Table of Contents

Key Points

- CIEL Limited’s profit after tax fell 27% to MUR2 billion ($43.1 million), despite a 6% revenue rise to MUR18.9 billion ($407 million).

- Finance revenue grew 9%, while healthcare rose 20%. Agro profits fell to MUR178 million ($3.83 million) due to lower sugar prices.

- CIEL’s total assets rose to MUR110.06 billion ($2.4 billion), and equity strengthened to MUR36.2 billion ($780 million), reflecting steady expansion.

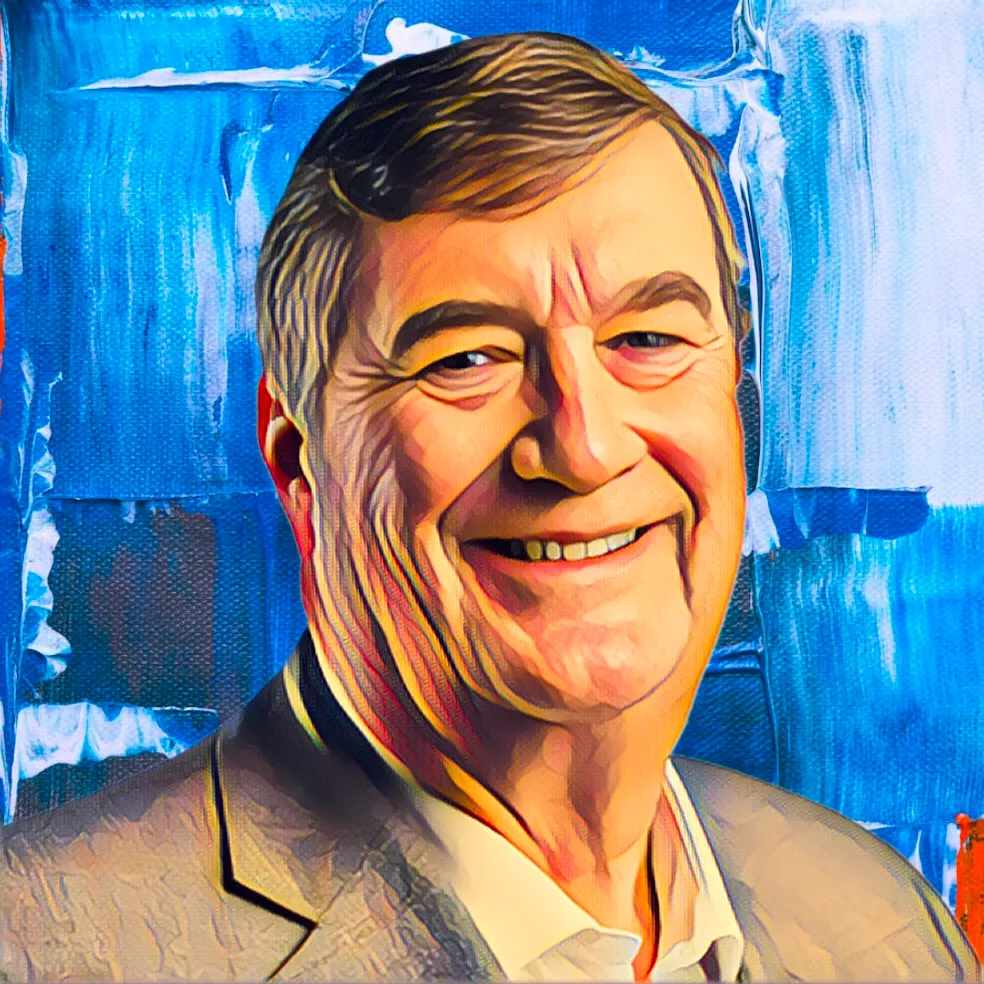

Mauritian conglomerate CIEL Limited, led by businessman Arnaud Dalais, wrapped up the first half of its 2025 fiscal year with mixed results. While revenue edged higher, the group’s profit took a hit, weighed down by new tax levies and weaker contributions from its agro business.

According to its unaudited financial results for the six months ending Dec. 31, 2024, profit after tax dropped 27 percent to MUR2 billion ($43.1 million), down from MUR2.74 billion ($58.98 million) a year earlier. This came despite a 6-percent rise in revenue, which climbed from MUR17.8 billion ($383.2 million) to MUR18.9 billion ($407 million), thanks to steady growth across its healthcare, textile, and finance segments.

Finance revenue rises 9 percent, agro profits drop

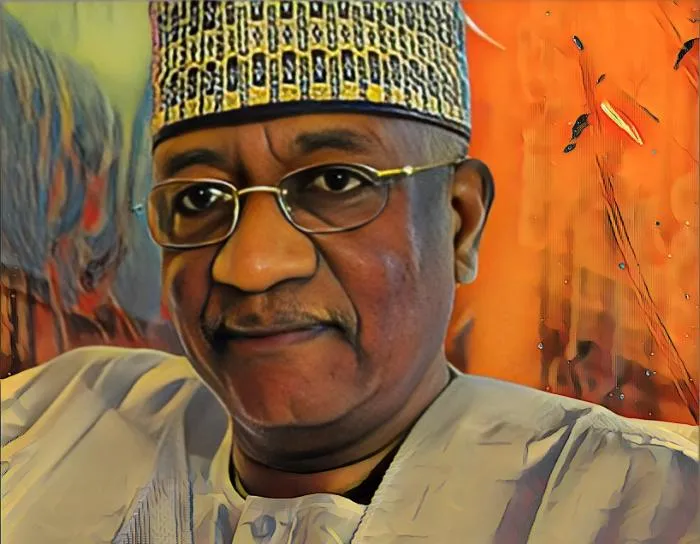

The healthcare business posted the strongest performance, with revenue jumping 20 percent to MUR2.7 billion ($58.12 million), fueled by solid operations in hospitals across Mauritius and Uganda, along with contributions from C-Lab in both regions. Textile revenue increased 5 percent to MUR8.5 billion ($183 million), driven by higher sales in India’s Woven segment and steady demand for Knitwear in the region.

Meanwhile, the finance cluster maintained its momentum, recording a 9-percent revenue increase to MUR3 billion ($65 million), up from MUR2.8 billion ($60.3 million). EBITDA rose 4 percent to MUR1.1 billion, reflecting a steady operational pace despite challenging market conditions in Madagascar.

In contrast, the agro business struggled. Profit fell to MUR178 million ($3.83 million) from MUR308 million ($6.63 million) a year earlier, mainly due to lower sugar prices. Gains from the Property segment were offset by weaker cane harvests and pricing pressures in the Agro division. The property business, however, was a bright spot, with revenue climbing 39 percent to MUR164 million ($3.53 million), driven by an expanded leasable area and higher rental rates in the Evolis portfolio.

CIEL’s assets and equity grow steadily

CIEL operates across 10 emerging and developing markets in Africa and Asia, with subsidiaries spanning agro and property, finance, hotels and resorts, textiles, and healthcare. Dalais, who serves as chairman, holds an 8.2-percent stake in the company, amounting to 138.69 million shares.

Despite the profit slump, CIEL’s overall portfolio value edged up 3 percent to MUR25.5 billion ($550 million). Total assets grew from MUR105.85 billion ($2.28 billion) in June 2024 to MUR110.06 billion ($2.4 billion) by the end of December. Equity also strengthened, rising from MUR33.72 billion ($726 million) to MUR36.2 billion ($780 million), reflecting the group’s resilience despite market headwinds.