Table of Contents

Key Points

- Hani Berzi’s stake in Edita Food Industries lost $6.99 million in 16 days, bringing its market value below $175 million.

- Edita shares fell 3.95%, reducing the company’s market capitalization below $390 million, raising investor concerns over future growth.

- Broader shifts on the Egyptian Exchange continue to weigh on Edita’s stock, adding to Berzi’s wealth decline this year.

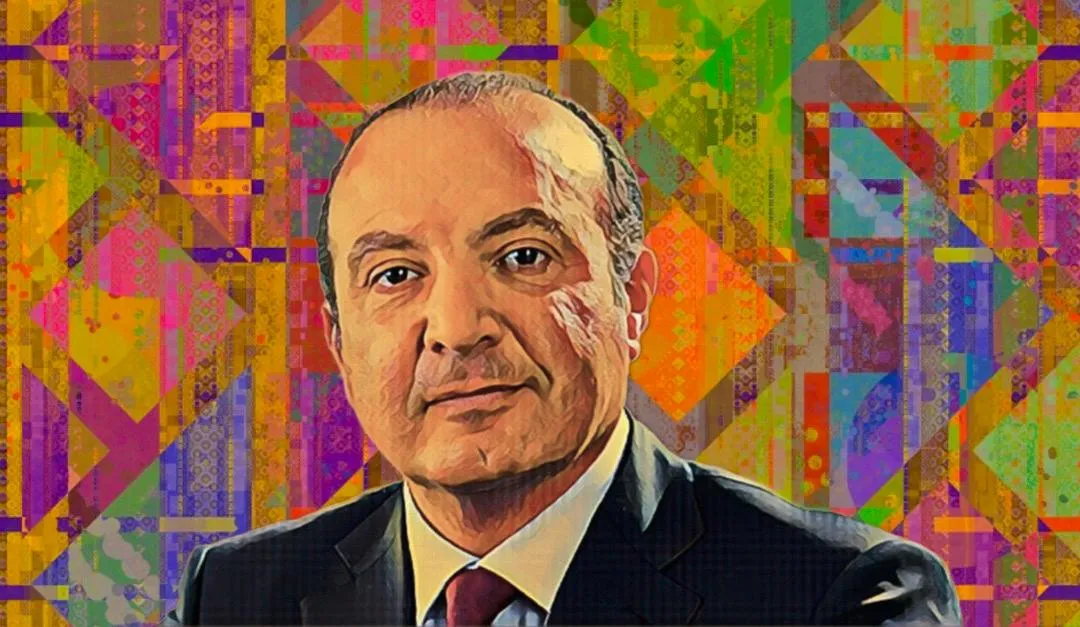

Egyptian billionaire Hani Berzi has taken another financial hit, with the market value of his stake in Edita Food Industries dropping by more than $6 million in just 16 days. The decline comes as the company’s stock continues to slide on the Egyptian Exchange (EGX), adding to losses he recorded earlier this year.

As chairman and managing director of Edita Food, Berzi holds a 41.95-percent stake in the packaged snack manufacturer. Over the past 16 days, the value of his holdings has fallen by EGP351.72 million ($6.99 million), bringing his stake below $175 million.

This latest drop adds to an earlier $4.40 million decline between Jan. 6 and Jan. 13, when his stake fell from EGP8.8 billion ($174.26 million) to EGP8.58 billion ($169.87 million). Wary investors have been pulling back from the company as part of a broader shift on the EGX, increasing selling pressure on Edita Food’s stock.

Edita shares drop, market value declines

Edita Food Industries is a major player in Egypt’s fast-growing packaged snack market, producing and distributing a range of popular products, including cakes, croissants, rusks, and wafers, through its extensive retail network.

Despite its strong presence, Edita’s share price has dropped 3.95 percent, falling from EGP28.87 ($0.57) to EGP27.73 ($0.55). The decline has pushed its market capitalization below $390 million, raising concerns about future growth and shaking investor confidence.

Hani Berzi faces loss in Edita stake

Hani Berzi has taken a hit as the market value of his stake in Edita dropped by EGP351.72 million ($6.99 million), falling from EGP8.91 billion ($177.21 million) to EGP8.56 billion ($170.22 million), following a dip in the company’s share price.

The continued slide in Edita’s stock reflects broader challenges in Egypt’s snack food industry, as businesses navigate shifting market conditions and economic uncertainty.