Table of Contents

Key Points

- Ameena and Zara Indimi claim their father unfairly excluded them from a $435.1 million dividend, demanding their 10% stake’s share in court.

- The oil mogul insists he legally bought out his daughters’ stakes for $10 million, denying accusations of coercion or unfairly reducing their ownership.

- His new FPSO, capable of storing one million barrels, will begin production at Okwok Oil Field in 2025, supporting Nigeria’s oil industry.

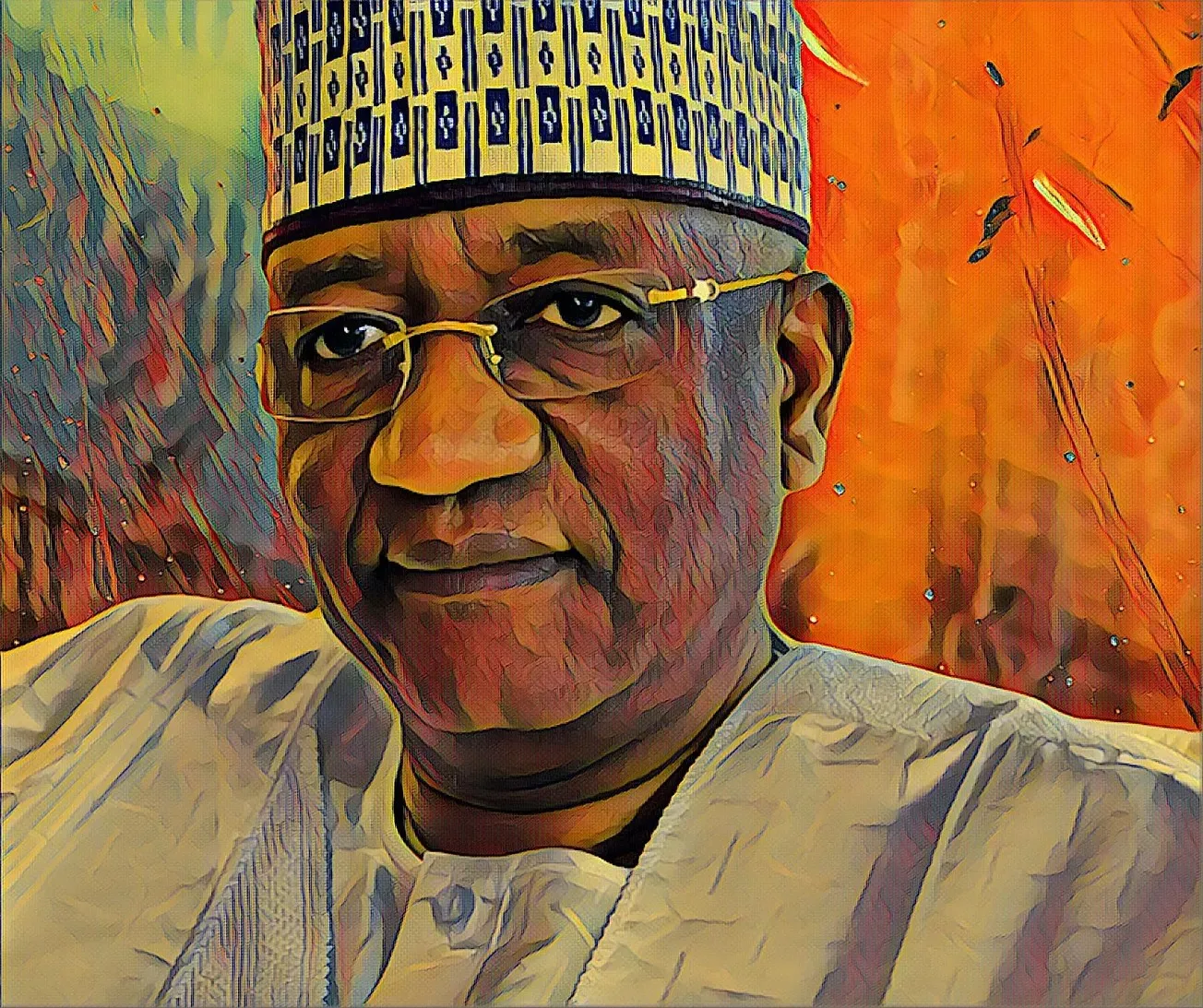

Nigerian oil mogul Mohammed Indimi, founder of Oriental Energy Resources, has resolved a family dispute over a $435.1 million dividend declared in 2024. To settle the issue, he revealed in federal court that he had bought out his children's stakes in the company for $10 million.

Daughters demand $43.5 million from father

Indimi's ongoing legal battle has captured public attention, marking an unexpected chapter for the billionaire and his family. His daughters, Ameena and Zara, have taken him to court, claiming they were unfairly excluded from their share of a $435.1 million dividend.

The sisters argue they are entitled to $43.5 million, based on their combined 10 percent stake in Oriental Energy, and accuse their father of reducing their stake without their consent.

In response, Indimi told the court he had purchased their stakes for $10 million, asserting they have no legal claim to the $43.5 million they are demanding. He has also denied their accusations of intimidation, insisting they were not pressured into transferring their shares.

Mohammed Indimi’s FPSO to boost Nigeria’s oil

This comes as Indimi, who is known for keeping a low profile and staying out of the media spotlight, unveiled a new, state-of-the-art Floating Production Storage and Offloading (FPSO) vessel. The vessel, designed to store up to one million barrels of oil, is set to begin production at the Okwok Oil Field in Nigeria’s Niger Delta.

Starting with an output of 17,000 barrels per day, the FPSO is expected to increase its production to 30,000 barrels per day. The vessel is scheduled to depart Dubai in early 2025, with operations kicking off in the middle of the year—an effort that is anticipated to boost Nigeria’s oil revenues and contribute to the country's broader development goals.

Indimi’s legacy and business power

Founded in 1990, Oriental Energy Resources is a private Nigerian oil firm and the cornerstone of Indimi’s wealth. The company operates three major offshore assets—the Ebok Field, Okwok Field, and OML 115—in the prolific Niger Delta region. Its flagship Ebok Terminal serves as a key production hub for crude oil storage and offloading.

Though Indimi’s net worth peaked at $670 million in 2014, it declined to $500 million in 2015, and Forbes stopped tracking his wealth thereafter. Despite this drop, he remains a powerful figure in Nigerian business, with substantial holdings, including being the largest shareholder of Jaiz Bank. While his personal fortune may have shrunk, Oriental Energy continues to boast assets worth billions, underscoring the high stakes in the ongoing family dispute.