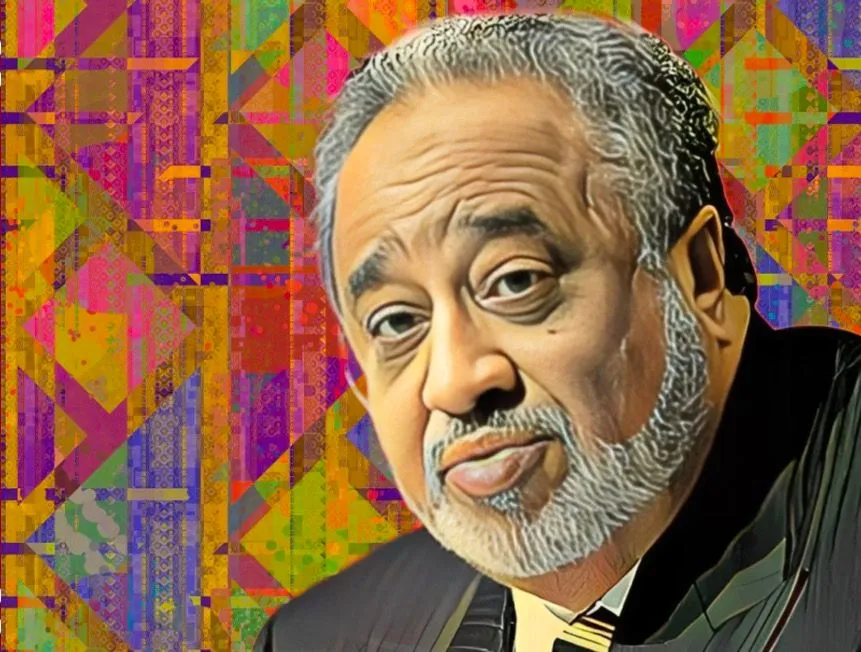

- Mohammed Al-Amoudi’s net worth surged by $552 million in 2025, reaching $9.4 billion, recovering from a $320 million loss in 2024.

- Al-Amoudi’s stake in Preem, Sweden’s largest energy company, rose to $3.95 billion, contributing significantly to his financial rebound.

- Al-Amoudi faced legal setbacks in 2024, with a $2.7 billion claim in Morocco dismissed by the International Center for Settlement of Investment Disputes.

Ethiopia’s richest man, Mohammed Al-Amoudi, has bounced back from a $320-million loss in 2024, adding more than half a billion dollars to his fortune since the start of 2025. His net worth now stands at $9.4 billion, reinforcing his status among the world’s wealthiest individuals.

According to the Bloomberg Billionaires Index, Al-Amoudi’s wealth has surged by $552 million this year, rising from $8.73 billion on Jan. 1 to $9.4 billion. This marks a turnaround from last year, when his fortune dropped from $9.05 billion to $8.73 billion. With his latest gains, he remains Ethiopia’s richest man and ranks 315th among the world's top 350 billionaires.

Al-Amoudi’s Preem stake jumps to $3.95 billion

A key driver of this rebound is the rising value of his stake in Preem, Sweden’s largest energy company, which refines over 18 million cubic meters of crude oil annually. Since the start of 2025, his share in Preem has grown from $3.4 billion to $3.95 billion.

Beyond Preem, Al-Amoudi has a diverse investment portfolio, including significant stakes in Svenska Petroleum, Midroc Gold, and Okote Gold. His holding in Svenska Petroleum is currently valued at $1.04 billion, while Midroc Gold is worth $725 million and Okote Gold stands at $1.01 billion.

He also owns a $185-million stake in Midroc Invest and $237 million in Midroc Properties, while his interest in Midroc Ethiopia is valued at $200 million. Additionally, his Saudi Arabia-based gas station operator, Naft Services, is estimated at $741 million, using revenue figures from its closest publicly traded competitor.

Al-Amoudi’s Preem stake jumps to $3.95 billion

Despite his business success, Al-Amoudi has faced challenges. In 2017, he was detained by Saudi authorities during an anti-corruption crackdown and was released in January 2019 without any public explanation of his arrest or the terms of his release.

More recently, in 2024, his Corral Group faced legal setbacks in Morocco when the International Center for Settlement of Investment Disputes in Washington, D.C., dismissed a $2.7-billion compensation claim linked to his business interests in the country.