Table of Contents

Key Points

- Flutterwave will only pursue an IPO once it achieves profitability, prioritizing long-term value and a sustainable business model.

- The fintech giant has expanded rapidly, with a valuation reaching $3.2 billion in 2024, cementing its position as Africa’s top tech startup.

- New licenses in Ghana and Uganda expand Flutterwave's reach, while partnerships enhance security and compliance in digital payments.

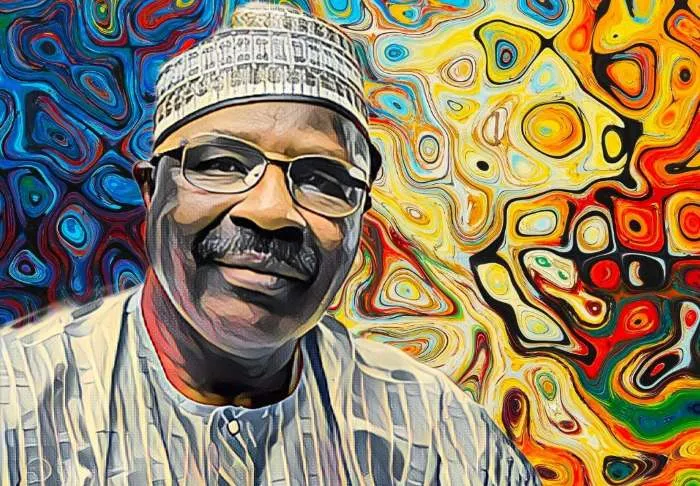

Flutterwave, the San Francisco and Lagos-based fintech giant, led by Nigerian tech entrepreneur Olugbenga Agboola, has made it clear that its long-awaited initial public offering (IPO) will only take place once the company is profitable.

In a recent Bloomberg interview, Agboola explained that this decision is grounded in the company’s commitment to building a strong and sustainable business, particularly in Africa, where profitability is a key measure of success.

“For a company operating in Africa, that’s a no-brainer; profitability is very important,” Agboola said, stressing that the primary goal is to create lasting value. “Right now, the focus is: ‘how do we build a profitable, resilient and scalable business’,” he added.

Agboola emphasized that the IPO’s timing isn’t just about being ready from an operational standpoint, but about delivering real, long-term value to its stakeholders.

A $3.2-billion fintech powerhouse

Since its founding in 2016, Flutterwave has rapidly established itself as a key player in Africa’s fintech space. With dual headquarters in San Francisco and Lagos, the company has become one of the continent’s standout success stories in digital payments. Led by Agboola, Flutterwave now processes payments in over 30 currencies across 40 countries, solidifying its reputation as a major force in the industry.

In early 2022, Flutterwave’s valuation skyrocketed to $3 billion after raising $250 million in funding, more than tripling its previous value of $1 billion. By 2024, reports from CNBC showed the company’s valuation had climbed to $3.2 billion, further affirming its position as Africa’s most valuable tech startup. Despite this remarkable growth, Flutterwave has remained focused on its core business—remittance services and enterprise solutions. This focus has paid off, with the company reporting a 50 percent increase in revenue in the first half of 2024.

New licenses boost Flutterwave’s reach

Flutterwave’s expansion across Africa is showing no signs of slowing. In 2024, the company secured an Enhanced Category Payment Service Provider License from the Bank of Ghana, allowing it to bypass third-party services and offer more comprehensive payment solutions directly in the country. Soon after, Flutterwave obtained a Payment Systems Operator (PSO) license from the Bank of Uganda, setting the stage for expanded operations in East Africa.

The company has also made strides in enhancing security and compliance in the digital payments sector. In partnership with Nigeria’s Economic and Financial Crimes Commission (EFCC), Flutterwave launched a Cybercrime Research Center aimed at tackling the growing threat of cybercrime. This is key to improving transaction security, a priority for users of digital payment platforms across Africa. As Flutterwave continues to grow, it remains committed to expanding its reach while ensuring long-term profitability and value for its stakeholders.

Skip to content

Skip to content