Table of Contents

Key Points

- Aliko Dangote's $23 billion refinery project in Nigeria is reducing fuel imports and reshaping global energy markets, making Nigeria a net exporter of jet fuel.

- The refinery, Africa’s largest, now processes 500,000 barrels per day and is set to reach full capacity of 650,000 b/d by March 2025.

- Dangote financed the project through loans, equity stakes, and intercompany loans, despite challenges, with $3 billion in debt still outstanding.

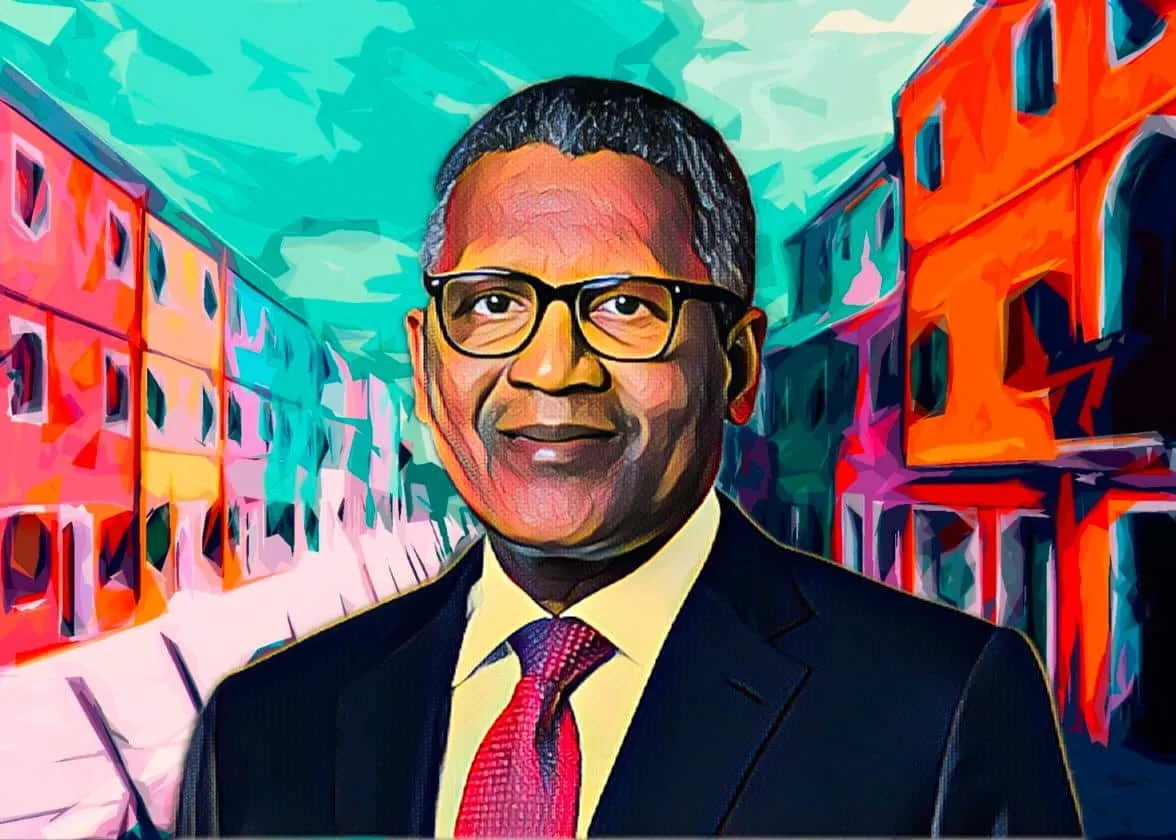

Aliko Dangote, Africa’s richest man, has built his empire by taking bold risks, but none bigger than his $23 billion bet on the Dangote Refinery. The project was designed to end Nigeria’s dependence on imported fuel and break the monopoly of the state-owned Nigerian National Petroleum Company (NNPCL). Now, it’s reshaping global energy markets. Reflecting on the decade-long journey to completion, Dangote told Forbes, “If this didn’t work, I was dead.”

A vision turned reality

For Dangote, the refinery is more than just a business venture—it’s a statement. “Africa has been a dumping ground for finished products,” he says. “We have to build our own continent by ourselves.” What started as an ambitious idea took years of calculated moves, unexpected hurdles, and sheer determination to become reality.

In 2013, he announced plans to build Africa’s largest oil refinery in southwest Nigeria. He partnered with Honeywell UOP for technology and Engineers India Ltd for engineering expertise. His longtime associate, Edwin Devakumar, a former World Bank engineer, led the project. Initially estimated at $10 billion, costs skyrocketed due to unforeseen challenges.

Securing land was the first major hurdle. Dangote originally planned to build in Ogun State, but local resistance forced him to relocate to Lagos, where he bought land for $100 million. The swampy terrain required dredging 65 million cubic meters of sand and building a dedicated port—delays that added time and money. Construction displaced thousands of people, sparking local opposition. Then COVID-19 hit, compounding logistical and financial strains. “I can spend the whole day telling you about these challenges,” Dangote admitted, shaking his head.

A game changer for Nigeria’s energy sector

After 11 years of relentless effort, the 6,200-acre refinery in the Lekki Free Zone finally came online last year. By mid-2024, it was processing 350,000 barrels per day (b/d). That figure climbed to 500,000 b/d in January 2025, and by next month, it’s expected to reach full capacity—650,000 b/d—making it the world’s seventh-largest refinery and Africa’s biggest.

The refinery has already transformed Nigeria’s energy sector. It has drastically cut the country’s reliance on imported fuel, forcing European refiners to seek new buyers. Energy intelligence firm Vortexa reports that gasoline imports into Nigeria are at an eight-year low. The country has even become a net exporter of jet fuel, naphtha, and fuel oil, according to S&P Global.

The financial rewards for Dangote have been massive. His net worth has surged to an estimated $23.9 billion—nearly double what it was last year—putting him back on Forbes’ list of the world’s 100 richest people for the first time since 2018. “I think I’m even richer,” he quipped. This statement aligns with Bloomberg’s wealth estimates, which suggest the African billionaire is worth $28.2 billion at the time of drafting this report—$4.3 billion more than Forbes estimates.

How Dangote financed his dream

Building the refinery involved taking on significant financial risk. Dangote secured $5.5 billion in bank loans, sold 3 percent stakes in Dangote Cement to Dubai’s Investment Corporation and an Australian sovereign wealth fund for $300 million each, and later brought in private equity firm Gateway Partners. His holding company, which includes cement, flour, and sugar businesses, provided a $10 billion intercompany loan to cover cost overruns. Despite this, the refinery still carries $3 billion in outstanding debt, with the total project costing $23 billion.

In August 2024, Fitch Ratings downgraded Dangote’s publicly traded bonds, citing concerns over liquidity and the naira’s steep depreciation—it has lost more than 70 percent of its value since Nigeria’s central bank floated the currency in mid-2023. However, Dangote remains confident. He argues that the refinery’s revenue, primarily in U.S. dollars, shields it from currency fluctuations. “Liquidity is not a problem,” he reassured investors.

The next chapter: Expansion, gas pipelines, and a public offering

Dangote remains hands-on at his refinery, frequently visiting the site and working closely with engineers and managers. His next steps include building a subsea pipeline to transport natural gas from the Niger Delta to Lagos and expanding fertilizer production. He also plans to take the refinery public within two years. “I’ve been fighting battles all my life,” he said. “And I have not lost one yet.”

His goal is to transform Nigeria from a crude exporter into a fuel producer. Government-led refinery projects failed for decades, leaving the country reliant on European imports while fuel subsidies drained public funds. The refinery, now running at 85 percent capacity, faces crude supply challenges. Edwin Devakumar, its head, said output could reach full capacity within a month. To ensure stability, Dangote is adding eight crude storage tanks, four of which are nearly complete. Once finished, storage capacity will rise 41.67 percent to 3.4 billion liters.

The refinery is already reshaping global markets, exporting diesel and aviation fuel to Cameroon, Angola, Ghana, and South Africa. It recently supplied jet fuel to Saudi Aramco, the world’s largest oil producer, valued at more than $1.7 trillion, marking its growing global reach.

For Dangote, the mega refinery is more than business—it’s his legacy. And he’s not done yet.